Sydney-based data center operator Iren Limited (IREN) is one of three neo-cloud stocks that have seen a massive rally this year, with IREN shares up over 311% year-to-date. Still, analysts on Wall Street believe IREN stock can eke out an additional 100% gain over the next 12 months to reach $80.40 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Behind the Massive Rally?

Since the start of the year, Iren’s massive gain, like those of its American competitor CoreWeave (CRWV) and Dutch rival Nebius (NBIS), has been driven by the hype on AI infrastructure and the elevated demand for data center infrastructure by AI hyperscalers such as Microsoft (MSFT) and Meta (META). As of Monday, CoreWeave’s shares have jumped over 106.9% since January, while Nebius’ climbed about 216% during the same period.

Despite various volatile points over the months, IREN stock has enjoyed momentum from Iren’s $9.7 billion deal with Microsoft in November.

What Challenges Stand in Iren’s Way?

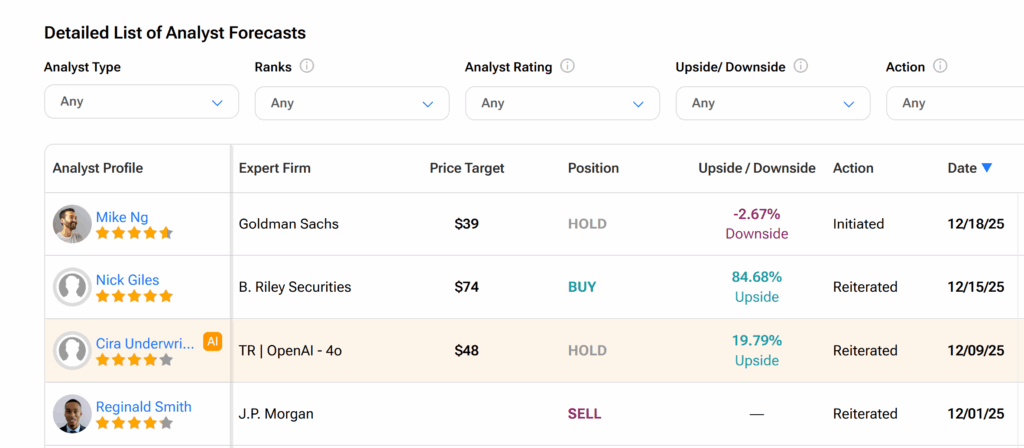

In its recent Q1 2026 earnings results, Iren turned its 27 cents per share loss from a year ago into earnings of $1.07 per share, with its revenue jumping 355.4% year-over-year to $52.76 million. However, despite the dramatic turnaround — which Goldman Sachs analyst Mike Ng has described as “hypergrowth” — Iren’s stock has remained volatile due to investor sentiment on AI stocks, as it is traded as a proxy for that theme.

The shares sank 21% last month, even as analysts continued to debate its financial readiness for the Microsoft deal. H.C. Wainwright analyst Mike Colonnese recently noted that he sees “quite high” execution and financial risks for Iren with regard to the deal.

Moreover, Iren recently generated $3.6 billion from its latest capital-raising effort.

What’s Next in 2026?

Several analysts have backed Iren heading into 2026. Recently, B. Riley analysts Nick Giles and Fedor Shabalin contended that Iren’s shares will benefit if investor sentiment on AI stocks takes a good turn in 2026. They also pointed to Iren’s $8.85 billion in accumulated capital to support its growth plans despite a funding shortfall of roughly $2.7 billion.

Is IREN a Good Stock to Buy Now?

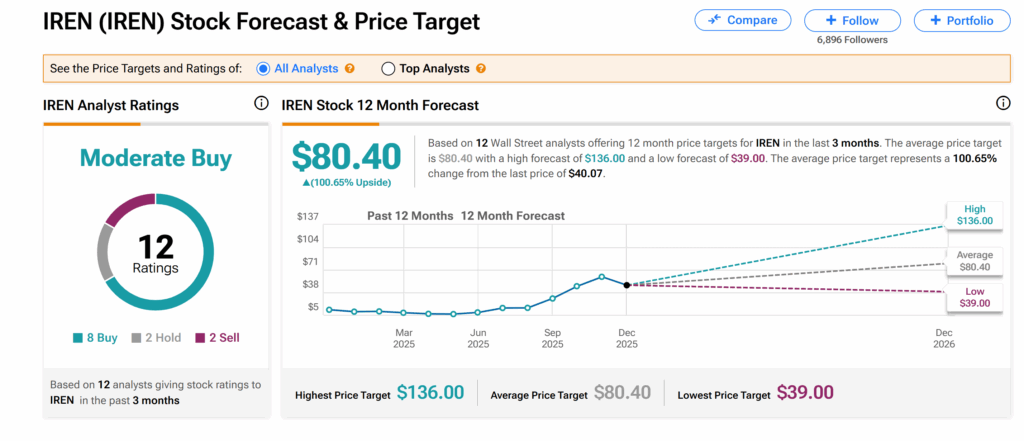

Across Wall Street, Iren Limited’s shares remain a Moderate Buy based on analysts’ consensus. This breaks down to eight Buys, two Holds, and two Sells issued by 12 analysts over the past three months.

However, the average IREN price target of $80.40 implies more than 100% growth potential from current trading levels.