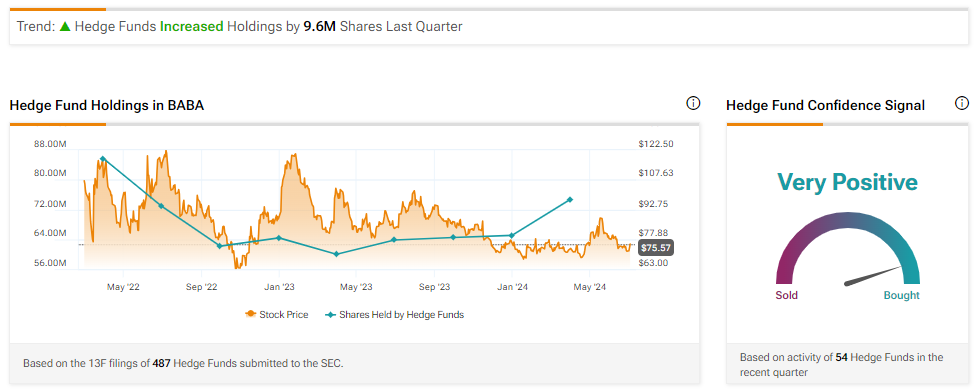

Shares of the Chinese tech giant Alibaba (NYSE:BABA) have underperformed the broader market year-to-date. However, hedge funds, popular for generating above-average returns, are optimistic about BABA stock. Using TipRanks’ Hedge Fund Trading Activity tool (which analyzes data from Form 13-Fs to offer hedge fund signals), we found that these experts have significantly accumulated Alibaba stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Hedge Funds Bought Alibaba Stock

It’s important to note that macroeconomic challenges and increased competition have impacted Alibaba’s stock. Additionally, Alibaba is investing heavily in its business to offer competitive prices and enhance the user experience.

This will likely pressure its margins in the short term. Nonetheless, the expected increase in gross merchandise volumes, reacceleration in its cloud business, and AI provide a solid foundation for future growth. The company is capitalizing on its lower share price and aggressively buying back its stock.

Given these positives, The Hedge Fund Confidence Signal is Very Positive for BABA stock based on the activity of 54 hedge funds. Hedge funds increased their BABA holdings by 9.6M shares in the last quarter. Gladstone Capital Management and Woodline Partners were among the hedge funds that started a new position in BABA stock. Meanwhile, Michael Burry of Scion Asset Management increased his holdings in Alibaba stock.

Is Alibaba a Buy, Sell, or Hold?

Along with hedge funds, Wall Street analysts are also bullish about Alibaba’s prospects. BABA stock has 14 Buys and three Hold recommendations for a Strong Buy consensus rating. The analysts’ price target on BABA stock is $103.70, implying an upside potential of 37.22% from current levels.

Bottom Line

Alibaba is a compelling stock based on the positive signal from hedge funds and analysts’ bullish outlook. Overall, it has an Outperform Smart Score of Perfect 10 on TipRanks, implying it is more likely to beat the broader market averages.