Alibaba (BABA) (HK:9988) is winning attention on Wall Street as analysts grow more confident in its AI and cloud ambitions. The Chinese e-commerce leader has seen its U.S.-listed shares surge over 120% this year, powered by steady gains in its core retail business and strong progress in AI-driven cloud services. Recent plans by CEO Eddie Wu to expand the company’s $53 billion AI budget over the next three years, along with a new partnership with Nvidia (NVDA), have strengthened investor optimism. These moves highlight Alibaba’s push to stay competitive against global and domestic tech rivals and could help fuel more gains for the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts Remain Upbeat on BABA Stock

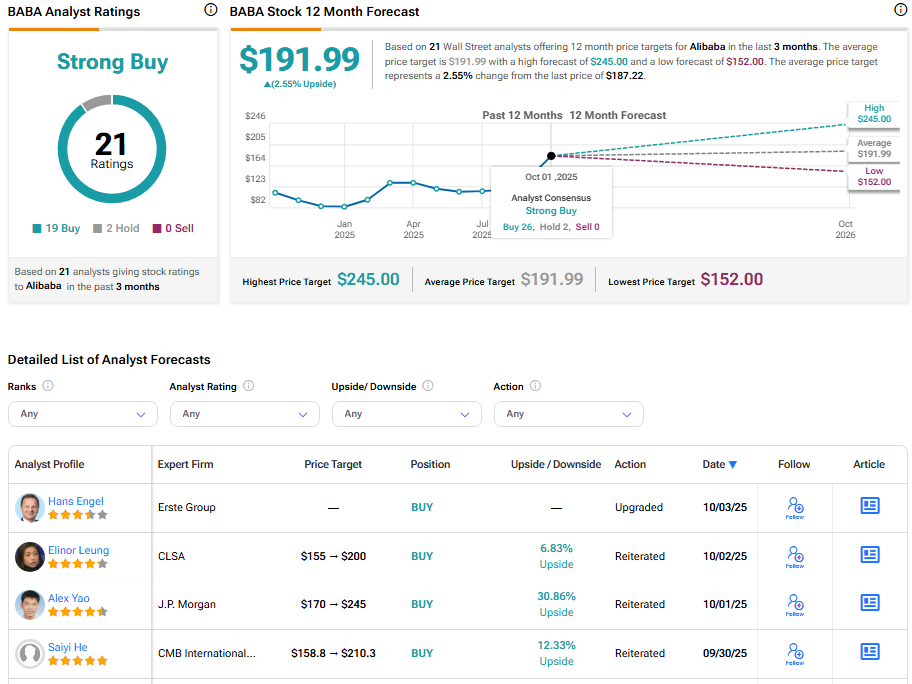

Erste Group analyst Hans Engel upgraded Alibaba stock from Hold to Buy, pointing to strong progress in artificial intelligence (AI) and cloud computing. Engel said Alibaba’s focus on turning its AI technology into revenue through cloud services and in-house chip development is driving long-term value.

He added that the company’s core e-commerce business and cross-border platforms like AliExpress remain solid growth engines. Engel also sees a “positive risk-reward” profile for investors and noted that Alibaba’s ongoing share buyback program continues to support the stock’s upward trend.

Similarly, JPMorgan analyst Alex Yao lifted his price target on Alibaba to HK$240 from HK$165, maintaining an Overweight rating. Yao said Alibaba’s stock has outperformed peers in recent months, helped by stronger-than-expected cloud growth and management’s upbeat outlook on food delivery and quick commerce.

After attending Alibaba’s Apsara conference, Yao said he is more confident in the growth potential of AliCloud, especially its ability to attract more external clients and work closely with Alibaba’s domestic e-commerce unit. He added that better results in both cloud and online retail support a higher valuation for the stock and show that Alibaba is regaining its place as one of China’s leading tech firms.

Is BABA a Good Stock to Buy Now?

For now, Wall Street remains highly bullish on Alibaba stock. With 19 Buys and two Holds, Wall Street has a Strong Buy consensus rating on Alibaba stock. The average BABA stock price target of $191.99 indicates 2.55% upside potential.