Alphabet (GOOGL) stock was lower today after a warning that U.S. leadership in AI faces competition from cheaper rivals.

Don’t Miss TipRanks’ Half Year Sale

- Take advantage of TipRanks Premium for 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Commoditized AI

In an interview with the Financial Times, respected investor and analyst Mary Meeker said OpenAI and Google’s Gemini models were at risk of being undercut by cheaper rivals such as DeepSeek which shook up the Magnificent 7 bunch earlier this year.

Meeker, who was an early investor in the likes of Meta Platforms (META) and Spotify (SPOT) said new AI advances would mint “multiple companies worth $10 trillion and they probably will not all be based in North America.”

She added: “We have never had a five-billion user market that one could get to so easily.”

Meeker said that the costs to train models such as OpenAI and Gemini was increasing, at the same time that competition from cheaper domestic firms and overseas groups was putting pressure on pricing power.

She said big AI models would become commoditized as a result.

DeepSeek Delivers

Her comments came as DeepSeek stated that R1-0528, the first significant upgrade to its R1 reasoning model, had matched the performance of top global competitors, including OpenAI and Google.

DeepSeek said improvements in its reasoning and creative writing capabilities, make it more adept at crafting argumentative essays, fiction and prose in styles that closely mimic human authors. Coding capabilities have also been enhanced.

The new version also achieved a 50% reduction in “hallucinations” – which is when AI generates misleading information.

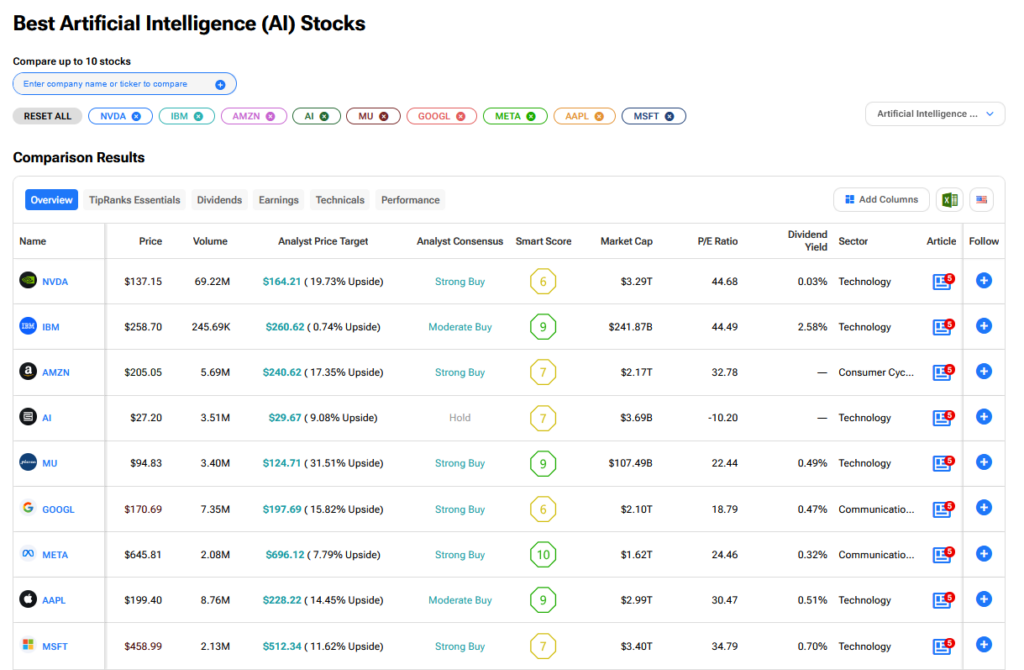

What are the Best AI Stocks to Buy Now?

We have rounded up the best AI stocks to buy using our TipRanks comparison tool.