Alibaba (BABA) (HK:9988) stock fell as much as 4.8% in Hong Kong on Monday, leading losses on the Hang Seng China Enterprises Index. The drop followed a report that the Trump administration has raised concerns over Apple’s (AAPL) partnership with Alibaba to bring the Chinese tech giant’s AI to iPhones sold in China.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

According to the report, U.S. officials are concerned about the deal’s implications, specifically how it could boost China’s AI capabilities, expose Apple to tighter Chinese data laws, and create potential national security risks.

The scrutiny around the Apple deal adds to Alibaba’s recent challenges. In Q4 FY25, the company posted mixed results, with revenue of RMB236.4 billion ($32.6 billion) falling short of the expected RMB237.91 billion. Earnings per ADS also missed the mark, coming in at $1.73.

AI Dreams Put on Hold

The U.S. pushback on the Apple deal casts doubt on Alibaba’s broader ambitions in China’s fast-growing AI industry. The company had positioned itself as a key player in the DeepSeek-inspired AI boom, with investors viewing its cloud business as a major growth driver. However, regulatory friction could force Alibaba to slow its momentum at this point of time.

Analysts also warn that ongoing regulatory hurdles could bring uncertainty to Alibaba’s growth, making investors worried about its short-term outlook. For instance, Bloomberg Intelligence analyst Catherine Lim said Alibaba’s “potential cloud-revenue upside” could be at risk due to “US resistance” to the deal. Without “more clarity,” she said the company might cut back on research and hold off on building new AI infrastructure.

Why Apple May Have More at Stake

While Alibaba’s shares suffered immediately, analysts warn that Apple could face deeper consequences if the deal falls through. China remains Apple’s second-largest market after the U.S., but its sales there fell 2.3% last quarter as competition from local brands like Huawei and Xiaomi intensified.

Analysts caution that without a solid AI partner embedded within China’s tech ecosystem, Apple risks falling behind. “Apple has much more to lose,” said Vey-Sern Ling of Swiss private bank Union Bancaire Privée. He added that Apple “will need an AI partner in China” to stay competitive in the region.

Is Alibaba Stock a Good Buy Right Now?

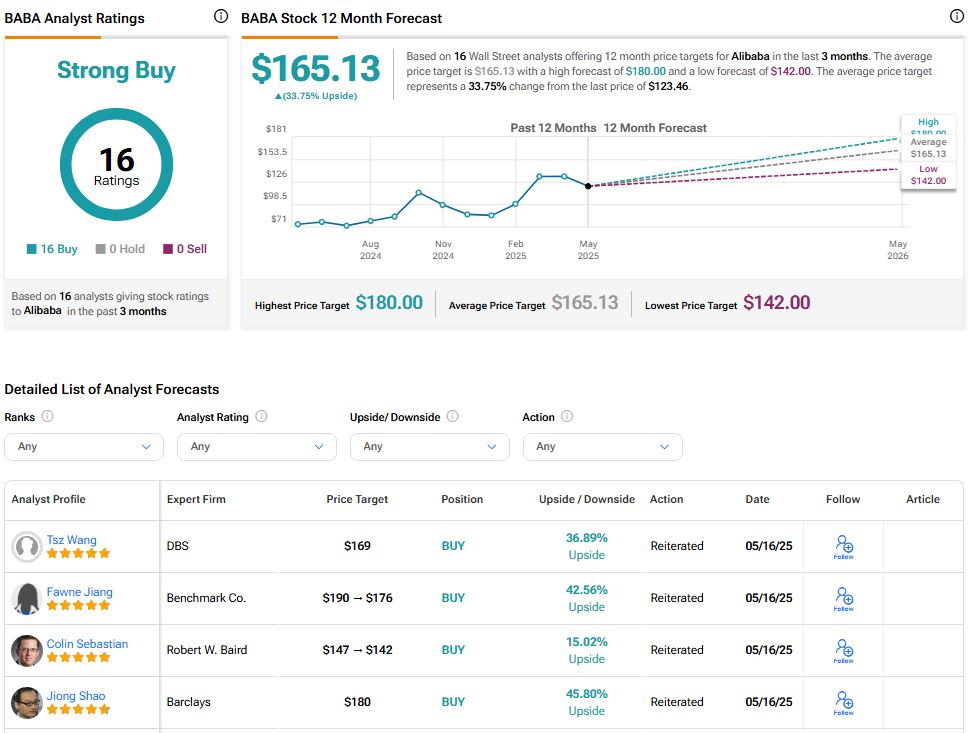

Analysts remain highly bullish about Alibaba’s stock trajectory. With 16 unanimous Buy ratings, BABA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Alibaba price target of $165.13 implies 33.75% upside potential from current levels.