Chinese stocks–including Alibaba (BABA), JD.com (JD), and Baidu (BIDU)–declined in Tuesday’s trading after rating agency Moody’s (NYSE:MCO) downgraded China’s government debt rating from stable to negative. However, Moody’s kept China’s A1 long-term rating intact for sovereign bonds.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The rating agency said that the broad downside risks to China’s economy could not be ignored anymore. Moody’s stated, “The outlook change also reflects the increased risks related to structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector. These trends underscore the increasing risks related to policy effectiveness.”

Moody’s also pointed out that the downturn in its property market continues to pose a risk to the nation’s economy. In addition, there are growing doubts about the extent to which the fiscal stimulus is working, as China’s macroeconomic data last week indicated a slowdown in manufacturing and services activities.

What Companies are in FXI?

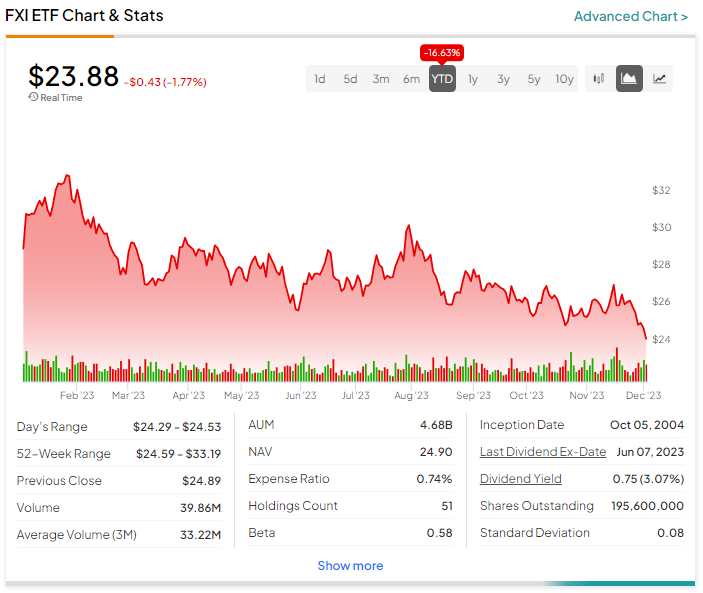

For investors interested in Chinese companies, the iShares China Large-Cap ETF (FXI) is a viable option. This ETF focuses on large-cap Chinese companies, including BABA and NetEase (NTES). As of December 1, the ETF had holdings in 51 Chinese companies.

China’s macroeconomic woes have meant that the FXI ETF has slid by more than 16% year-to-date.