Alibaba Group Holding Limited (BABA) is setting the stage for a potentially pivotal earnings report on May 15, and it’s doing so with a wave of momentum, both in the market and behind the scenes. The company recently filed a series of Next Day Disclosure Returns with the Hong Kong Stock Exchange, outlining its latest share repurchase activity from April 28 to May 2, 2025.

This move comes along with growing investor optimism, and for good reason.

Stock Surges as U.S. Demand and Tech Bets Pay Off

Alibaba’s stock price has surged roughly 6% over the last five trading days, fueled partly by a rise in popularity among U.S. shoppers hunting for bargains. Its platform, Alibaba.com, has soared to the top of the iOS App Store’s shopping category, highlighting the company’s growing traction in the American market.

At the same time, Alibaba’s aggressive investment in AI and cloud technology is also drawing attention. The company has laid out a bold $53 billion plan to supercharge these capabilities over the next three years, and this push is already paying dividends: its cloud division is showing strong revenue growth and positioning itself as a key pillar in Alibaba’s future.

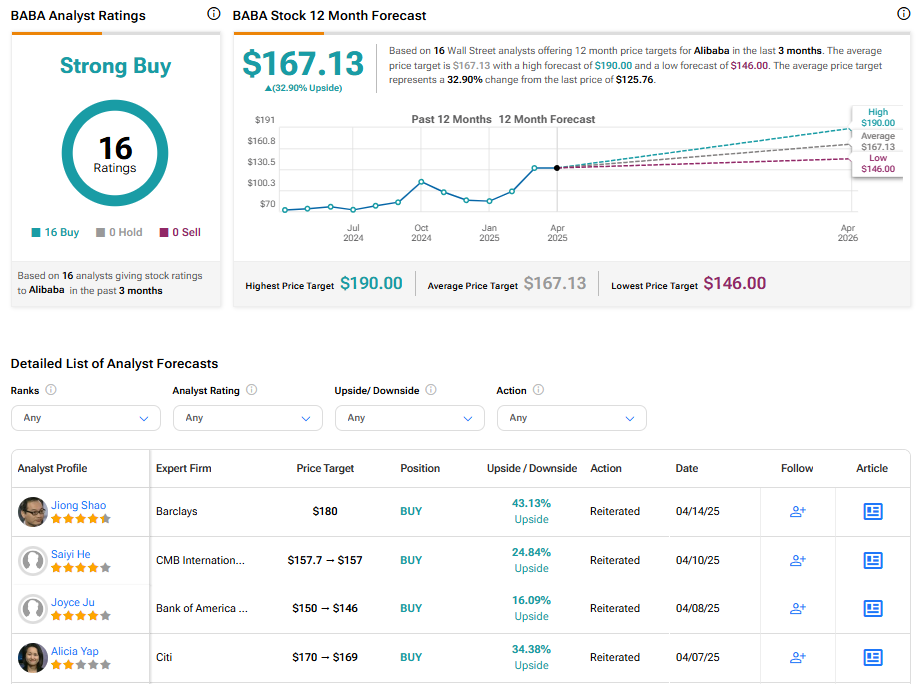

Despite persistent U.S.-China trade tensions, analysts remain bullish over BABA stock. Alibaba’s ability to navigate geopolitical headwinds while staying ahead in the AI race has earned it a Strong Buy consensus rating, making it a standout in both tech and e-commerce.

Buybacks That Tell a Bigger Story

Over the fiscal year ending March 31, 2025, Alibaba repurchased 1,197 million ordinary shares (equivalent to 150 million ADSs) for $11.9 billion. This led to a 5.1% net reduction in outstanding shares, even after factoring in stock issued through employee programs.

These repurchases are more than financial engineering, as they signal management’s confidence and a strategic step to boost EPS, strengthen market positioning, and potentially support stock price performance going into earnings.

Spark’s View: “Outperform”

TipRanks’ AI analyst, Spark, maintains an Outperform rating on Alibaba stock. According to Spark:

“Alibaba’s strong financial performance, positive earnings call outcomes, and reasonable valuation contribute to a solid overall stock score. The company’s strategic investments in AI and cloud and robust e-commerce growth bolster its market position despite challenges in free cash flow and specific segment losses.”

However, challenges remain, including segment-specific losses and pressures on free cash flow, but the overall picture is optimistic. Alibaba’s e-commerce strength, AI leadership, and clear tech vision are compelling factors for institutional and retail investors.

While short-term technical signals may remain cautious, Alibaba’s fundamentals, paired with the strategic timing of its buybacks and strong U.S. app growth, suggest a potentially positive surprise on May 15.

What to Watch in Alibaba’s Earnings Report

- Will the reduced share count translate into a stronger-than-expected EPS?

- How much revenue lift is Alibaba seeing from its cloud and AI investments?

- Can Alibaba maintain its growth in international e-commerce, especially in the U.S.?

- What’s the outlook for free cash flow and capital allocation amid global uncertainties?

With the company firing on multiple cylinders and sentiment shifting, May 15 could be a turning point, not just for Alibaba’s stock but also for how investors view the future of China’s tech champions on the global stage.

Is Alibaba Stock a Good Buy Right Now?

According to Wall Street analysts, Alibaba has a Strong Buy rating and an average price target for BABA stock of $167.13, implying a 32.90% upside potential.