CrowdStrike’s (CRWD) latest earnings release paints a picture of a company at a crucial crossroads. The cybersecurity giant delivered what initially appears to be solid Q2 FY2025 results after a year in which shares climbed 63%. Annual revenues grew 32% to $964 million, beating consensus estimates by a robust margin. However, some concerning trends emerge when digging deeper and looking at the fallout from the company’s key role in the largest IT outage in history. As a result, I’m bearish in the next few years for the company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Crowdstrike’s Slowing Growth Story

CrowdStrike’s steadily decreasing revenue growth really worries me. The 32% increase, while clearly impressive in isolation, marks a significant slowdown from the 45%+ growth seen in recent years. Equally troubling is the trajectory of net new Annual Recurring Revenue (ARR), which grew just 11% year-over-year to $218 million. This critical metric serves as the best indicator of growth potential. Still, its persistent deceleration suggests the company’s hypergrowth phase may be ending, perhaps attributed to the recent global outage caused by its software.

Events such as the outage, where a faulty sensor configuration update triggered a fault in 8.5 million computers, can naturally lead to enormous sell-offs. The company was able to patch the issue in 79 minutes, but operational recovery takes much longer and can cause reputational damage that many firms simply do not recover from. Shares in the company dropped 32% in the 12 trading days after the outage, leading to a barrage of lawsuits and negative sentiment.

Moreover, I’m concerned that the cybersecurity market has become increasingly crowded, with formidable competitors attacking from multiple angles. Microsoft’s Defender suite (MSFT) has built significant traction, leveraging deep enterprise relationships and aggressive bundling strategies. Recent market data also suggests that Microsoft has been winning a share in endpoint security, particularly in segments with higher price sensitivity.

Crowdstrike’s Margin Pressures

CrowdStrike’s margin story presents another area of worry. While operating margins improved to 24%, the company continues to spend heavily on sales and marketing, which consumes a substantial 37% of revenues. This persistent high spending suggests acquisition costs remain stubbornly high, likely due to increasing competitive intensity.

Recent progress in artificial intelligence, particularly the Charlotte AI initiative, will likely require substantial ongoing investment. While necessary to maintain leadership, such investments will likely pressure margins for the foreseeable future. R&D expenses have concerningly increased 40% year-over-year, significantly outpacing revenue growth.

While strong at 81%, subscription gross margins have also shown little improvement over the past year despite increasing scale. This plateau in gross margins suggests limited remaining operating leverage in the business model, making significant future margin expansion increasingly unlikely.

Valuation Disconnect for Crowdstrike Shares

However, I think the most glaring issue facing CrowdStrike investors is the valuation. Trading at a huge 531 times earnings and 23 times forward sales, the market cap of $89 billion prices in near-perfect execution at a time when execution is increasingly challenging. Palo Alto Networks, for comparison, trades at 75 times earnings and 11 times sales despite similar growth characteristics.

Even using free cash flow as a metric, CrowdStrike’s valuation appears stretched. The 28% free cash flow margin is impressive, but at current levels, the free cash flow yield sits at just 1.2%. This suggests limited upside potential unless growth reaccelerates significantly.

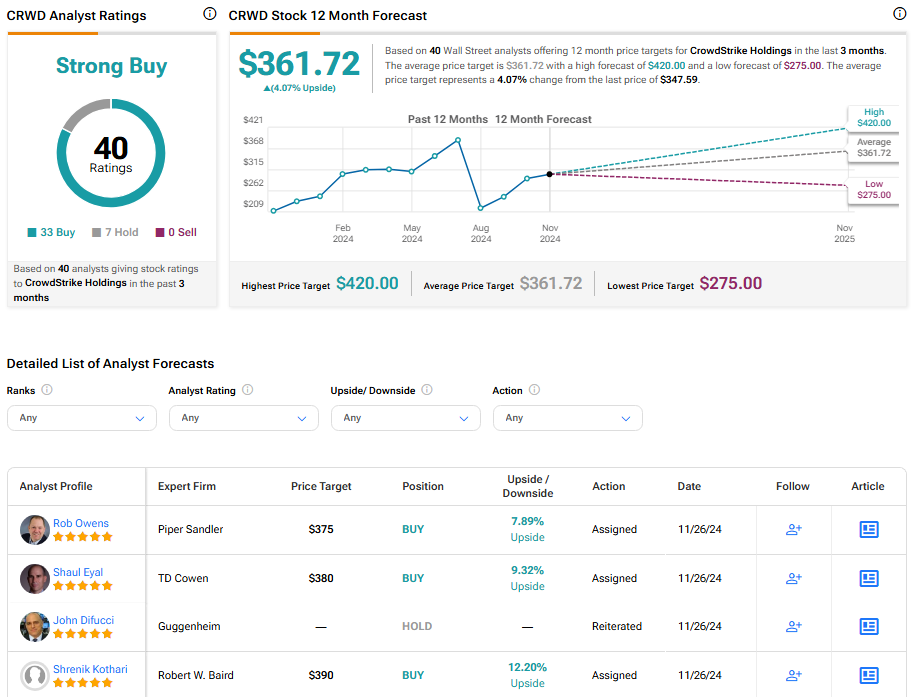

Wall Street seems to agree with me somewhat, with limited upside potential in the average price target, albeit with the majority of analysts suggesting the company is still very much a Buy.

Scrutinizing Crowdstrike’s Projections

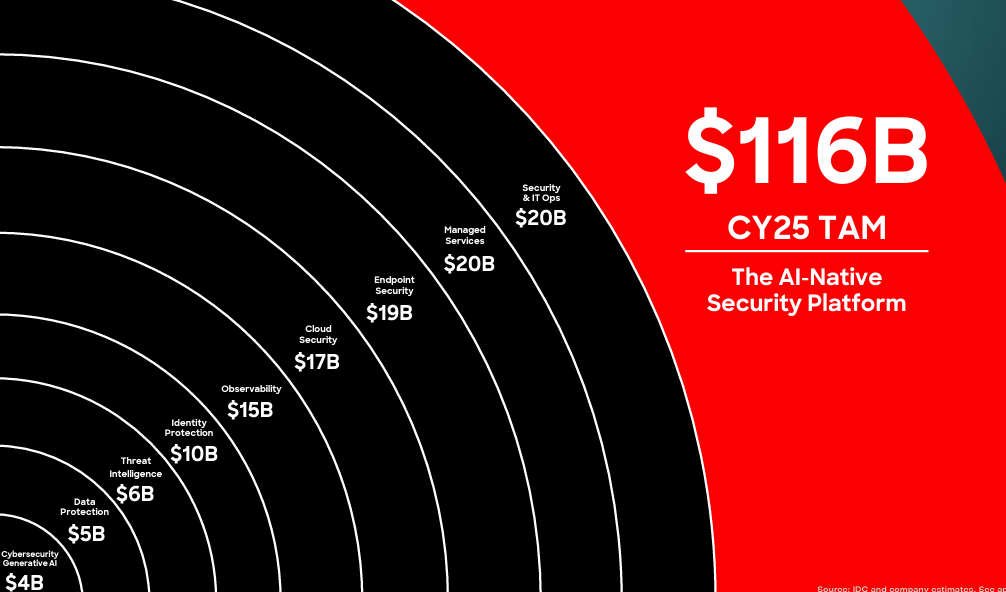

From my bearish perspective, management’s projection of a $100 billion Total Addressable Market (TAM) by 2024, expanding to $225 billion by 2028, requires scrutiny. These estimates include substantial and ambitious opportunities in surrounding markets where CrowdStrike faces entrenched competitors.

The company’s current $3.86 billion ARR represents less than 4% of the 2024 TAM, raising questions about its ability to capture a meaningful share of this purported opportunity. As I noted, these are perfectly valid targets, but if the company fails to deliver, investors could be disappointed.

The performance of CrowdStrike’s newer business lines also presents a mixed, uncertain picture. Cloud Security reached $515 million in ARR with 80% growth, while Identity Security hit $350 million growing at 70%. While this growth impresses, they start from relatively small bases and will face intense competition in each category.

The Q3 revenue guidance of $979.2-984.7 million fell short of Wall Street expectations. More concerning is the full-year EPS guidance of $3.61-3.65, which suggests management sees challenges ahead. This conservative outlook and decelerating growth metrics indicate the company may be struggling to maintain its historical momentum.

Investment Implications

From my perspective, I can fully understand why many investors holding CrowdStrike shares may consider it a suitable time to reassess. While the company remains a leader in cybersecurity, with strong technology and an effective land-and-expand strategy, I’d say the risk-reward profile has deteriorated significantly after the major IT outage. The combination of decelerating growth, increasing competitive pressures, and persistent high spending requirements suggests the current valuation premium is increasingly difficult to justify.

Of course, the cybersecurity market remains attractive long-term, but at current levels, I fear that CrowdStrike’s stock price reflects an optimism that appears increasingly disconnected from business fundamentals.

The next few quarters will determine whether my bearish thesis will play out. However, with multiple warning signs flashing, the prudent approach may be to maintain a cautious stance until management demonstrates it can successfully navigate these growing challenges while maintaining the premium growth rates that justify a premium valuation.