Microsoft (NASDAQ:MSFT) has lagged behind the NASDAQ over the past year but is off to a strong start in 2025, outperforming the broader market.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

With the tech giant reporting December quarter (F2Q25) earnings today after the close, Wall Street will be keeping a close eye on proceedings, particularly on the growth trajectory of cloud computing platform Azure.

Goldman Sachs’ Kash Rangan, an analyst who ranks in the top 4% of Wall Street stock experts, notes that his checks indicate Azure’s growth could reach 32% USD/CC (constant currency) in the quarter, with momentum “tracking well toward 2H25 acceleration.” By comparison, the Street estimates stand at 30% and 32% USD/CC.

“Recent strength in the dollar (trade weighted USD +4% in CQ4) could add incremental pressure to USD expects though investors are likely to reward constant-currency growth,” the 5-star analyst commented.

For the headline numbers, Rangan projects revenue of $68.9 billion, reflecting an 11% year-over-year increase – in line with consensus. His EPS estimate of $3.13 also matches Street expectations. Looking ahead to F3Q25, the analyst expects Azure’s growth to accelerate to 34% USD/CC, surpassing the Street’s 32%–33% projections, reinforcing his confidence in a second-half recovery.

For FY25, Rangan forecasts revenue of $279.6 billion (+14% y/y) and EPS of $12.96 (+10% y/y), compared to FactSet consensus estimates of $278.5 billion and $13.01, respectively.

Beyond the near term, Rangan sees Wall Street underestimating what’s ahead. He believes several tailwinds in the second half of the year and beyond should drive an “EPS re-acceleration,” potentially leading to at least 2%–3% upside to FY26/FY27 FactSet consensus EPS forecasts.

Rangan thinks that both OpenAI’s losses and CapEx investments – the two biggest concerns surrounding the stock – are “well-baked” into consensus estimates. Additionally, the companies’ updated partnership, following the Stargate announcement, suggests that Microsoft will take a more cautious approach to future investments, helping to mitigate any potential headwinds.

Moreover, Rangan believes Microsoft’s balance sheet is discounted, as it only accounts for the carrying value of its OpenAI investment rather than its market value, which according to Rangan’s analysis should be anything between $31 billion and $79 billion. Lastly, strong cash yields could help drive growth in net interest income over the next couple of years, providing a cushion against depreciation and equity-related costs.

Bottom line, ahead of the print today, Rangan rates MSFT shares a Buy while his $500 price target points toward a one-year gain of 12%. (To watch Rangan’s track record, click here)

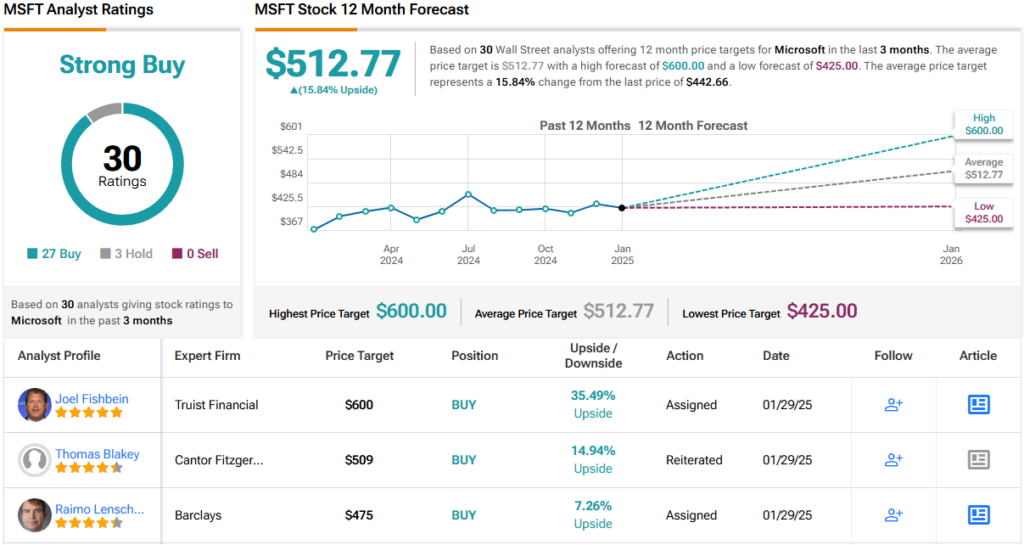

The Street’s average price target is a bit higher; at $512.77, the figure makes room for one-year returns of ~16%. The analyst consensus rates this stock a Strong Buy, based on a mix of 27 Buys vs. 3 Holds. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.