U.S.-based Alaska Air Group (ALK) reported adjusted earnings per share (EPS) of $0.97 in Q4, exceeding analysts’ expectations of $0.47. Additionally, the company reported a net income of $71 million in the fourth quarter, reversing a loss of $2 from the same quarter last year. Alaska Air’s performance was driven by strong holiday travel demand and more corporate travelers.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Alaska Air Ends 2024 with Record Revenue

Alaska Air Group wrapped up 2024 with record revenues of $11.7 billion, up from $10.4 billion last year. In Q4, the company saw a 38% year-over-year revenue increase, reaching $3.53 billion, surpassing analysts’ expectations of $3.43 billion. The growth was primarily driven by the acquisition of Hawaiian Airlines, completed in September. Last month, the company announced its goal to generate an additional $1 billion in profits by 2027, capitalizing on its acquisition of Hawaiian Airlines and the growing demand for premium travel.

The company also benefitted from its improved pricing power by increasing the proportion of premium seats on its flights. It further intends to introduce a premium credit card as part of an overhaul of its loyalty program.

Alaska Air Sees Q1 Loss in 2025

Looking ahead to 2025, the company expects an adjusted loss of $0.50 to $0.70 per share in the first quarter, better than Wall Street’s estimate of a $0.72 loss per share.

However, the company noted that it typically incurs a loss in the first quarter but earns profits in the subsequent quarters. Additionally, the Hawaiian network is expected to post a loss in the March quarter, with a smaller profit expected for the rest of the year.

Is Alaska Airlines Stock a Good Buy?

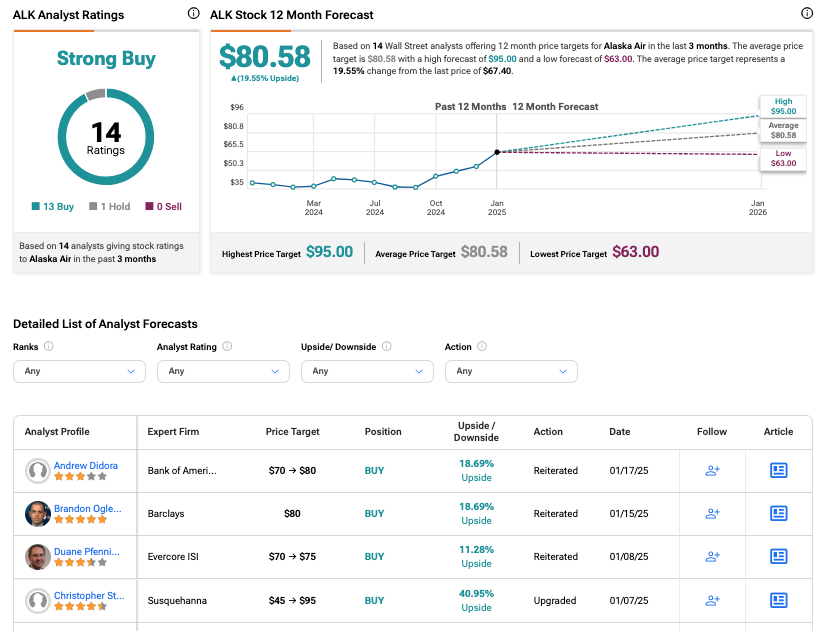

As per the consensus rating on TipRanks, ALK stock has a Strong Buy rating, supported by 14 recommendations. It includes 13 Buys and one Hold rating The Alaska Air share forecast is $80.58, which is 19.5% below the current price level.

It is important to note that these ratings may change following ALK’s favorable results.