Alphabet (GOOGL), the tech company that owns Google, is raising a large amount of money through bond sales in order to help fund its AI and cloud computing investments. Indeed, it just launched a €6.5 billion ($7.48 billion) bond offering in Europe, which was more than originally expected. In addition, it is planning to raise another $15 billion in the U.S. by selling bonds in as many as eight parts, with repayment terms ranging from 3 to 50 years, according to Bloomberg.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These are Alphabet’s first bond sales since April and come shortly after Meta (META) announced that it would raise $25 billion through a similar offering. Interestingly, Alphabet expects to spend a record $91–93 billion this year to build infrastructure, such as data centers that support AI. It is also worth noting that analysts at Morgan Stanley believe that major tech firms could spend around $3 trillion on such infrastructure by 2028, with about half of this amount coming from their own profits.

Unsurprisingly, the bonds are expected to receive high credit ratings, and Alphabet may use some of the funds to pay off older debt. Nonetheless, as more tech companies borrow to fund AI projects, it’s starting to affect the bond market. For instance, U.S. corporate bond spreads, which measure how much extra interest companies must pay compared to government bonds, have risen slightly. As a result, JPMorgan analysts expect more bond deals before the end of the year, which could widen spreads further, but not enough to cause a major downturn.

Is Google Stock a Good Buy?

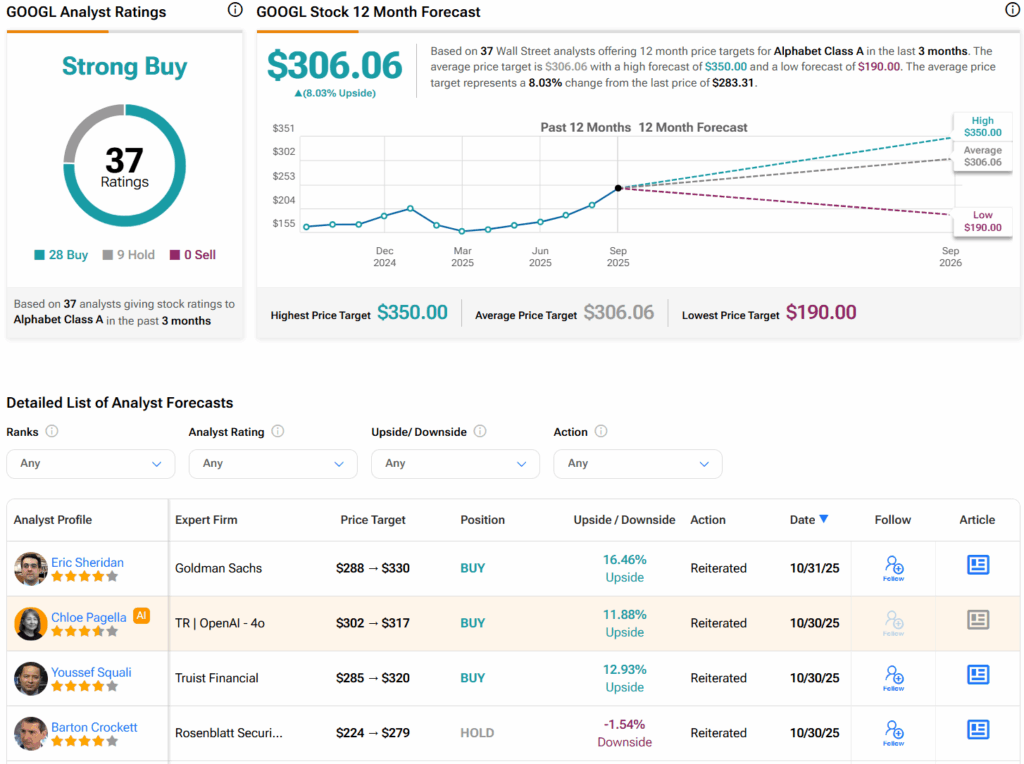

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 28 Buys and nine Holds assigned in the past three months. Furthermore, the average GOOGL price target of $306.06 per share implies 8% upside potential.