Since the start of the year, video game software company Unity Software’s (U) shares have surged over 100% to reach about $45 per share. However, looking ahead to 2026, analysts’ latest consensus points to only a modest gain of about 6% for the stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Mobile Ad Tailwinds Could Lift Unity in 2026

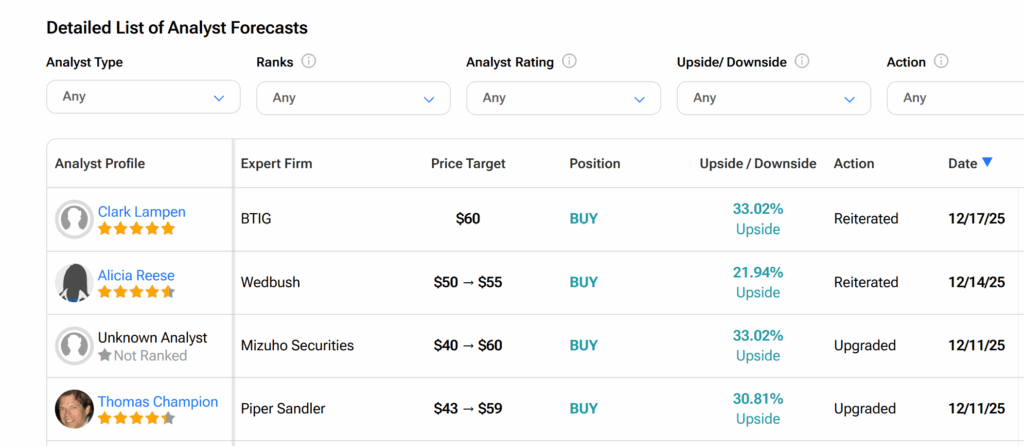

Recently, BTIG analyst Clark Lampen upgraded his rating on U from Neutral (Hold) to Buy. The five-star analyst reaffirmed his price target of $60 — which implies about 33% growth potential — pointing to upside opportunity in Unity Software’s Grow and Create In-App Purchasing (IAP) features that “don’t seem fully understood” or priced in by the market.

Both are monetization features: while Unity Grow uses AI to help developers turn their games and apps into profitable businesses by finding players, Create IAP makes it possible for these developers to sell digital goods — such as coins, extra levels, or subscriptions.

Chipping in, Piper Sandler analyst Thomas Champion elevated U from Neutral to Overweight (Buy), noting that the mobile app advertising market “looks healthy” entering 2026. Similarly, Wells Fargo analyst Alec Brondolo believes Unity is positioned to benefit from a “torrid year” of mobile game advertising growth next year.

Champion expects Unity Software to see double-digit growth in revenue from ads placed via Unity Vector, the California-based company’s AI-driven advertising and user acquisition platform. The analyst therefore raised his price target on U from $43 to $59, implying about 31% upside.

On his part, Brondolo raised his price target from $42 to $51, suggesting about 13% upside.

Is U Stock a Good Buy?

Analysts on Wall Street currently have a Moderate Buy consensus rating on Unity Software’s shares based on 13 Buys, seven Holds, and one Sell issued by 21 analysts over the past three months.

This comes with an average U price target of $47.77 that implies 5.91% upside from current trading levels.