Air Products and Chemicals (NYSE:APD) stock fell about 13% yesterday following the release of mixed fiscal fourth quarter results. The company is a global provider of industrial gases and chemicals.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

APD reported Q3 revenues of $3.2 billion, down 11% year-over-year, and missed the consensus estimate of $3.35 billion. Meanwhile, the company’s adjusted earnings stood at $3.15 per share, up 11% from the same quarter last year. Further, the figure topped the analysts’ expectations of $3.11 per share.

Segment-wise, the company witnessed a drop in sales in the Americas, Asia, and Europe by 12%, 7%, and 18%, respectively. Particularly in Asia, volume dropped by 7%, primarily due to the sluggish pace of China’s recovery and subdued demand in the electronics market.

Earnings Outlook

Looking forward, APD expects fiscal first-quarter adjusted EPS between $2.90 and $3.05. The analysts are expecting earnings of $3.00 per share. Furthermore, the company anticipates Fiscal 2024 adjusted earnings in the range of $12.80 to $13.10, compared with the consensus estimate of $12.84. It is worth mentioning that the company’s EPS guidance indicates 13% growth at the midpoint compared to its Fiscal 2023 figure.

Is APD a Good Stock to Buy?

Air Products benefits from its impressive footprint, as it has operations in over 50 countries. The company’s growing scale is reflected in its steadily increasing bottom line in the past few quarters. Moreover, having increased dividends for over 40 years, APD has successfully made its place among the Dividend Aristocrat stocks. Also, the company’s dividend yield of 2.34% remains above the sector average of 1.64%.

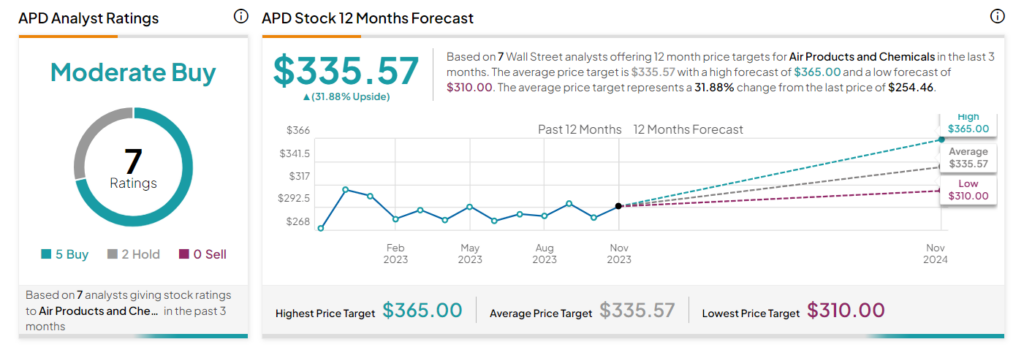

On TipRanks, APD has a Moderate Buy consensus rating based on five Buy and two Hold recommendations. The average Air Products stock price target of $335.57 implies a 31.88% upside potential. The stock is down 15.5% so far in 2023.