It appears that anything related to AI (Artificial Intelligence) is catching investors’ interest these days. For instance, AI-related stocks like Nvidia (NASDAQ:NVDA), C3.ai (NYSE:AI), Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG), and Microsoft (NASDAQ:MSFT) have seen strong buying and have outperformed the broader markets on a year-to-date basis. Along with individual stocks, AI-focussed ETFs (Exchange-Traded funds) like Roundhill Generative AI & Technology ETF (CHAT) and Global X Robotics & Artificial Intelligence ETF (BOTZ) have also witnessed a large inflow of cash.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to a Wall Street Journal report, assets in the recently launched CHAT ETF have grown to $35 million, reflecting a net inflow of about 13 million on June 1. Meanwhile, BOTZ RETF has attracted $450 million of new money so far in 2023.

Overall, the tech-focused ETFs witnessed a net inflow of $8 billion in May, which shows investors’ optimism in AI and, more broadly, in tech stocks, the report highlighted.

While both ETFs provide exposure to AI, the Roundhill Generative AI & Technology ETF is more focused on generative AI. Thus, investors with a keen interest in AI-related stocks could consider this ETF.

Is CHAT a Good ETF to Invest In?

Thanks to the uptrend in its top holdings, the CHAT ETF has already gained about 8.5% in less than a month. It also has an Outperform Smart Score of eight, implying it has a higher probability of beating the broader markets.

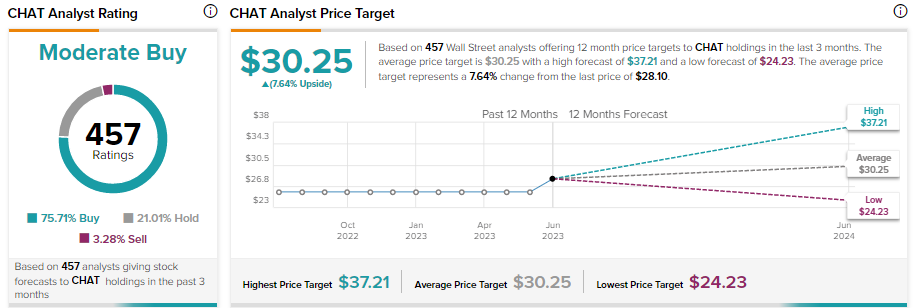

Moreover, per the recommendations of 457 analysts giving stock forecasts for the holdings of CHAT, the 12-month average price target of $30.25 implies 7.64% upside potential from current levels. Also, the ETF has a Moderate Buy consensus rating on TipRanks.

Among the analysts providing ratings on its holdings, 75.71% have given a Buy rating, 21.01% have assigned a Hold rating, and 3.28% have given a Sell rating.