Shares of apparel and footwear provider Allbirds (NASDAQ:BIRD) are plummeting today after the company reported a big fourth-quarter miss.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue dropped 13.4% year-over-year to $84.18 million, missing the cut by $12.6 million. Further, net loss per share at $0.17 too came in wider than expectations by $0.03. For the full year of 2022, physical retail channel sales in the U.S. dropped by 60%.

The company continues to face macro and execution hiccups. Now, it is focusing on brand strategy, lowering the pace of store openings, working to improve capital efficiency, and evaluating international go-to-market strategy to drive results.

Looking ahead, for Q1, BIRD expects net revenue to hover between $45 million and $50 million. Adjusted EBITDA loss is anticipated between $29 million and $26 million.

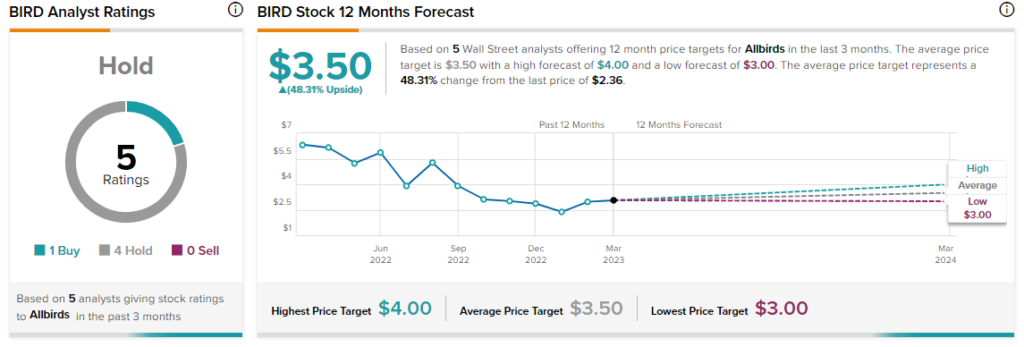

Overall, Wall Street has a consensus price target of $3.50 on BIRD, implying a 48.31% potential upside in the stock. That’s after a nearly 60% drop in BIRD shares over the past year.

Read full Disclosure