The valuations of the world’s largest tech firms have soared to staggering heights, with the so-called Magnificent 7 now boasting a combined market capitalization exceeding $20 trillion. News of such American tech gigantism has crossed the Atlantic, prompting the Bank of England to warn of a potential “sharp correction” due to what it calls “stretched” valuations — a metaphorical rubber band pulled perilously close to its limit.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors have long recognized these inflated valuations, as seen in companies like Palantir (PLTR) and Tesla (TSLA), as well as an entire cavalcade of AI-focused names — but this time may feel different. A series of seemingly paradoxical developments is unfolding simultaneously.

The U.S. government faces a shutdown, yet stock markets remain at record highs. The Federal Reserve hesitates to cut interest rates, yet the bull market continues unabated. Meanwhile, Bitcoin (BTC-USD) has surged to new all-time highs above $125,000 and is increasingly viewed as a safe-haven asset. Gold has broken $4,000/oz with analysts targeting $5,000/oz.

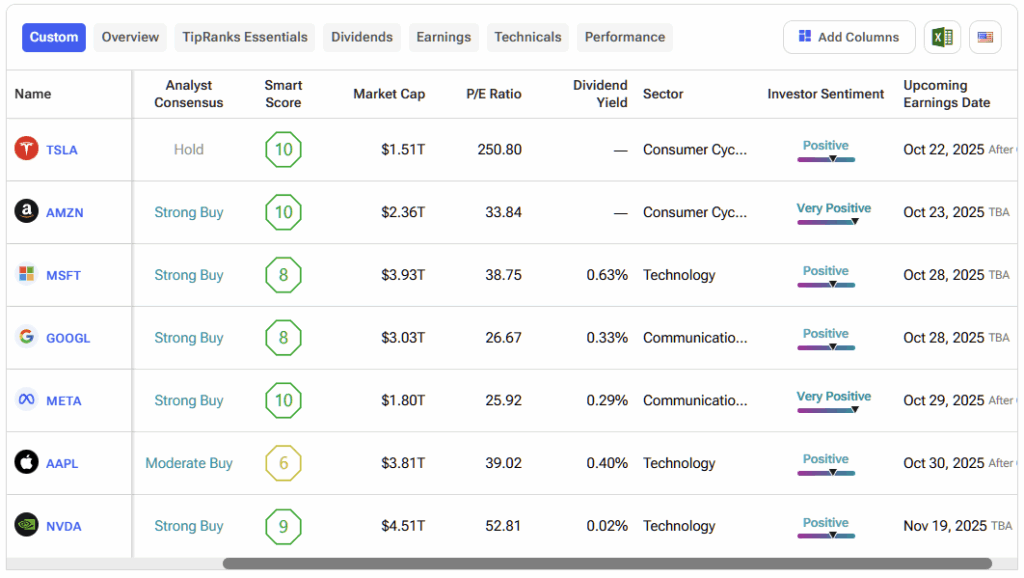

In this “new normal,” the S&P 500’s (SPX) total market capitalization of roughly $65 trillion appears almost modest beside the top seven U.S. firms, which now account for more than a third of that total. Either America’s markets are undergoing extraordinary growth—or seven companies are quietly cornering the wealth of an entire index. Either way, all seven firms will report their results over the coming 40 days at a critical time for the U.S. economy.

The Most Highly Anticipated Earnings Season Since the GFC

Starting October 14, the fourth-quarter “earnings season” will begin in earnest, with every member of the so-called Magnificent Seven — Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Alphabet (GOOGL), Meta (META), and Tesla (TSLA) — due to report before mid-November. As is tradition, the banks will kick off proceedings next week with Wells Fargo (WFC), Goldman Sachs (GS), Citigroup (C), and J.P. Morgan Chase (JPM) due on Tuesday.

Investors are bracing for what could be a decisive moment for global equity markets, as companies that drove much of recent market gains are expected to post results under intense scrutiny, with some of Donald Trump’s vocal market influence already priced in. The scene is somewhat reminiscent of the Global Financial Crisis (GFC) in 2008, when overextended valuations and a sense of invincibility met the harsh light of economic reality.

This time, the risk may not lie in bad loans or collapsing banks, but in tech dependency and concentration risk — where a handful of companies now determine the fortunes of entire indexes, ETFs, and retirement portfolios. Moreover, what concerns the Bank of England is that hundreds of billions of dollars have been funneled into infrastructure and computing capacity on the strength of future promises rather than present profits—a wager that could prove precarious if outcomes are slow in coming.

If earnings disappoint or forward guidance falters, the ripple effects could spread far beyond Silicon Valley, testing not just investor sentiment but the very foundation of this decade’s bull market.

Goldman Weighs In

U.S. investment bank Goldman Sachs remains cautiously optimistic, arguing that the current valuations of top tech firms are supported by solid fundamentals. However, the bank is urging investors to “diversify amid high levels of concentration” and increased competition in the AI space.

Similarly, the Bank of England has flagged several downside risks — including slower-than-expected AI adoption, heightened rivalry among major players, and bottlenecks in power, data, and semiconductor supply chains that could undermine frothy growth expectations.

So, if the bearish naysayers are right, perhaps we’re not facing a bubble about to burst, but—borrowing another analogy—entering a plateau where the market pauses to consolidate after a breathless climb. This upcoming earnings season should help answer that question, revealing whether the market’s confidence is well-founded or if the first signs of bullish fatigue are starting to show.

Meanwhile, private credit markets have been shaken by bankruptcies at Tricolor and First Brands, while political uncertainty in France, Japan, and the U.S. has added to a growing list of global headwinds. It’s hardly an ideal backdrop to this month’s calendar.

Ultimately, the next 40 days could define the narrative that has dominated investor attention since 2023: AI. Will the Bank of England’s warning prove prophetic — signaling the beginning of the end for the AI-fueled rally — or will the Magnificent 7 repeat the trick by exceeding lowballed forecasts and propel valuations even deeper into nosebleed territory? We’ll soon find out.