Last week, I wrote about how a sharp rise in DRAM prices was forcing PC and smartphone makers to reduce memory allocations in new devices, even as demand remained firm. Since then, the picture has become clearer. The memory crunch isn’t just about higher prices, and it’s starting to reshape entire product cycles across the PC, smartphone, and gaming markets.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

At the center of the issue is AI infrastructure. As more capital flows into large data centers, memory suppliers are shifting capacity away from consumer products and toward higher-margin uses.

AI Data Centers Take Priority

In the earlier piece, we noted that memory makers were redirecting production toward high-bandwidth memory used in AI servers. That trend has since accelerated.

International Data Corporation now warns that global PC shipments could decline by 4.9% to 8.9% in 2026. That is a sharp downgrade from forecasts made just one month earlier. At the same time, average PC prices are expected to rise by 4%-8%, with some manufacturers signaling even larger increases.

Dell Technologies (DELL) and Lenovo Group (LNVGY) have already said they plan to pass on higher costs to buyers. In addition, several manufacturers are now reducing standard memory levels to protect margins. Mid-range laptops that once shipped with 16GB of RAM are increasingly offering 8GB as the base option.

Meanwhile, memory suppliers are openly prioritizing AI customers. In recent earnings calls, Micron Technology (MU) said demand from AI data centers has locked in tight supply conditions through at least 2026. Samsung Electronics (SSNLF) and SK Hynix have also confirmed that much of their future output is already reserved.

As a result, consumer markets are competing for a shrinking pool of chips.

Consumer Devices Face Tough Trade-offs

The pressure is spreading beyond PCs. Smartphone makers are also cutting memory to control costs. Entry-level phones are sliding toward 4GB of RAM, while mid-tier models are losing features that were standard just one year ago.

Apple (AAPL) is also not immune to the shortage. The cost of a 12GB LPDDR5X chip used in the iPhone 17 Pro has more than doubled in 2025. With key supply agreements set to expire in early 2026, Apple may face higher component costs across its lineup.

Now, gaming consoles are entering the conversation. Reports suggest that next-generation systems from Sony Group (SONY) and Microsoft (MSFT) could face delays if memory prices remain elevated. Console makers rely on stable, long-term pricing to plan launches years in advance. That stability is no longer guaranteed.

Samsung is expanding production at its Pyeongtaek facilities, which should add new capacity. However, analysts expect meaningful relief only in late 2026 or later.

For investors, the takeaway is simple. Memory suppliers remain the clear winners as AI demand sets a firm price floor. Meanwhile, device makers face slower unit growth, higher prices, or both. What began as a component shortage might be shaping the entire consumer tech roadmap.

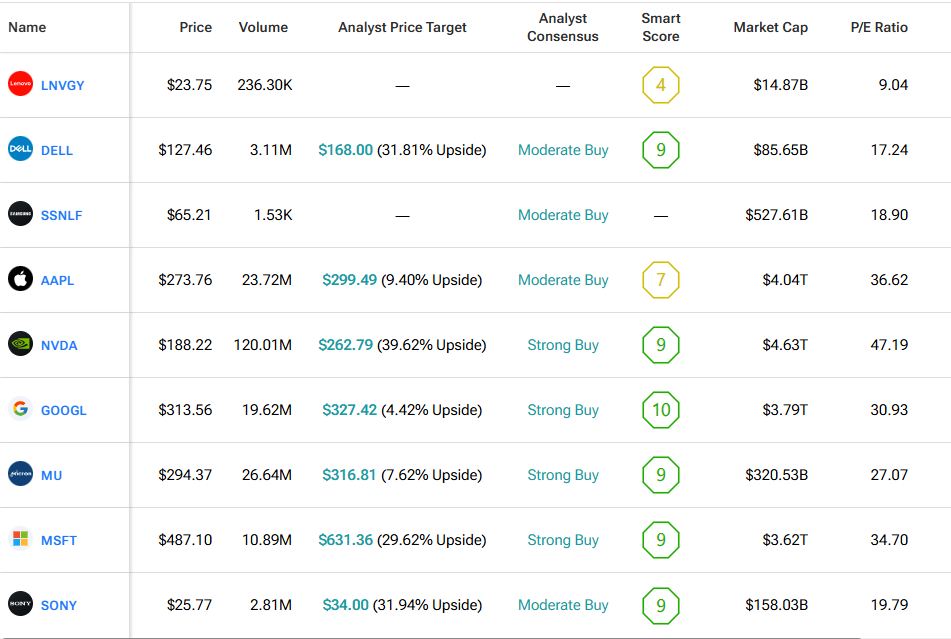

We used TipRanks’ Comparison Tool to align all the stocks appearing in the piece. This tool is very useful for an in-depth look at each stock and the semiconductor industry as a whole.