Alibaba (BABA) is making steady progress in the artificial intelligence space. Its new open-source model, Qwen3-Coder, has quickly climbed the ranks in AI code generation. Data from OpenRouter, which tracks usage across AI models, shows that Qwen is gaining market share from rivals such as Amazon (AMZN)-backed Anthropic and Google (GOOGL).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In mid-July, Anthropic’s Claude Sonnet 4 accounted for 46.3% of code generation requests on OpenRouter, while Google’s Gemini 2.5 Pro held 13.4%. By August 11, Claude’s share had fallen to 32.3%, and Gemini dropped to 5.8%.

Meanwhile, over the same period, Alibaba’s Qwen3-Coder rose quickly, capturing 20.7% of the market within weeks of its late July launch. The trend suggests that developers are increasingly turning to Alibaba’s open-source model for their coding needs.

What Does This Mean for Alibaba?

Alibaba’s move into AI comes at a time when its core e-commerce business faces slower growth. For Alibaba, the strong uptake of Qwen3-Coder marks progress in its broader AI push. The company is positioning itself as a key player in open-source AI, a space where China is rapidly catching up with Western rivals.

For Alibaba, Qwen’s rapid adoption could be a catalyst for the stock, provided the company can translate strong developer interest in its free model into commercial opportunities.

Is Alibaba Stock a Good Buy Right Now?

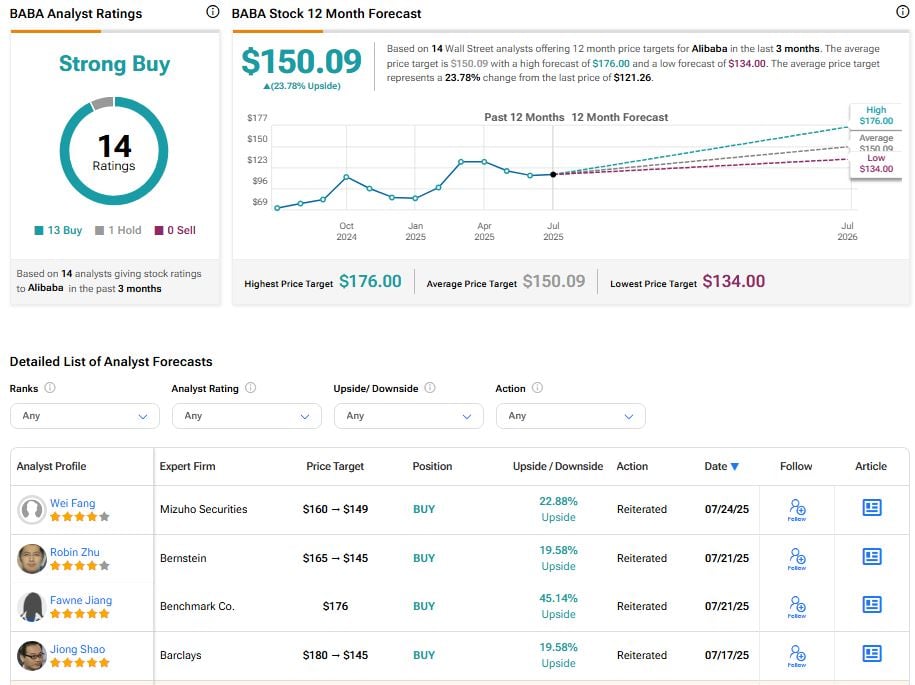

Analysts remain highly bullish about Alibaba’s stock trajectory. With 13 Buy ratings and one Hold rating, BABA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Alibaba price target of $150.09 implies about 23.78% upside potential from current levels.