Super Micro Computer (SMCI) is betting big on America as the next frontier for AI server production. The San Jose-based company, a key supplier of servers powering artificial intelligence models, plans to expand its manufacturing footprint beyond Silicon Valley, eyeing new sites in Texas and Mississippi.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In an interview with The Wall Street Journal, CEO Charles Liang says AI demand is growing “very rapidly” and Super Micro wants to be ready. At the same time, the cost of doing business in California is rising, and reshoring pressure from Washington is heating up. Liang is looking to get ahead of both trends.

SMCI Wants to Stay Ahead of the Curve

Earlier this year, Super Micro announced a third production campus in San Jose. But now, with the AI boom in full swing, it’s thinking bigger. Liang sees growth opportunities not just in the U.S. but also in Europe and Japan. With tech giants like Microsoft (MSFT) and Amazon (AMZN) pouring billions into AI data centers, Super Micro wants to ensure it stays front and center in the AI supply chain.

Still, the road ahead isn’t smooth. The company recently cut its full-year revenue forecast for Fiscal 2025 from $23.5–$25 billion to $21.8–$22.6 billion. The forecast cut stemmed from delayed orders, citing economic uncertainty and the impact of U.S. tariffs.

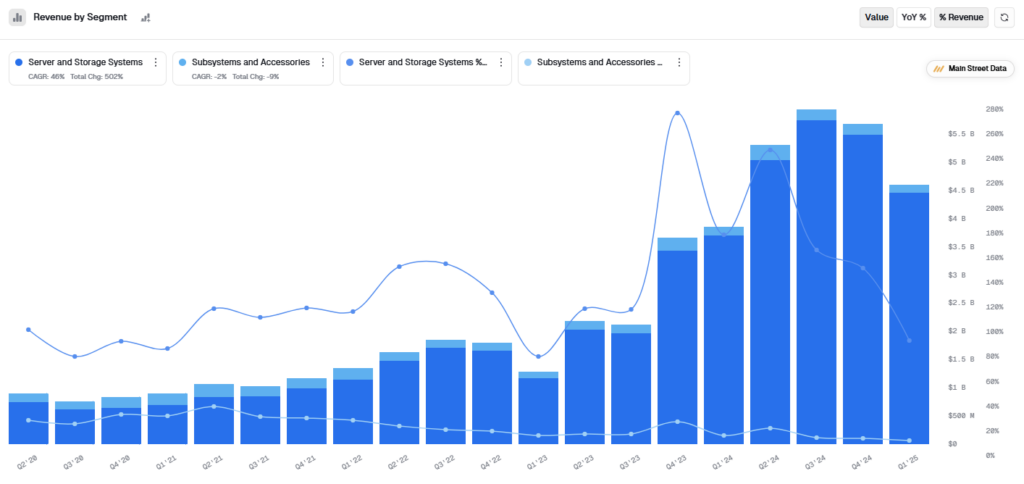

The chart below, by Main Street Data (MSD), tells the story clearly: Super Micro surged during the early phases of the AI boom, but the momentum shows signs of a slowdown in 2025. After a period of rapid growth, revenue is starting to flatten, mirroring the company’s recent guidance cut. For investors, it’s a reminder that the next leg of growth may depend less on hype and more on execution, especially as Super Micro ramps up new U.S. production and waits for those deferred AI deals to come through.

That’s not the only concern. Super Micro’s Q3 sales also fell short of expectations, reaching around $4.5–$4.6 billion, well below the $5–$6 billion it had guided for. While Liang remains confident that delayed orders will come through in the next couple of quarters, investors are watching closely.

SMCI has been one of the hottest AI infrastructure stocks, but with expectations running high, any stumble can sting. For investors on TipRanks, it’s a time to look under the hood: watch for analyst updates, shifts in Smart Score, insider trades, and hedge fund moves.

Is SMCI Stock a Good Buy?

The Street’s analysts rate Super Micro as a Moderate Buy, with an average SMCI stock price target of $40.83. This implies a 4.54% downside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue