Strategy (MSTR) is a U.S.-based company that has transitioned from a business intelligence software provider to a major corporate holder of Bitcoin. The stock has gained more than 31% year-to-date. The company is scheduled to report its Q1 2025 earnings today, with Wall Street expecting the company to report a loss of $0.11 and revenues of $116.6 million. Ahead of the earnings release, several Top analysts have maintained their Buy ratings on the stock. Among them is H.C. Wainwright’s Mike Colonnese, who calls MSTR one of the “most compelling public equity investments” for investors looking to benefit from rising Bitcoin prices. With that in mind, it’s worth exploring who owns MSTR.

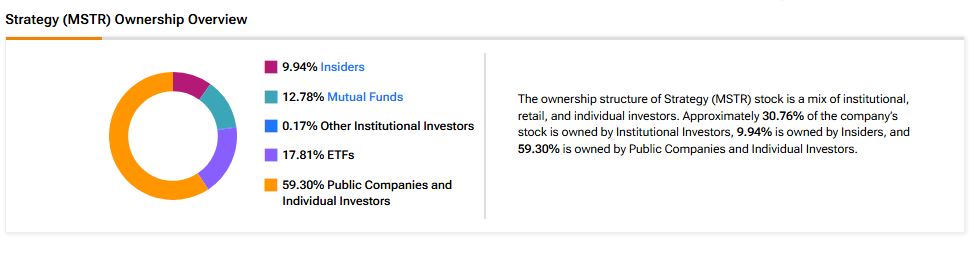

Now, according to TipRanks’ ownership page, public companies and individual investors own 59.30% of HOOD. They are followed by ETFs, mutual funds, insiders, and other institutional investors at 17.81%, 12.78%, 9.94%, and 0.17%, respectively.

Digging Deeper into MSTR’s Ownership Structure

Looking closely at top shareholders, Saylor Michael J owns the highest stake in MSTR at 9.90%. Next up is Vanguard, which holds a 6.32% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.43% stake in Strategy stock, followed by the Invesco QQQ Trust ETF (QQQ) with a 2.00% stake.

Moving to mutual funds, Vanguard Index Funds holds about 5.58% of MSTR. Meanwhile, Growth Fund of America owns 2.75% of the stock.

Is MSTR Stock a Good Buy?

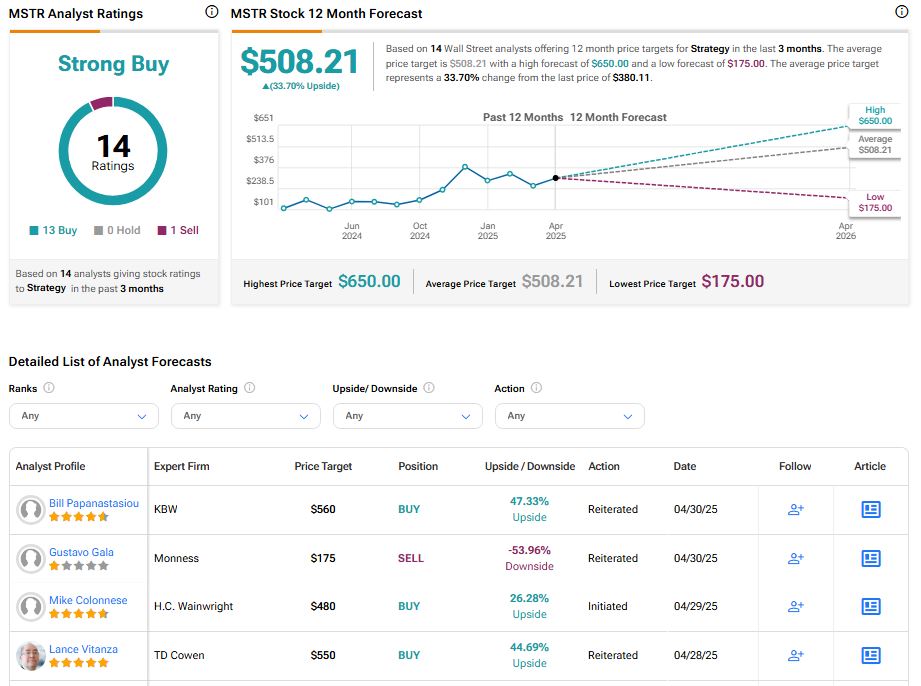

According to TipRanks, MSTR stock has a consensus Strong Buy rating among 14 Wall Street analysts. That rating is based on 13 Buys and one Sell assigned in the past three months. The average MSTR price target of $508.21 implies a 33.70% upside from current levels.

Conclusion

TipRanks’ Ownership Tab provides valuable insights into the category-wise ownership structure of the company, enabling investors to make well-informed investment decisions.