Snowflake (SNOW) stock has quietly doubled over the past year, even tagging fresh 52-week highs in late August. Yet it remains miles below its November 2021 peak of $395 per share, when the market had priced in perfection and then some. The reason is simple. AI workloads are finally translating into visible, measurable consumption on Snowflake’s platform.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Product revenue, operating margins, and cash flow are all moving higher as Snowflake scales. However, the firm isn’t just adding new customers—it’s entrenching its engagement with other ecosystems via high-profile strategic partnerships with Microsoft (MSFT), OpenAI, and Anthropic. These alliances expand Snowflake’s role at the center of enterprise AI adoption, positioning its platform as the go-to platform for next-generation workloads. As growth accelerates, margins expand, and cash flow grows, Snowflake’s fundamentals appear to be inflecting at just the moment its AI strategy is gaining critical mass.

That lift is showing up in revenue growth after a prolonged deceleration, and the forward setup looks stronger than the backward-looking charts suggest. With growth re-accelerating and unit economics improving, the valuation, while rich, doesn’t look unhinged to me. Thus, I’m Bullish.

Snowflake’s Growth Reignites as AI Adoption Drives Q2 Inflection

After several quarters of slowing growth, Snowflake’s Q2 FY26 saw a notable rebound, reporting revenue of $1.14 billion and product revenue of $1 billion, both up 32% year-over-year. Net revenue retention ticked up to 125%, remaining performance obligations (RPO) rose 33% to $6.9 billion, and customers spending more than $1 million rose to 654. Management also highlighted that more than 6,100 accounts now use Snowflake AI weekly, which is clear evidence that the “AI trade” isn’t just hype on Wall Street, but an actual macro trend, and for Snowflake, that translates to growing usage.

To see why that matters, look at the trend line. Q4 FY25 product revenue grew 28%, Q1 FY26 slowed to 26%, then Q2 jumped to 32%, a decisive inflection after the digestion period of 2023–24. On the back of that momentum, Snowflake raised full-year FY26 product revenue guidance to ~$4.395 billion (about 27% growth). That’s a faster clip than the ~24–25% outlook it started the year with.

The mechanics behind this renewed growth are simple. Essentially, consumption grows as customers modernize data estates and point new AI apps at the same data. As those apps move from pilots to production, consumption tends to compound. The swelling RPO and steady NRR tell me accounts are deepening, not churning, precisely what you want to see heading into heavier AI deployment in 2026.

Snowflake’s AI Layer Unlocks Higher Margins

In the meantime, profitability is quietly improving with scale. In Q2, SNOW’s adjusted operating margin hit 11% and its adjusted product gross margin landed at 76%. Now, cash generation was seasonally light (adjusted FCF margin ~6% in the quarter). However, for FY26, management still guides to a 9% adjusted operating margin and a healthy ~25% adjusted FCF margin, which I think shows that the model throws off cash when billings seasonality flips in the back half.

What matters here is that higher-margin AI services—like Cortex, vector search, and application workloads—run on the same storage and compute foundation. As the enterprise mix deepens and scale builds, sales efficiency and platform gross margins are expected to improve. With over 650 customers already generating more than $1 million each and a net revenue retention rate of 125%, operating leverage appears poised to accelerate in FY26–27.

In Defense of SNOW’s Premium Valuation

So what’s the price of this acceleration? Consensus adjusted EPS stands at about $1.18 for FY26, climbing to roughly $1.65 in FY27. With shares at ~$226, that equates to a forward P/E near 137x and a price-to-sales ratio in the mid-to-high teens. Expensive, yes—but far from the froth of 2021.

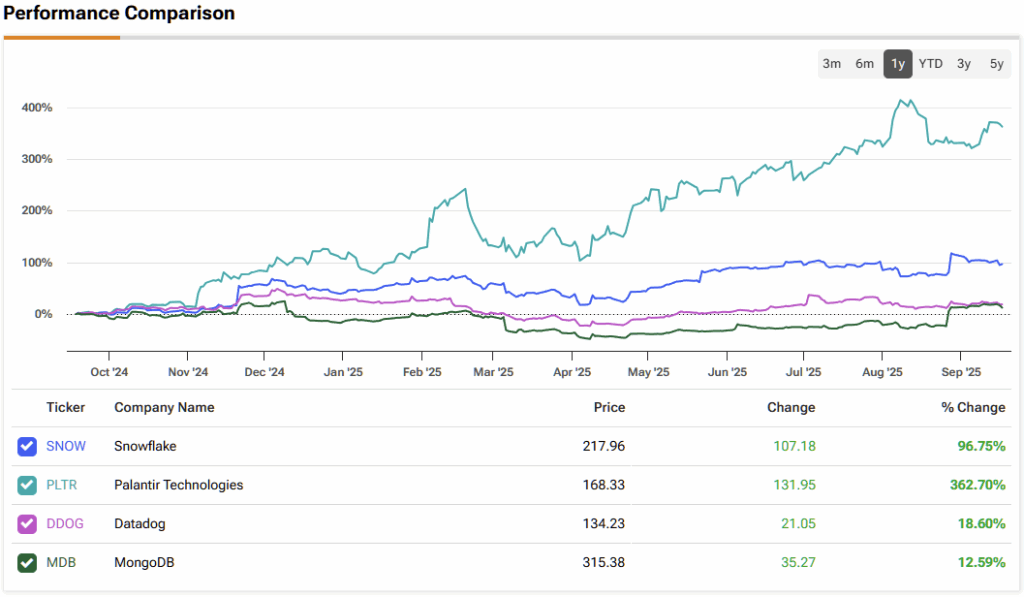

Relative to peers, Snowflake’s valuation looks steep but not out of line. Datadog (DDOG) trades at ~62x forward earnings and ~16x sales, MongoDB (MDB) at ~94x earnings and ~12x sales, and Palantir (PLTR) at ~196x earnings with sales multiples well into triple digits. In short, across the sector, any company pairing AI tailwinds with revenue acceleration and margin expansion commands a multiple that, at first glance, appears extreme.

With consensus estimates seeing EPS growth north of 40% over the second half of this decade, you can see why investors are willing to pay such high multiples for a leader like Snowflake. Additionally, note that Snowflake has consistently beaten revenue consensus estimates since its initial public offering. Thus, it is likely that its actual revenue (and EPS, given higher scale) will be significantly higher in the medium term compared to what analysts currently expect.

Is Snowflake a Good Stock to Buy?

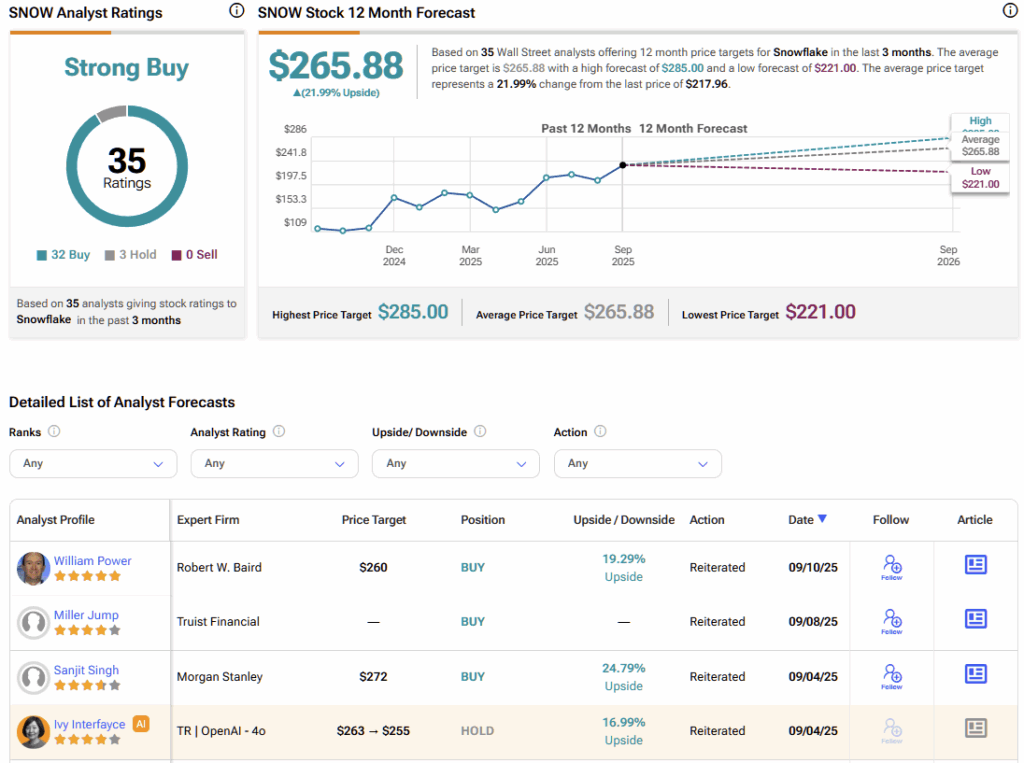

Wall Street is very bullish on Snowflake, with the stock carrying a Strong Buy consensus rating based on 32 Buy and three Hold recommendations over the past three months. Impressively, not a single analyst rates the stock a Sell. In the meantime, SNOW’s average stock price target of $265.88 suggests almost 22% upside from current levels over the coming year.

Snowflake Has the Stage for a Return to Prior Highs

Snowflake has doubled in value over the past year, yet it still trades below its 2021 peak. That gap alone won’t attract new buyers—but the re-acceleration of growth might. With product revenue climbing again, AI adoption driving real monetization, and margins improving as scale takes hold, the path back to prior highs looks increasingly viable as enterprises standardize around AI data stacks.

Multiples could compress, yes—but if FY26–27 delivers accelerating usage and steadier profitability, today’s valuation will likely look far more reasonable in hindsight, and the stock should have room to run.