It is hard not to admire Procter & Gamble (PG). This is the company that has washed, wiped, and powdered its way through wars, recessions, and inflation spikes, while sending out a dividend check every single year since the 19th century.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Yet when I look at today’s demographic and macro backdrop, the story feels less comforting. Volumes are stalling, price increases are doing the heavy lifting, and the cohorts P&G sells to are getting older and more frugal. Taken together, these dynamics temper my enthusiasm for the company’s future dividend growth. Given the current valuation, I arrive at a neutral stance on PG stock.

Aging Consumers, Slower Volumes

The U.S. is aging fast. The population aged 65 and over rose to roughly 61 million last year (a 3.1% year-over-year increase), while the number of children continued to fall. In 11 states, older adults now outnumber children. Seniors make up about 18% of the U.S. population, and the fertility rate has dropped to roughly 1.6 births per woman. For a company like P&G, with significant exposure to diapers and feminine care, those demographic trends represent a meaningful structural headwind.

P&G’s own breakdown shows that Baby, Feminine & Family Care accounts for about 24% of net sales. In fiscal 2025, organic sales in the segment grew just 1%. Baby care, in particular, saw low single-digit declines in North America as volumes fell and price/mix did the work. You can feel the demographic drag because of fewer babies, slower category growth, and the sad truth that P&G needs to lean harder on pricing and premiumization to keep the top line moving higher.

That pattern continues into the current year. In Q1 FY26, P&G reported 2% organic sales growth, with volume being flat and pricing and mix each adding 1 percentage point. Fabric and Home Care, and Baby, Feminine & Family Care were only up about 1% each, with the quarter characterized by “essentially flat” unit volumes and a 30 bps decline in global aggregate market share. Management has been clear that consumers in the U.S. and Western Europe are more nervous, with category growth muted and some U.S. categories actually down in both volume and value in recent months.

For higher-income households, higher prices may be a minor irritation. But for lower-income consumers, especially those on fixed incomes, it pushes them towards value brands and other private labels. Management may insist that this is about “value” and not pure affordability. Still, they also acknowledge intensified promotions in categories such as baby and fabric care and the need to sharpen pack-price architecture for paycheck-to-paycheck shoppers. Regardless, that is not quite what you want to hear when part of your portfolio is structurally losing demographic momentum.

The Dividend Problem

Admittedly, P&G’s dividend track record is top-notch. The company has now hiked its dividend for 69 consecutive years, with the last two hikes at 7% in April 2024 and 5% last April. Today, the annual dividend of $4.23 yields roughly 2.9%. The payout is already quite sizable, as the company is distributing about 62% of its earnings as dividends.

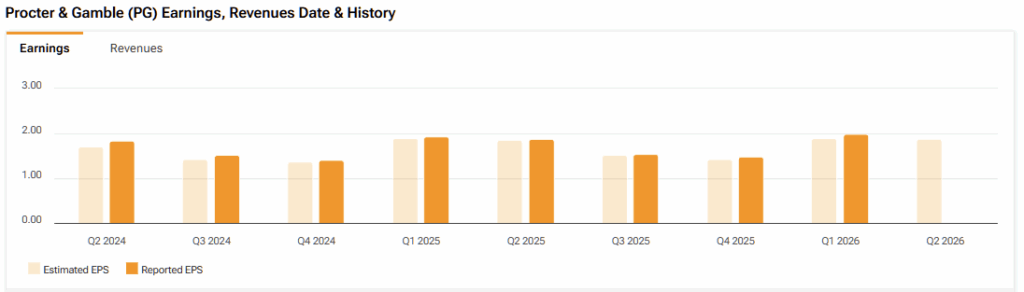

Here’s where I see a problem. EPS growth is slowing down, and for P&G to maintain a healthy dividend payout ratio, dividend hikes are set to decelerate significantly. I mean, P&G’s own guidance for FY26 points to core EPS of $6.83–$7.09. The midpoint of $6.96 implies YoY growth of 2%. Consensus sits a bit higher at $7.01. But again, that’s roughly 2–3% growth.

If volumes remain flat to modestly up, price/mix can only do so much before elasticity or private-label competition bites. Management has explicitly said that the sector over-relied on price/mix for a couple of years and now needs to “restimulate volume growth” through greater innovation and marketing investment. That is a good strategy, but it will keep margins tight. So you have a stock yielding just under 3% in a declining rates environment, and its dividend growth is potentially slowing to about 1-3%. This sounds like a lot of outflows from retirement funds and income-oriented individuals, which might pressure shares lower.

Paying a Rich Multiple for Modest Growth

The current valuation doesn’t help the stock’s investment case either. At about $146, using the $7 consensus EPS for FY26, the stock trades at roughly 21x forward earnings. That multiple might be easy to accept when EPS is growing in the high single digits. It feels more demanding when the company itself is signaling a growth range of 0–4% and the midpoint is barely 2%.

To be clear, you are paying for quality. P&G has a portfolio of global brands, strong cash generation, and one of the cleanest dividend records in the market. But you are not getting that quality at a discount. In fact, you are paying a premium multiple for what increasingly looks like low- to mid-single-digit structural EPS growth, in categories facing both demographic headwinds (fewer babies, aging households) and persistent affordability tensions at the lower end.

Is PG a Buy, Hold, or Sell?

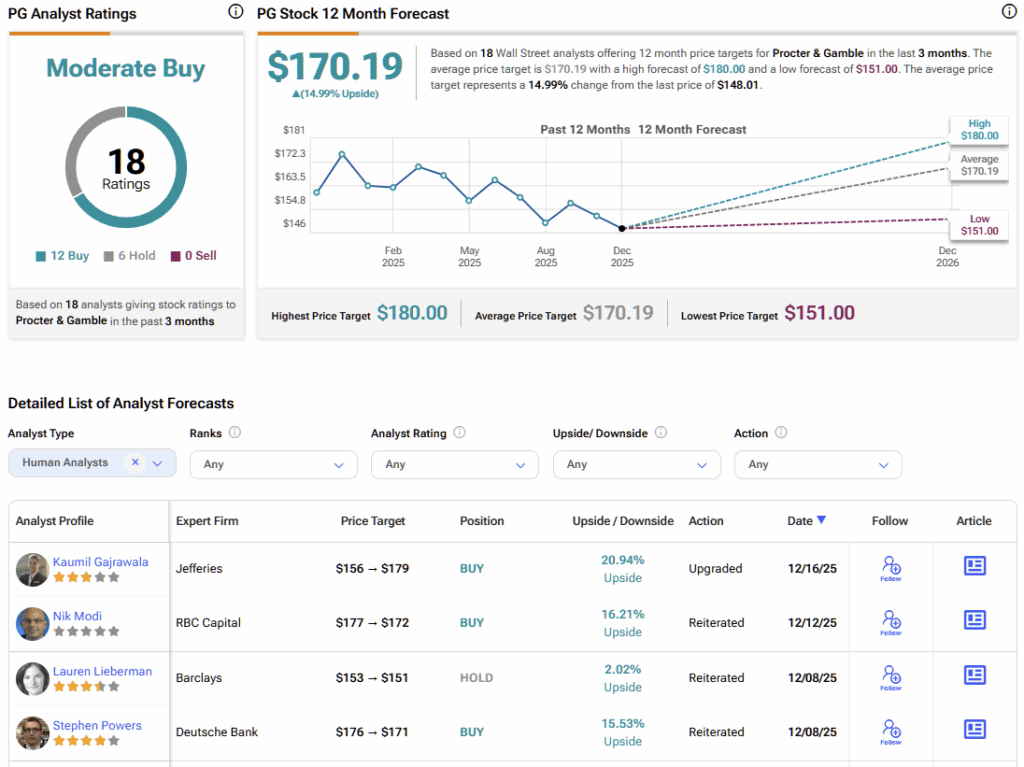

On Wall Street, P&G stock carries a Moderate Buy consensus rating based on 11 Buy and seven Hold ratings over the past three months. No analyst rates the stock a Sell. PG’s average stock price target of $168.75 implies about 16% upside potential over the next twelve months.

High-Quality Business That’s Fully Valued

Putting everything together, P&G still stands out as a solid, durable business that would be comfortable to own over the long term. That said, at the current valuation, it is difficult to make a compelling case for new capital. Aging demographics and a stretched consumer backdrop point to slower underlying volume growth, while tariffs and persistent competitive pressure are likely to continue weighing on margins and limiting dividend-growth headroom. Given this operating setup, paying roughly a 21x multiple leaves little margin for error.