Customer relationship management software leader Salesforce (CRM) is stumbling toward the end of 2025, down roughly 20% and sharply decoupling from the S&P 500 (SPX) since May, which has moved in the opposite direction by nearly the same magnitude. In my view, this weakness reflects investor uncertainty around Salesforce’s transition to an AI-first operating model rather than any fundamental deterioration in the business. I see the recent drawdown as a compelling entry opportunity.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Salesforce is in the midst of a pivotal transformation as Agentforce and Data Cloud begin to redefine its growth trajectory. I expect the next 12–18 months to deliver a clear inflection point, marked by accelerating revenue, expanding margins, and stronger free cash flow as enterprise AI adoption shifts from experimentation to scaled production. At current valuations, I remain firmly bullish on CRM.

Why Incumbent SaaS Players Hold the Advantage in Agentic AI

I continue to believe incumbent SaaS vendors like Salesforce are best positioned to drive near-term adoption of agentic AI. While there is plenty of innovation happening around custom-built agents and point solutions, I am not seeing broad evidence that enterprises are putting large-scale, custom agentic applications into production that displace core SaaS systems. Instead, enterprises appear to prefer extending and augmenting existing platforms where data, workflows, governance, and security are already deeply embedded.

This dynamic strongly favors Salesforce. The company already sits at the center of customer relationship data, business processes, and enterprise identity. Agentforce builds on that foundation by enabling AI agents to operate directly within Salesforce workflows, rather than requiring customers to stitch together fragmented tools. As a result, Salesforce’s path to monetization is less about replacing existing systems and more about expanding wallet share within its installed base.

Over the past few quarters, I have become incrementally more positive on the prospects for revenue reacceleration as signs of Agentforce traction become clearer. The shift toward agentic AI is not a short-term product cycle—it represents a structural expansion of Salesforce’s addressable market into what management increasingly frames as “digital labor.”

Q3 Results: A Progress Check, Not the Whole Story

Salesforce’s Q3 results served as an important progress report, but they are only one piece of the broader thesis. The company delivered a solid quarter marked by strengthening bookings, accelerating Agentforce adoption, and continued stability across the core business.

Current remaining performance obligation (cRPO) grew 11% from last year to $29.4 billion, coming in above guidance. Management described the quarter as one of the strongest booking periods in nearly three years, an important signal given that booking momentum typically leads revenue growth.

Agentforce metrics were particularly encouraging. Combined ARR from Agentforce and Data Cloud surpassed $1.4 billion, up more than 100%, with Agentforce alone reaching $540 million in ARR and growing at more than 300%. Six of the company’s top ten deals in the quarter were driven by Agentforce, and customers running Agentforce in production increased roughly 70% year-over-year—an important signal that deployments are moving beyond pilots.

That said, I view Q3 less as a destination and more as confirmation that the early pieces of the Agentforce strategy are starting to come together.

Why the Growth Inflection Lies Ahead

From my perspective, Q3 highlighted several confidence builders that support a reacceleration thesis rather than simply confirming near-term execution.

First, Salesforce is now roughly four quarters removed from the general availability of Agentforce version one. The product has matured rapidly and is now better suited for complex enterprise use cases that combine advanced data management with agentic capabilities. Second, the sharp increase in agents moving into production shows that customers are progressing beyond experimentation. Third, usage is expanding beyond initial customer service deployments into sales and broader operational workflows.

Sales capacity also matters. Salesforce grew sales capacity by roughly 20%, setting the stage for stronger pipeline conversion. At the same time, pricing and packaging for Agentforce consumption are becoming more attractive to large enterprises, helping to ease adoption friction. Improving new bookings, combined with stable attrition, should mechanically translate into better subscription and support revenue growth as these contracts roll through the income statement.

Critically, management has emphasized that net new annual order value (NNAOV) is now growing faster than average order value and cRPO. This is precisely what you want to see ahead of a revenue inflection. It underpins management’s confidence that subscription and support revenue can reaccelerate over the next 12–18 months.

Agentic AI also materially expands Salesforce’s long-term opportunity. While the company already commands roughly 20%+ share in front-office CRM, agentic AI is positioned as a broader digital labor platform. In that context, the incremental total addressable market could ultimately exceed $1 trillion, far exceeding the value of traditional CRM alone.

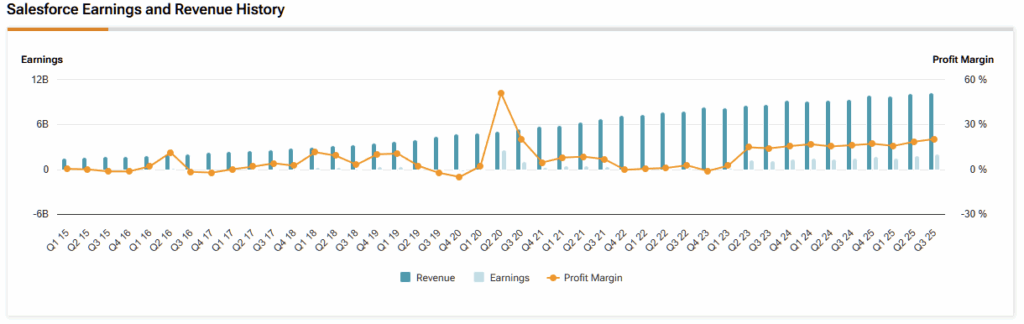

Margins, Cash Flow, and the Path to ‘Rule of 50’

Salesforce’s financial model continues to improve alongside the growth narrative. Management raised full-year EPS guidance to $11.75–$11.77 and lifted free cash flow growth expectations to 13%–14% year-over-year. Operating margin guidance remains strong at approximately 34%. Capital expenditures remain modest at under 2% of revenue, supporting strong cash generation.

Looking ahead, I am increasingly confident that Salesforce can achieve “Rule of 50” status by the end of the decade. The Rule of 50 refers to the combined total of revenue growth plus operating margin equaling 50 or more—a benchmark often associated with elite, durable software franchises. If Agentforce-driven growth reaccelerates while margins remain in the mid-30s, Salesforce has a credible path to hitting that threshold by 2030.

Current Valuation Suggests a Disconnect

Salesforce currently trades at valuation levels broadly in line with peers and meaningfully below its historical norms. The stock trades at a P/E of 23.1x, compared with a five-year average of 36x and a sector median of 24.6x. Similarly, its Price-to-Cash Flow multiple of 18.5x compares to a five-year average of 28.3x and a sector median of 19.0x.

Based on an average of 14 valuation methodologies, including five-year DCF (revenue exit), Price-to-Sales, P/E multiples, and a multi-stage dividend discount model, I estimate Salesforce’s intrinsic value at approximately $340 per share. This represents roughly 27% upside from the current stock price.

Is CRM a Buy, Sell, or Hold?

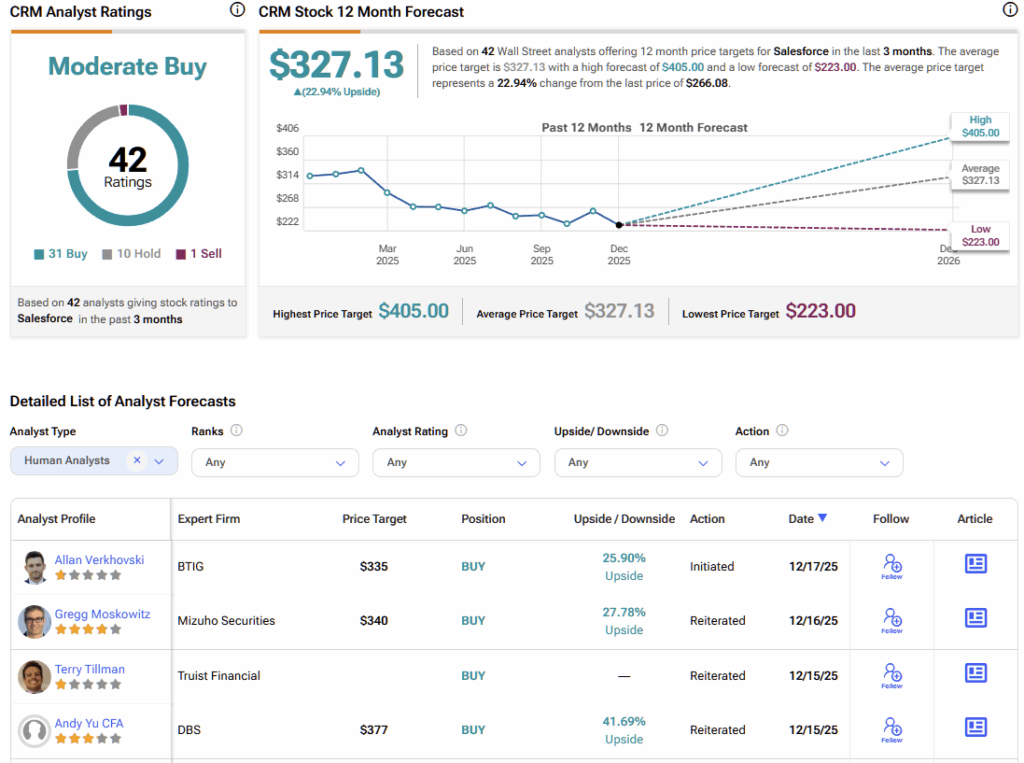

Wall Street sentiment remains constructive, with a Moderate Buy consensus and the majority of analysts rating the stock a Buy. According to Wall Street analysts tracked by TipRanks, the average price target stands at $327.13, representing a nearly 23% upside potential from current levels over the course of 2026.

Salesforce’s Agentic Pivot Sets the Stage for Growth in 2026

Salesforce is in the midst of a strategic evolution toward the agentic enterprise. Agentforce is emerging as a credible growth catalyst, deepening monetization across Salesforce’s vast installed base while unlocking a significantly larger long-term opportunity.

With bookings trending higher, enterprise AI adoption gaining momentum, margins remaining resilient, and valuation increasingly compelling, I believe the risk-reward profile has turned decisively favorable. Accordingly, I remain bullish on Salesforce and view the recent share price weakness as an attractive opportunity to build exposure.