Shares of food and drug retailer Albertsons Companies (NYSE:ACI) are in focus today after the company delivered a better-than-expected third-quarter performance. Revenue increased by 2.3% year-over-year to $18.56 billion, exceeding estimates by $200 million. In tandem, EPS of $0.79 outpaced expectations by $0.14.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

During the quarter, digital sales increased by 21%, and identical sales ticked higher by 2.9%. Impressively, the company’s loyalty members surged by 17% to 38.5 million. However, since its pharmacy operations offer lower margins, the combination of more pharmacy business and higher shrink led to a contraction in gross margins for ACI. Further, adjusted EBITDA for the quarter stood at $1,106.5 million.

Separately, the company announced a quarterly cash dividend of $0.12 per share. The ACI dividend is payable on February 9 to investors of record on January 26.

Is ACI a Good Buy?

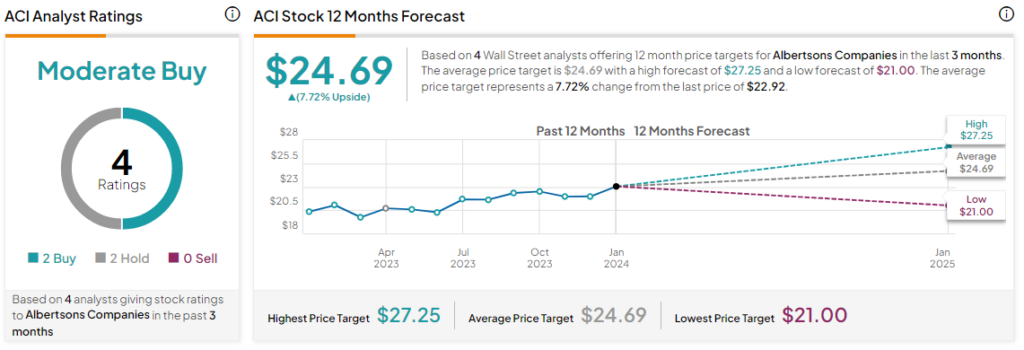

Overall, the Street has a Moderate Buy consensus rating on Albertsons Companies. Following a nearly 10% rise in the company’s share price over the past year, the average ACI price target of $24.69 implies a modest 7.7% potential upside in the stock.

Read full Disclosure