Chinese e-commerce giant Alibaba (BABA) has launched a 2 billion yuan (US$281 million) plan to boost its instant commerce business through Taobao, its popular online shopping platform. The company will upgrade local convenience stores across China under the Taobao brand instead of opening new ones.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Under the program, store owners will receive help from Alibaba’s 1688.com wholesale site, supply chain services from its Aoxiang platform, and Taobao branding. These upgrades will make it easier for shops to manage inventory, restock quickly, and deliver orders faster.

Alibaba said the goal is to ensure every partner store can provide “one-stop, 24-hour, and 30-minute delivery” service to customers.

Program Expands to 200 Cities across China

The first Taobao-branded stores opened recently in Hangzhou and Nanjing. Alibaba plans to expand this program to more than 200 cities across China. According to Hu Qiugen, head of Alibaba’s instant commerce division, the goal is to create a “win-win” for both Alibaba and local stores by providing small businesses with new customers and digital tools.

Alibaba Leverages Taobao’s Rapid Growth

This move builds on the success of Alibaba’s fast-growing Taobao Shangou platform, which delivers groceries and daily essentials to customers within 30 minutes. The service now has 300 million monthly users, with daily orders recently reaching 120 million.

Alibaba CEO Eddie Wu said the company aims to grow user activity and improve customer experience as competition heats up.

According to an institute under China’s Ministry of Commerce, China’s instant commerce market is expected to grow to 2 trillion yuan, and Alibaba’s latest investment shows it wants a bigger share by connecting online and offline retail under Taobao’s name.

Is Alibaba Stock a Good Buy Right Now?

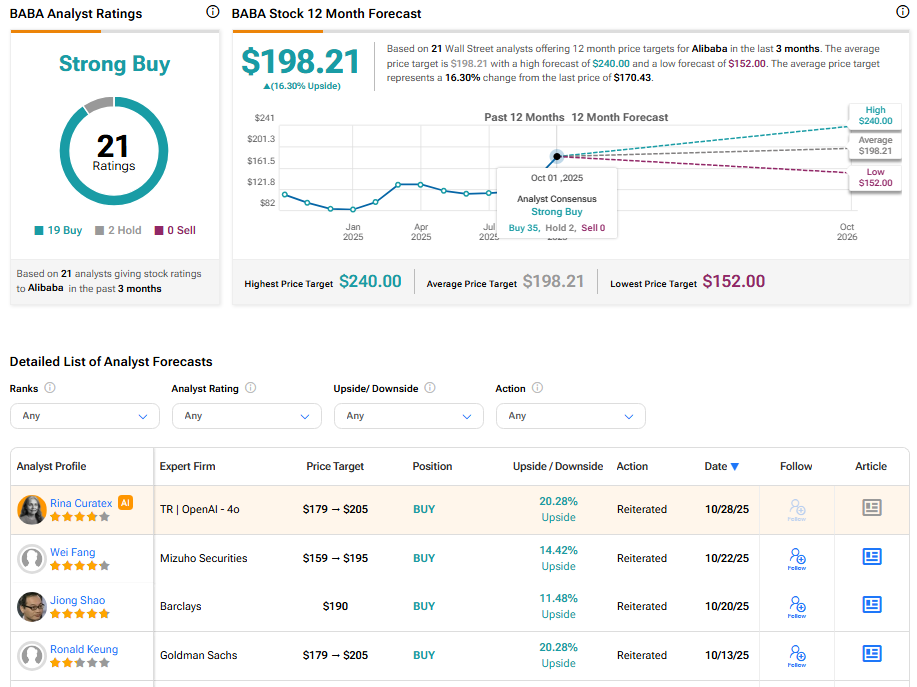

Analysts remain highly bullish about Alibaba’s stock trajectory. With 19 Buy ratings and two Hold ratings, BABA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Alibaba price target of $198.21 implies about 16.30% upside potential from current levels.