As we enter the fourth quarter, not even a government shutdown appears capable of derailing the stock market’s current upward trend. The S&P 500 is up 14% year-to-date, while the tech-centered NASDAQ is up 18%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With technology once again leading the charge, the sector has caught the eye of Mizuho analyst Lloyd Walmsley, who is rated by TipRanks among the top 1% of Wall Street’s analysts. It’s no surprise that Walmsley is directing his focus toward areas where AI is rapidly reshaping digital business models.

“Our subsector coverage includes Online Advertising, eCommerce/Rideshare/Food Delivery, and Online Travel. We look at key themes across each subsector, the impact of AI, and company-specific product initiatives to identify the most compelling investment themes and stocks… We are particularly bullish on the online advertising space broadly, driven by several themes, most notably AI driving more user engagement, better advertising efficacy, helping expand the addressable market, and on the cusp of benefiting from a wave of customer acquisition spending from AI native companies,” Walmsley opined.

Getting into specifics, the top analyst singles out Alphabet (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN), two of the Magnificent 7’s biggest headline generators, as his top picks among the group. Let’s give these two mega-cap stocks a closer look and see why Walmsley considers them the best Magnificent 7 stocks to buy right now.

Alphabet

The first stock we’ll look at here is Alphabet, the parent company of the world’s largest search engine, Google. Alphabet is a $2.98 trillion mega-cap giant, and the fourth-largest company on Wall Street. Through Google and its other chief subsidiary, YouTube, Alphabet controls the internet’s largest search engine and holds a leading position in the online video-sharing segment. The company uses these advantages to support its primary revenue-generating business in digital advertising.

Digital advertising makes up approximately 74% of Alphabet’s total revenue, which in 2024 grew by nearly 14% and came to just over $350 billion. The company’s most recent report, covering 2Q25, showed a top line of $96.4 billion. That figure was up 13.8% from 2Q24 and beat the forecast by $2.4 billion; of the quarterly revenue total, $71.3 billion came from Google advertising activities.

In addition to its core work in digital advertising, Alphabet is also a leader in developing and building out AI technology and its practical applications. Alphabet has been integrating AI into the Google search engine, in part to improve the accuracy and relevancy of search results and in part as a response to the challenge presented by generative AI models such as ChatGPT, which are increasingly being used as search engines. The clearest result of this expanded capability of Google is the ‘AI Overviews’ that the search engine has begun providing ahead of the list of search results, and the ‘AI Mode’ that Google users can choose when viewing those search results. Alphabet has also been creating ever-larger AI integrations for the Google Cloud subscription platform. Google Cloud is one of the top cloud computing platforms, and like its peers, is presenting more and more AI-powered tools and apps for subscribers to use.

Also notable among Google’s expanded AI services are the upgrades to Google Translate, the practical application of large language models. The AI features in Translate permit real-time translations, with capabilities to facilitate face-to-face communications across languages. The new features are available on the Android and iOS operating systems. Google has other features on the way that make use of AI, including agentic AI features such as ordering event tickets or reserving tables at restaurants.

The rise of AI, particularly of generative and agentic AI technologies and platforms, has presented a serious challenge to Alphabet. Internet users are increasingly using AI platforms as substitutes for internet searching, presenting a threat to Google Search and to Alphabet’s leading position in web search. Adopting AI tech, stepping into a leading position to develop new AI capabilities, and integrating AI into Google’s services all present a full-court press by Alphabet to maintain its current leading position in the fast-moving world of online search and services.

We noted above Alphabet’s strong Q2 revenue numbers. The company’s EPS in the quarter, $2.31, was 12 cents per share better than had been expected and was up 22% year-over-year. Alphabet’s results in the quarter were strongly supported by 32% growth in revenue from Google Cloud, which hit $13.6 billion.

Turning to Lloyd Walmsley and the Mizuho view, we see that the top analyst is upbeat on Alphabet and writes: “We see Alphabet well positioned to benefit from leverage AI across the themes we like in cloud and online advertising, including new GenAI native app advertising, AI/ML driven TAM expansion into broader S&M expense, and AI improving content quality/recs driving more time spent (YouTube). We remain concerned on potential risk of share loss to ChatGPT (and an eventual ad model), though recent Similar Web browser data points to (1) a broader deterioration in ChatGPT time/user/day post AI Mode rollout and (2) lack of sustained upside post GPT-5 – which we do not think investors appreciate – makes us cautiously optimistic Google can continue to see benefits outweigh risks from AI.”

Quantifying this stance, Walmsley rates GOOGL shares as Outperform (i.e., Buy), and he sets a $295 price target that suggests a 20% upside potential for the coming year. (To watch Walmsley’s track record, click here)

Overall, Alphabet carries a Strong Buy consensus based on 38 recent analyst reviews, including 30 Buys and 8 Holds. However, the Street’s average target of $247.60, just 1% above the current price, trails Walmsley’s more optimistic forecast by a wide margin. (See GOOGL stock forecast)

Amazon

The next Walmsley pick is Amazon, the $2.34 trillion powerhouse of online retail and cloud computing. As the undisputed leader in e-commerce, Amazon has transformed its early advantage into a vast, finely tuned logistics machine, backed by an unrivaled network of warehouses and delivery hubs that make rapid, reliable shipping its signature strength. delivery assets and guaranteed short-term delivery. North American and International retail segments generated $137 billion in sales in its last reported quarter, 2Q25, or 82% of its total top line.

In addition to expanding its retail offerings, Amazon is also improving its retail technology. AI integrations have made the company’s retail site search more responsive, set up an online shopping assistant, and enabled new features such as Amazon Lens.

Retail may form the core of Amazon’s business, but the company’s technology side is the fast-growing future. Amazon is well known for both its cloud computing and AI services, and its AWS cloud computing platform is a world-class subscription service that competes head-to-head with Google Cloud and Microsoft’s Azure. The company has been integrating AI technology into AWS, expanding the platform’s array of tools, its capabilities, and relevance to customers’ needs. AWS saw its Q2 revenue this year grow by 17.5% year-over-year, to reach $30.9 billion.

AWS is not the only place where Amazon is advancing AI. The company is a major backer of Anthropic, the AI startup that created the Claude models; Amazon’s investments in Anthropic total some $8 billion. Anthropic recently released what it describes as ‘the world’s best coding model,’ Claude Sonnet 4.5, and it is also closely involved in developing Amazon’s Project Rainier, an AI computing initiative backed by AWS that is creating world-class AI supercomputer clusters. The project uses distributed architecture, modeled on cloud computing, to establish these supercomputer clusters across AWS’s own widespread data centers. The aim is to permit increased power and thermal efficiency while maintaining ultra-low latency connections. The project’s backers see the cluster design as a way to dramatically increase the computing power available to train the Claude models.

Amazon has also announced some important expansions of its AWS-AI platforms and services this month. On October 1, the company announced that the NBA had made AWS its official cloud and cloud AI partner, and that the league will use the partnership to make data points and interactive insights available to fans. And in the Middle East, the world’s largest telematics service provider, Cambridge Mobile Telematics, has begun using AWS to expand its AI mobility platform in the Kingdom of Saudi Arabia.

When we turn to Amazon’s financial performance, we note that the $167.7 billion quarterly revenue in 2Q25, the last period reported, was up 13% year-over-year. The strong 17.5% gain in AWS – the cloud service accounted for more than 18% of the revenue total – was the main driver of the gains. At the bottom line, Amazon realized an EPS of $1.68, beating the forecast by 35 cents. The company has deep pockets to sustain its expanding operations, and finished the first half of 2025 with a 12-month operating cash flow of $121.1 billion.

Among the bulls is Mizuho’s Walmsley, who says of Amazon, “We see AWS growth accelerating (+22% in ’26 vs BBG consensus at +18%) as capacity comes online in 2H and 2026, with its anchor GenAI client Anthropic continues scaling its compute demand. We see potential for meaningful upside to growth at AWS as GenAI apps proliferate and inference demand scales and grows in the mix of AI compute. While AWS does not have as advantaged a position in GenAI it has had historically, we think a rising inference tide lifts all boats. We see Street estimates for NA retail in ’26 (+8.5% vs Mizuho +7%) as slightly high but see AWS re-acceleration as more important to the stock.”

To this end, Walmsley assigns AMZN shares an Outperform (i.e., Buy) rating, along with a $300 price target that points toward a ~37% upside potential in the next 12 months.

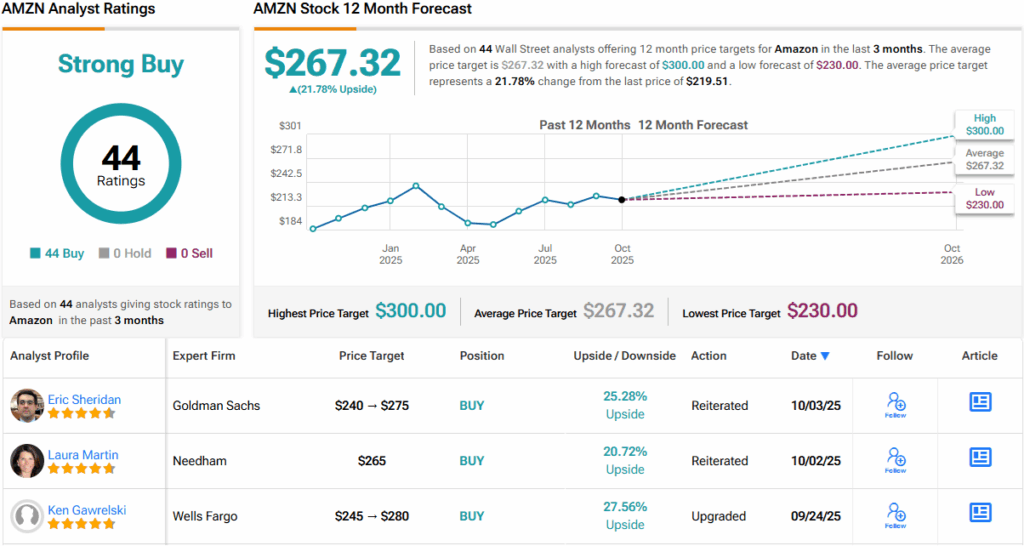

AMZN is that rare beast – a stock with plenty of coverage where everyone is in agreement. It has garnered 44 analyst reviews over the past 3 months – all Buys – naturally making the consensus view here a Strong Buy. The average price target currently stands at $267.32, implying the shares will deliver returns of ~22% over the one-year timeframe. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.