Shares of Adobe (ADBE) have dropped more than 21.5% year-to-date, pressured by rising AI competition and slow progress in monetizing new tools. The creative software company is scheduled to report third-quarter Fiscal 2025 results on September 11, with Wall Street expecting earnings of $5.18 per share on revenues of $5.92 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ahead of the report, analysts remain divided. RBC Capital analyst Matthew Swanson reiterated an Outperform rating with a $480 price target, while Melius Research analyst Ben Reitzes downgraded the stock to Sell, noting that investors may find better opportunities in “infrastructure winners” such as Microsoft (MSFT) and Oracle (ORCL). With that in mind, it’s worth looking at who owns ADBE.

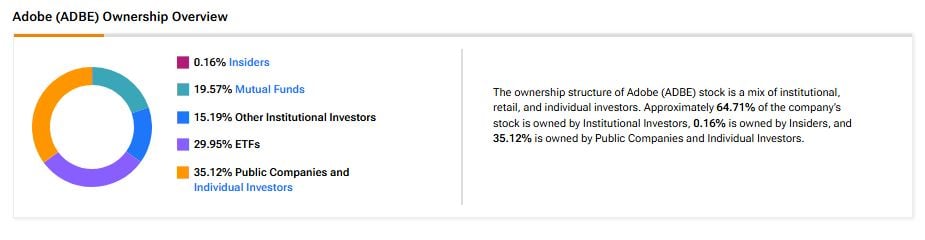

Now, according to TipRanks’ ownership page, public companies and individual investors own 35.12% of ADBE. They are followed by ETFs, mutual funds, insiders, and other institutional investors at 29.95%, 19.57%, 15.19%, and 0.16%, respectively.

Digging Deeper into ADBE’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in Adobe at 8.67%. Next up is Vanguard Index Funds, which holds a 7.28% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.23% stake in Adobe stock, followed by the Vanguard S&P 500 ETF (VOO) with a 2.85% stake.

Moving to mutual funds, Vanguard Index Funds holds about 7.28% of ADBE. Meanwhile, Fidelity Concord Street Trust owns 1.80% of the stock.

Is ADBE Stock a Good Buy?

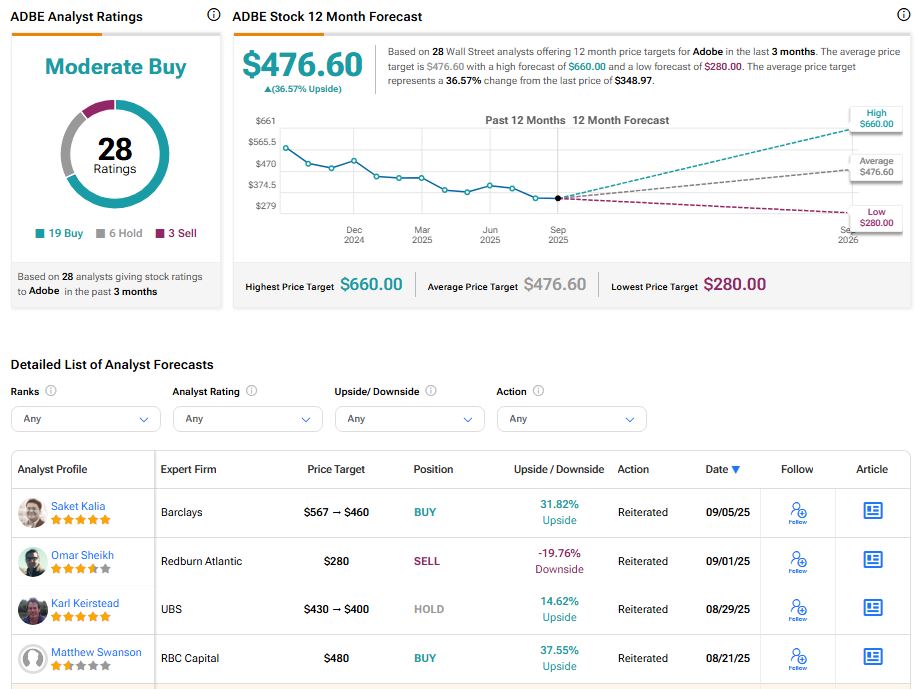

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ADBE stock based on 19 Buys, six Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average ADBE price target of $476.60 per share implies 36.57% upside potential.