Affirm Holdings (NASDAQ:AFRM) stock gained about 11% in the extended trading hours yesterday after fiscal first-quarter results beat consensus estimates. The company benefitted from solid demand for its debit cards and one-time virtual cards.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Affirm is a financial technology company that offers buy now, pay later services, allowing consumers to make purchases and pay for them over time.

Closer Look at AFRM’s Q1 Performance

The company reported a net loss of $0.57 per share, which compared favorably with a loss of $0.86 in the prior year quarter. Moreover, the loss was lower than Wall Street’s expectation of a loss of $0.70.

In addition, Q1 revenues rose 37% to $497 million, exceeding analysts’ expectations of $444 million. Excluding transaction costs, revenue was $212 million, or 3.8% of gross merchandise volume (GMV). The topline growth was driven by higher interest income as loans held for investment increased and higher pricing initiatives.

In other key metrics, the company registered a 28% year-over-year jump in GMV to $5.6 billion. Also, active consumers grew 15% to 16.9 million.

Q2 and Fiscal 2024 Outlook

Looking forward, management expects revenue for the second quarter to be in the range of $495 million to $520 million. For reference, analysts were expecting $504 million in revenue. Meanwhile, GMV is anticipated to be between $6.70 billion and $6.90 billion.

As for Fiscal 2024, management expects revenue to remain flat year-over-year, while GMV is expected to be more than $24.25 billion.

Is AFRM Stock a Good Buy?

Following the earnings release, BTIG analyst Lance Jessurun reiterated a Sell rating on AFRM stock but raised the price target to $12 from $10. The analyst expressed concerns over the company’s higher expense growth rate compared to revenues and a saturated buy now, pay later environment.

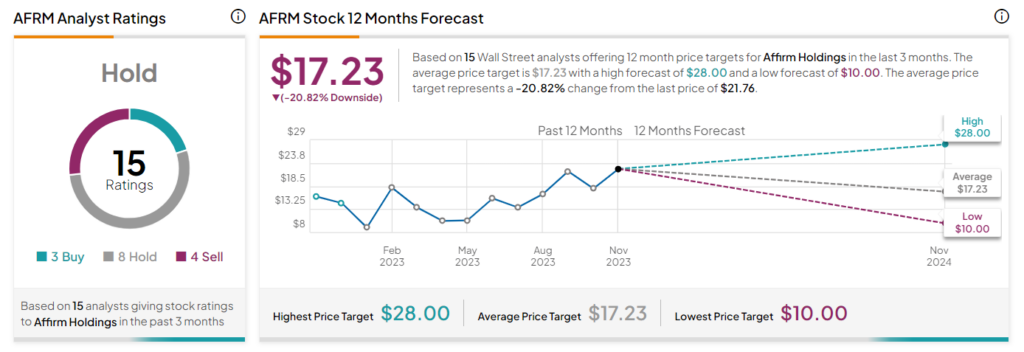

AFRM stock has a Hold consensus rating based on three Buys, eight Holds, and four Sells. The average Affirm stock price target of $17.23 implies 20.8% downside potential. The stock has gained 139% year-to-date.