For the past three years, U.S. stock markets have been driven mainly by enthusiasm around artificial intelligence. This rally has been led by the “Magnificent Seven,” a small group of large tech companies. Recently, though, some investors have started to feel uneasy about whether AI will really deliver the huge economic impact and profits many had expected. According to Ed Yardeni, chief investment strategist at Yardeni Research, this uncertainty has led to “AI fatigue.” As a result, investors are beginning to shift money away from big tech and toward the other 493 companies in the S&P 500 (SPY).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Interestingly, this change has been subtle but steady since the market hit a record in late October. Since then, the Magnificent Seven index has fallen about 2%, while the rest of the S&P 500 has gained nearly 2%. Investors have rotated out of expensive, high-momentum tech stocks and into more defensive and better-valued sectors. In fact, funds that exclude the largest tech names have seen consistent inflows, and performance across the broader market has held up well.

However, history shows that shifts away from market leaders are often volatile, as seen during the Nifty Fifty collapse in the 1970s and the dot-com bust in 2000. Some strategists think that the AI trade still has room to run, while others believe valuations are stretched. In addition, Wall Street forecasts suggest the Magnificent Seven will contribute less to earnings growth in 2026, while profits for the remaining S&P 493 are expected to accelerate, thereby making value-focused sectors more appealing.

Is SPY Stock a Good Buy?

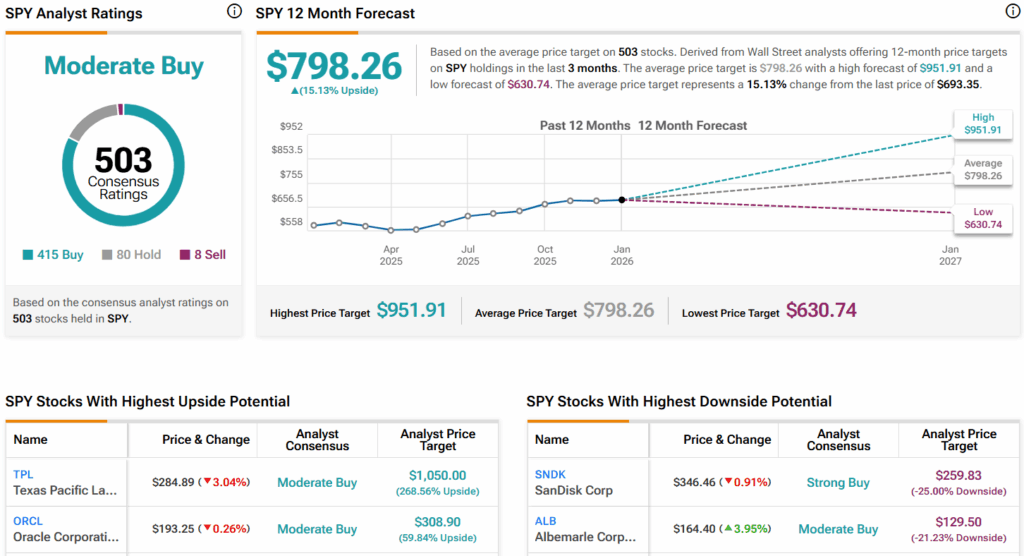

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust (SPY) based on 415 Buys, 80 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $798.26 per share implies 15.1% upside potential.