Chinese e-commerce and cloud giant Alibaba Group (NYSE:BABA) is well-positioned for growth even as China’s economy continues to struggle with issues related to rising unemployment and plunging secondhand home prices. The company enjoys a tremendous advantage in the fast-growing cloud space in the Chinese market, and its e-commerce business can surge due to the country’s rising middle class.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

These are leading factors Wall Street analysts have considered when suggesting that BABA shares constitute a buying opportunity for investors. I share their optimism about the potential for Alibaba stock to climb, going forward. Below, we take a closer look at some of the elements likely to impact Alibaba’s performance.

Fast-Growing Cloud Infrastructure Business Could Provide Cash Flow

While Alibaba is known as an e-commerce provider, one of its key drivers of cash flow is cloud infrastructure. With about $10.7 billion in Cloud revenue for the 2023 fiscal year and about $90.6 billion in China and International Commerce revenue, Alibaba’s Cloud business remains just a fraction of the size of its retail arm.

However, cloud services generally have much higher margins than online retail sales, and thus provide better cash flow. Fortunately for Alibaba, China’s cloud services market is growing at a rapid clip. For Q3 2023, for instance, cloud infrastructure spending in mainland China was 18% higher than the prior-year quarter.

As this trend is likely to continue into the coming years, investors may watch to see if Alibaba’s cloud business represents a larger and larger portion of its total revenue and, with it, if free cash flow rises as well.

Potential for Retail Boom

As mentioned, the largest portion of Alibaba’s revenue is generated by its retail and e-commerce business. Typically heavily impacted by the state of the economy, China’s recent concerns regarding unemployment, housing, and more may be a threat to retail nationwide.

On the other hand, there are bright aspects to China’s economic news that could signal a boom for Alibaba’s retail business. In the first two months of the year, retail sales nationwide rose 5.5%. Although this was down from December’s 7.4% improvement, it still came in ahead of an expected 5.2% increase.

China has about 400 million people representing its middle class, a figure that has grown in recent years. The global middle class is traditionally a core demographic for retail and e-commerce business. However, economic concerns have pushed many middle class consumers in China and elsewhere around the world to tighten their belts.

Still, Alibaba has the infrastructure and supply chain to be flexible in response to the shifting needs of this huge group of potential retail consumers. Indeed, several years ago, the company made a concerted effort to expand its offerings to lower-income markets.

The company is thus well-positioned to be able to meet consumers where their needs lie. While the economy is sluggish, Alibaba can pivot to providing items at lower price points. As China’s economy recovers from its long-lasting COVID-19 restrictions, the company has the consumer base and the market share to see a major retail boom. Between Alibaba’s Taobao and Tmall platforms, the company enjoys the majority of the Chinese e-commerce market.

Lots of Cash and a Great Valuation

Alibaba’s strong market position has also provided it with a cash cushion to adapt to changing conditions. The company ended the last fiscal year with about $92 billion in cash, cash equivalents, or other short-term investments. Given that its stock has fallen more than 13% in the last year, Alibaba also enjoys a forward P/E ratio of just over 8x (major American competitor Amazon.com (NASDAQ:AMZN), by comparison, has a forward P/E ratio of more than 42x), making it an attractive value prospect.

Is BABA Stock a Buy, According to Analysts?

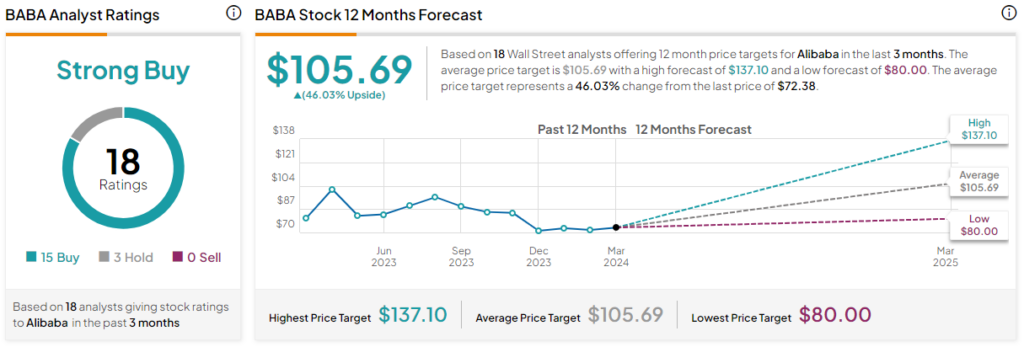

The above reasons explain Wall Street analysts’ overwhelming Buy rating for BABA shares, based on 15 Buy ratings, three Holds, and zero Sells. The average BABA stock price target of $105.69 implies 46% upside potential.

BABA: There’s Potential for Patient Investors

Particularly for investors willing to weather China’s economic issues, Alibaba is a worthwhile prospect. The company’s dominance in China, its booming cloud and e-commerce businesses, and its attractive valuation and cash holdings make it primed for growth.