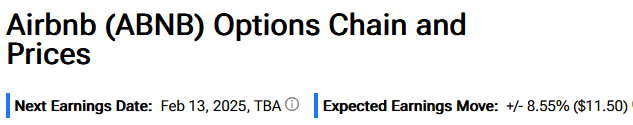

Rental and experiences platform Airbnb (ABNB) is expected to announce its fourth-quarter results after the market closes on Thursday, February 13. Shares have declined 9% over the past year, reflecting investor concerns about intense competition and margin compression due to the company’s growth investments. Analysts expect Airbnb to report Q4 earnings per share (EPS) of $0.58 compared to a loss of $0.55 per share in the prior-year quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meanwhile, Q4 revenue is expected to come in at $2.42 billion, reflecting a 9% year-over-year increase. It is worth noting that Airbnb missed analysts’ earnings expectations in two of the first three quarters of 2024.

Analysts’ Opinions Ahead of ABNB’s Q4 Results

Heading into Q4 results, Evercore ISI analyst Mark Mahaney reiterated a Hold rating on Airbnb stock with a price target of $155. The five-star analyst stated that based on industry data points, third-party channel checks, and peer Expedia’s (EXPE) strong Q4 results, he expects Airbnb to deliver a “Beat and Bracket Q4:24.” However, he cautioned that currency headwinds could limit the upside to the Q1 guidance.

Mahaney added that the Street’s Q1 2025 year-over-year booking growth guidance of 10% and revenue growth outlook of 8% look reasonable, though any possible variance to the downside could occur due to forex headwinds, the extra day in 2024 (leap year), and Easter timing as highlighted by Expedia.

Meanwhile, UBS analyst Stephen Ju increased the price target for Airbnb stock to $143 from $142 but maintained a Hold rating. While the analyst sees the possibility for an upside on Q4 results across the major online travel players, he is cautious due to forex headwinds, given the strengthening of the U.S. dollar against global currencies. For Airbnb, Ju continues to await signals indicating reaccelerating volume growth or greater monetization on various value-added services.

Options Traders Anticipate a Major Move on ABNB’s Q4 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 8.6% move in either direction in reaction to ABNB’s Q4 2024 results.

Is ABNB Stock a Good Buy?

Wall Street has a Hold consensus rating on Airbnb stock based on five Buys, 10 Holds, and five Sells. The average ABNB stock price target of $138.22 implies about 3% upside potential.