Alphabet Inc. (GOOGL) wrapped up its I/O 2025 event with a strong focus on AI. The biggest highlight was AI Mode—a new chatbot-style search tool that gives direct, helpful answers. CEO Sundar Pichai called it a “total reimagining of search.” Google also added Gemini across its apps, launched a $249.99/month AI plan for business users, and showed off smart glasses and creative tools like Veo 3 and Google Beam.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Following these AI-driven updates, several top analysts reaffirmed their bullish stance on the stock.

Anmuth’s Views About Google Post Google I/O

Doug Anmuth, a Top analyst at JPMorgan, reaffirmed an Overweight rating and a $195 price target on Alphabet. He came away from Google I/O “incrementally positive,” noting that Google is ahead in several areas of AI. Gemini is leading on model leaderboards, and AI Mode brings Gemini into Search with “agentic capabilities” from Astra, Mariner, and Deep Research.

Anmuth also noted that Google is now “shipping faster than ever.” AI Mode is already rolling out to U.S. users, just a year after AI Overviews were launched. He believes this “total reimagining of search” is taking shape as AI Mode links tools that once worked apart.

While the road ahead stays tough, Anmuth believes that Google can handle the shift to AI Search.

Josey’s Perspective on Alphabet’s AI Strategy

Meanwhile, another five-star analyst, Ronald Josey of Citi, also reiterated a Buy rating and $200 price target on GOOGL, pointing to Google’s growing user base and faster product updates. He noted that AI Mode is now live in the U.S., the Gemini App has hit 400 million monthly users (up from ~350 million in March), and AI Overviews are boosting queries. This shows stronger “product cadence” and wider use of Google’s tools, which could help support Search growth.

Josey said Google I/O focused on “creating a more personalized user experience” through its Agentic features in Mariner, Astra, and the Gemini App—plus its launch of new AI-powered glasses.

Though he flagged the strong competition in the tech sector, Josey still sees Alphabet set up for steady gains in its core Search business.

Are Google Shares a Good Buy?

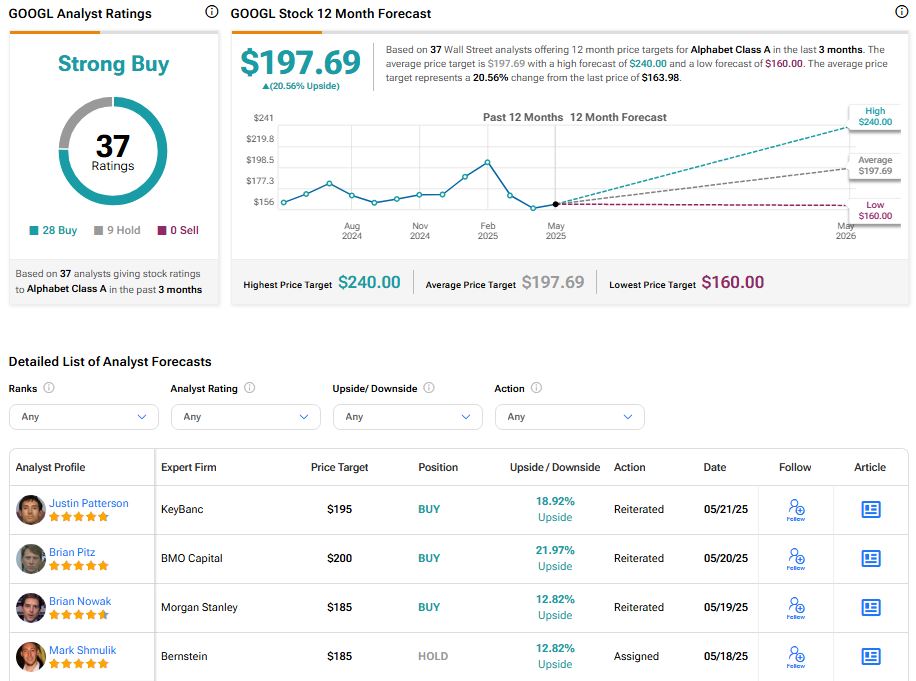

Overall, Wall Street analysts have a Strong Buy consensus rating on GOOGL stock based on 28 Buys and nine Holds assigned in the past three months. The average GOOGL price target of $197.69 per share implies a 20.56% upside potential.