Shares of C3.ai (NYSE:AI) surged in after-hours trading after the software company reported earnings for its fourth quarter of Fiscal Year 2024. Earnings per share came in at -$0.11, which beat analysts’ consensus estimate of -$0.30 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sales increased by 19.6% year-over-year, with revenue hitting $86.6 million. This beat analysts’ expectations of $84.4 million.

Looking forward, management now expects revenue and adjusted earnings for Q1 2025 to be in the ranges of $84 million to $89 million and -$30 million to -$22 million, respectively.

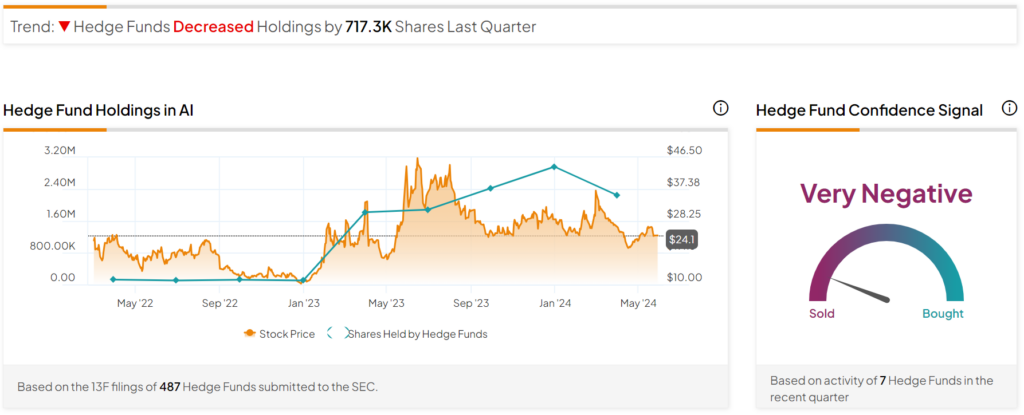

Hedge Funds Are Very Negative

When it comes to “smart money,” money managers don’t seem to be all that confident in AI stock. Indeed, hedge funds decreased their holdings in the stock by 717,300 shares in the past three months. As a result, they have a Very Negative confidence signal, as indicated by the graphic below.

What Is the Price Target for AI?

Turning to Wall Street, analysts have a Hold consensus rating on C3.ai stock based on one Buy, Hold, and Sell assigned in the past three months, as indicated by the graphic below. After a 45% decline in its share price over the past year, the average C3.ai price target of $31.67 per share implies 30.17% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.