Air Lease Corp. (NYSE:AL) shares surged nearly 4% today after the aircraft leasing company’s third-quarter EPS of $1.59 came in better than expectations by $0.57. Further, revenue soared by 17.5% year-over-year to $659.4 million, outperforming estimates by nearly $1.7 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amid robust demand, the company sold eight aircraft in Q3 for nearly $350 million and has placed 100% of its contracted order book positions on long-term leases for deliveries through the end of 2025. Further, Air Lease ended the quarter with committed minimum future rental payments of $31.2 billion and a total fleet size of 878.

Notably, Air Lease anticipates that the supply of commercial aircraft will remain constrained owing to supply chain and other OEM (original equipment manufacturer) challenges. The company ended the quarter with total liquidity of $6.6 billion and $18.6 billion in total debt financing.

Amid a healthy demand and sales environment, Air Lease has increased its quarterly dividend by 5% to $0.21. The AL dividend is payable on January 10 to investors of record on December 15.

Is AL a Good Stock to Buy?

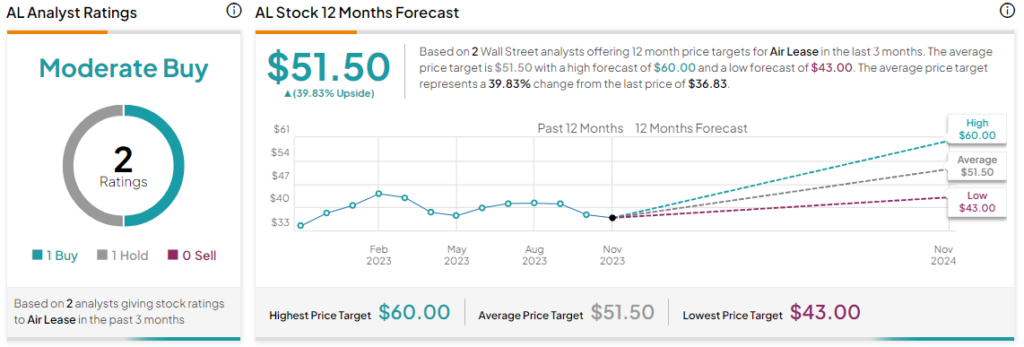

Overall, the Street has a Moderate Buy consensus rating on Air Lease. The average AL price target of $51.50 implies a substantial 39.8% potential upside.

Read full Disclosure