Alphabet (GOOGL) is reaping the rewards of its AI push. The tech giant’s Google One subscription service, which offers paid cloud storage and access to AI tools, has now surpassed 150 million users. The growth was driven by surging interest in premium AI-powered features and expanded cloud storage. Notably, the latest milestone underscores a growing consumer appetite for premium digital experiences, a shift Alphabet is actively leveraging by embedding AI more deeply into its product ecosystem.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Notably, the 150 million subscriber mark reflects a 50% jump since February 2024, when Google One surpassed 100 million users nearly six years after its launch. That month, Google also rolled out a $199.99/month premium plan, giving users access to advanced AI tools not available to free users.

Google Doubles Down on AI to Defend Search

Alphabet’s growing success in subscriptions may prove crucial to its long-term financial strategy as AI chatbots, such as Microsoft (MSFT)-backed OpenAI’s ChatGPT and even Google’s own Gemini, pose a threat to its dominance in search.

The competitive pressure is intensifying. Recently, Apple’s (AAPL) Eddy Cue revealed in court that AI tools contributed to the first-ever decline in Safari browser searches. Additionally, Apple’s push toward integrating AI-powered search features dealt a blow to Alphabet, wiping out $150 billion in market value in a single day.

Overall, Google relies heavily on ad revenue from commercial searches, and losing that traffic could be a major blow. That’s why the company is aggressively rolling out new features to keep users engaged within its ecosystem.

Is Alphabet Stock a Buy Now?

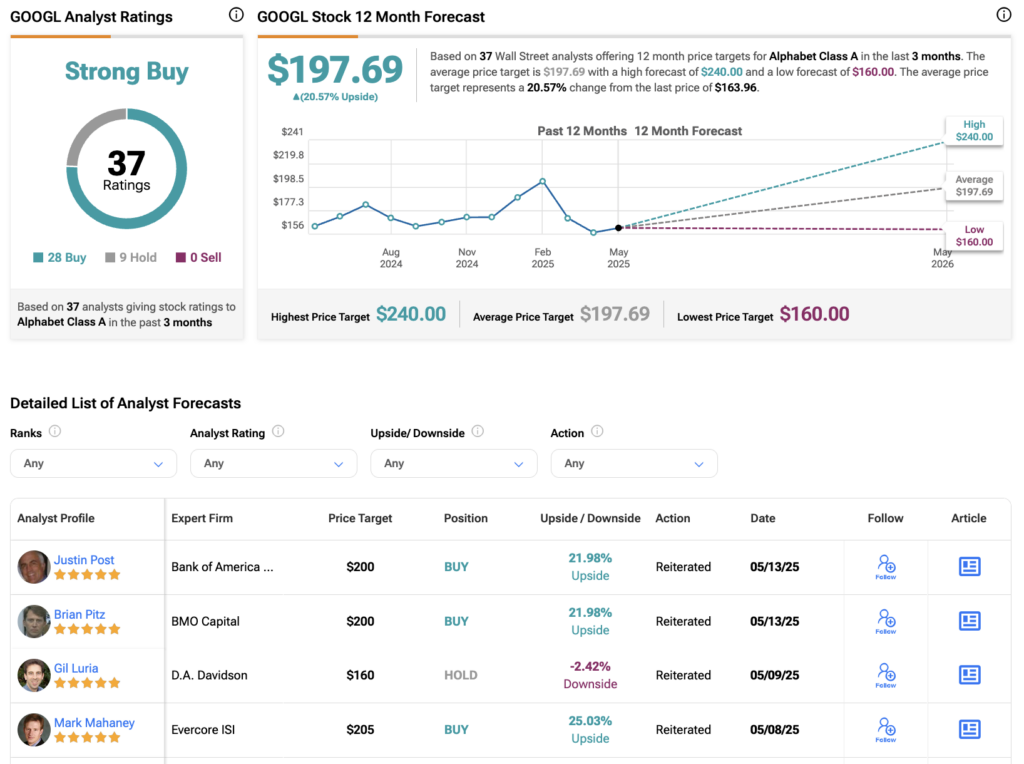

Overall, Wall Street analysts have a Moderate Buy consensus rating on GOOGL stock based on 28 Buys and nine Holds assigned in the past three months. The average GOOGL price target of $197.69 per share implies a 20.57% upside potential.