Alibaba (BABA) announced a massive investment of $53 billion over the next three years to expand its AI (artificial intelligence) and cloud computing capabilities. This investment, which surpassed its total spending in the sector over the past decade, solidifies Alibaba’s position as a global leader in cloud technology. Moreover, Alibaba’s huge investment signifies China’s push to surpass the U.S. in AI development. Year-to-date, BABA stock has surged nearly 70%, driven by optimism around faster AI adoption after DeepSeek’s cost-effective models, partnership with Apple (AAPL), and strong Q3 FY25 results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Notably, Alibaba announced plans to invest in the sector during its earnings report on Friday but did not disclose a specific amount.

Alibaba Calls AI a “Once-in-a-Generation” Opportunity

During Alibaba’s recent earnings call, CEO Eddie Wu called AI a “once-in-a-generation”opportunity. He emphasized that the company’s long-term focus is artificial general intelligence (AGI), which could transform industries by replicating human thinking and physical tasks.

Wu further highlighted as AI advances, more AI-generated data will rely on cloud networks for processing and distribution, strengthening Alibaba Cloud’s role as a key infrastructure provider. Wu added that cloud computing is Alibaba’s strongest revenue source in AI, driven by rising demand for AI hosting services.

Alibaba Cloud Poised for Growth Amid AI Revolution

In Q3 FY25, Alibaba’s cloud revenue grew 13% year-over-year to ¥31.7 billion ($4.3 billion). Meanwhile, AI-related product revenue saw triple-digit growth for the sixth consecutive quarter.

Looking ahead, Alibaba’s AI-driven growth in cloud intelligence is expected to accelerate further. Morgan Stanley expects Alibaba Cloud’s revenue to double to ¥240 billion by 2028, while BofA forecasts over 30% year-over-year growth in cloud intelligence revenue for FY26.

Is Alibaba Stock a Good Buy Now?

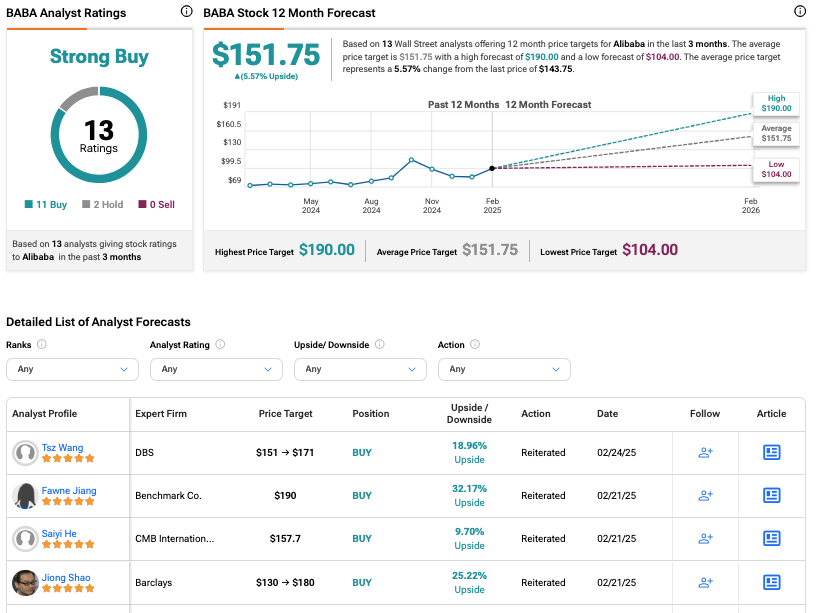

After Alibaba’s earnings on Thursday, multiple Wall Street firms raised their price targets and maintained a positive outlook on BABA stock.

On TipRanks, BABA stock has a Strong Buy consensus rating based on 11 Buys and two Holds assigned in the last three months. At $151.75, the Alibaba share price target implies a growth rate of 5.6% on the current trading price.