Tesla (TSLA) remains a hot topic on Wall Street, with analysts’ opinions split. While traditional analysts maintain a Hold rating due to market volatility and political uncertainties, TipRanks’ A.I. Analyst tool is more optimistic, giving TSLA an Outperform rating.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks, giving investors a clear and concise snapshot of a stock’s potential. Moreover, TipRanks’ A.I.-driven rating combines insights from multiple models, including OpenAI’s (PC:OPAIQ) GPT-4o and Perplexity’s SonarPro.

AI Analyst Sees Upside for TSLA Stock

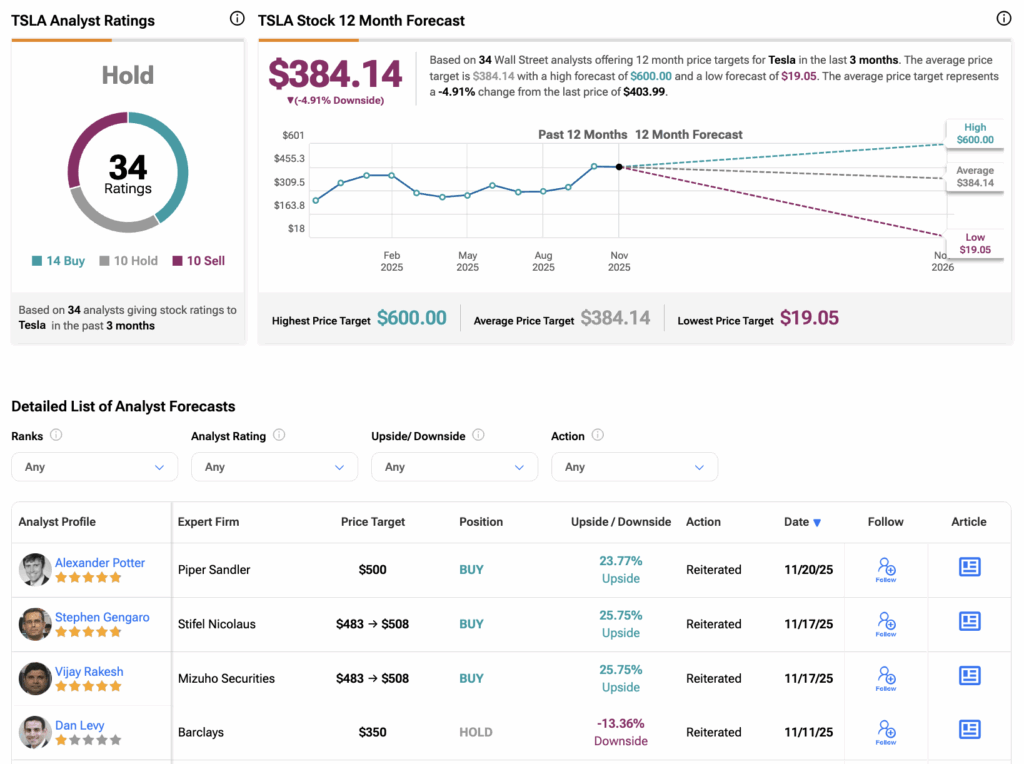

According to TipRanks A.I., TSLA stock currently scores 76 out of 100 based on Google’s (GOOGL) Gemini 2.5 model. It also assigns Tesla a price target of $490.0, implying an upside of more than 20% from current levels. On the other hand, Wall Street analysts have a price target of $384.14, which is 5% below the current price level.

AI Analysis Reveals Key Strengths and Weaknesses

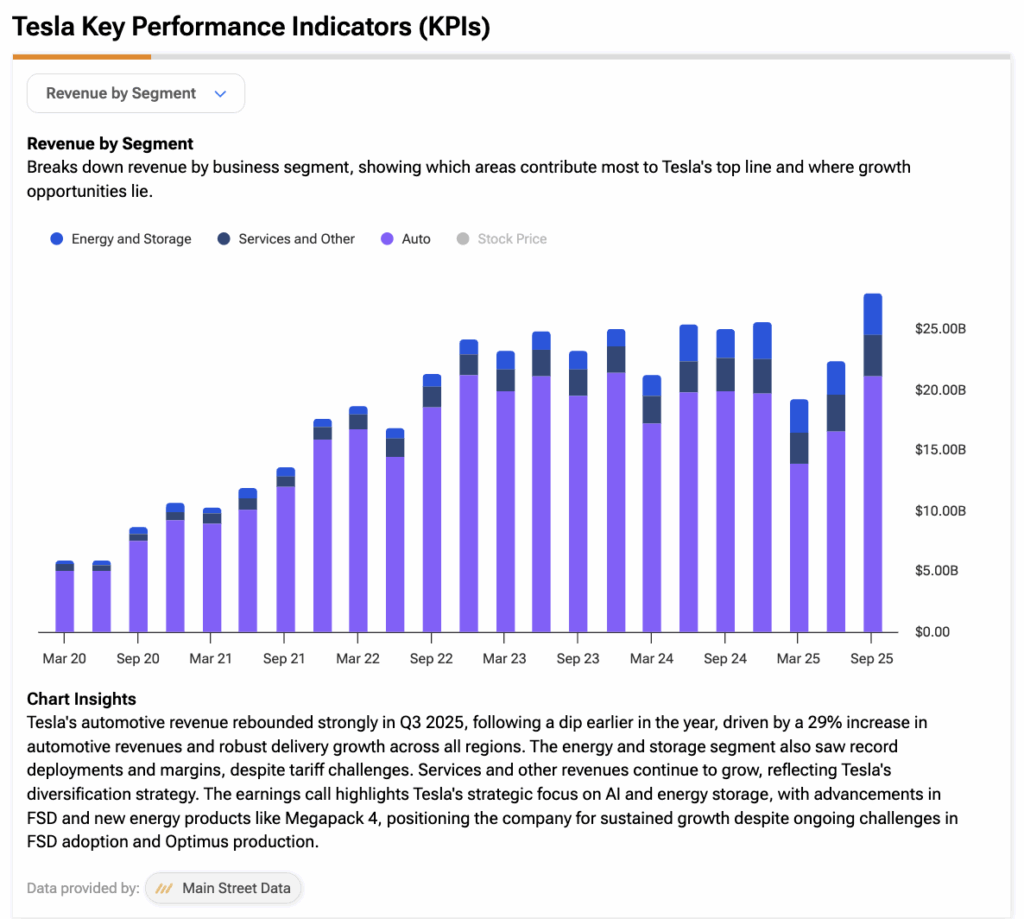

Tesla’s bullish outlook is supported by several key strengths. First, the company reported a 6% year-over-year and 27% quarter-over-quarter jump in Automotive revenues, keeping the company on a steady growth path. Second, Tesla’s progress in Full Self-Driving (FSD) and its push into robotaxis reinforce its lead in autonomous technology and could unlock major new revenue opportunities.

Finally, Tesla’s expanding energy business—especially with growing Megapack deployments—adds another layer of growth, helping diversify the company beyond vehicles and strengthening its position in the clean-energy market. Below is a screenshot showing Tesla’s revenue growth over the years.

On the flip side, the A.I. Analyst flags several challenges that could limit its long-term growth. Slow adoption of FSD remains a major hurdle, potentially delaying the payoff of its autonomous technology investments. Additionally, production challenges with Optimus may slow the robot’s rollout, postponing both market entry and the revenue Tesla expects from this new product line. Together, these factors create meaningful risks for Tesla’s future performance.

Wall Street Stays Cautious on Tesla Stock

Wall Street remains split on TSLA stock. Bulls like Piper Sandler’s five-star-rated analyst Alexander Potter believes Tesla’s latest FSD software is so advanced that it may already drive better than a human. Notably, Potter has a Buy rating on TSLA with a price target of $500.

On the bearish side, Wells Fargo’s Colin Langan sees over 70% downside in TSLA stock from current levels and maintains a Sell rating. Langan pointed out “widespread weakness” in the company’s latest vehicle deliveries across the U.S., EU, South Korea, and China.

Is Tesla a Buy, Sell, or Hold?

According to TipRanks, TSLA stock has received a Hold consensus rating, with 14 Buys, 10 Holds, and 10 Sells assigned in the last three months. The average Tesla stock price target is $384.14, suggesting a potential downside of 5% from the current level.