“Mobile-first” digital commerce specialist Affirm Holdings (AFRM) has emerged as one of 2025’s standout fintech stories. Its latest quarter delivered a blitz of positive news for AFRM bulls. Record-breaking metrics and successful product expansions were, understandably, supplemented by rapid revenue growth alongside a long-awaited shift to operational profitability.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

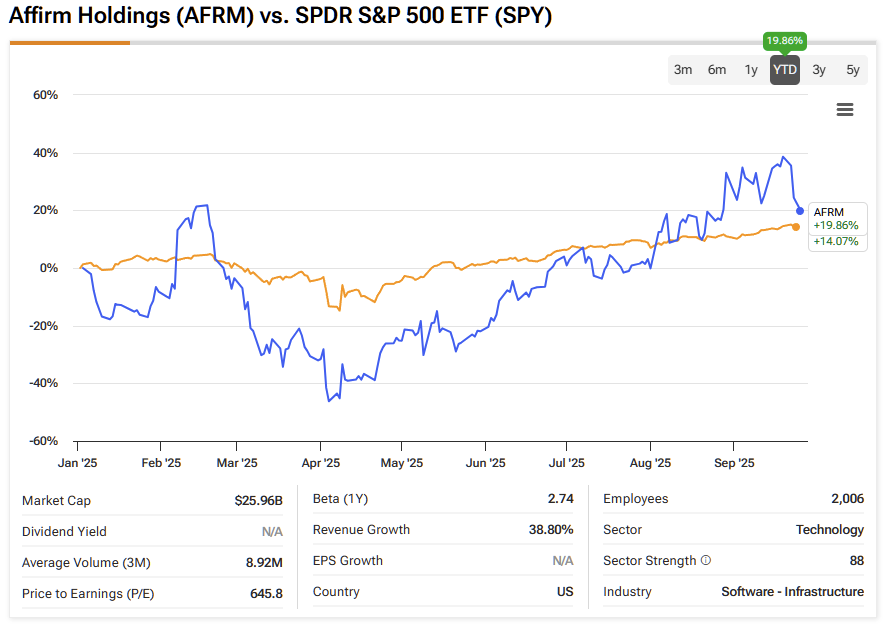

Year-to-date, AFRM has tracked the S&P 500 (SPX) pretty nicely, despite the summer’s geopolitical turmoil, while adding a handsome 20%.

However, before investors become too giddy too soon, the stock’s premium valuation tempers the case. I wholeheartedly respect Affirm’s growth trajectory and improving financials, but I remain Neutral, as the disruptive stock’s strong fundamentals are offset by the risk of overpaying for future gains.

Affirm Fires Up Its Growth Engines

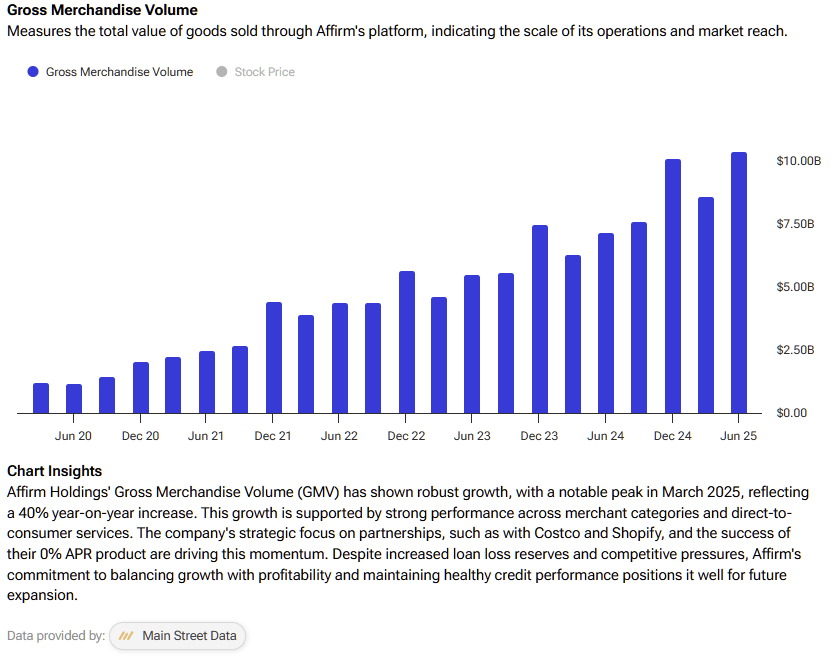

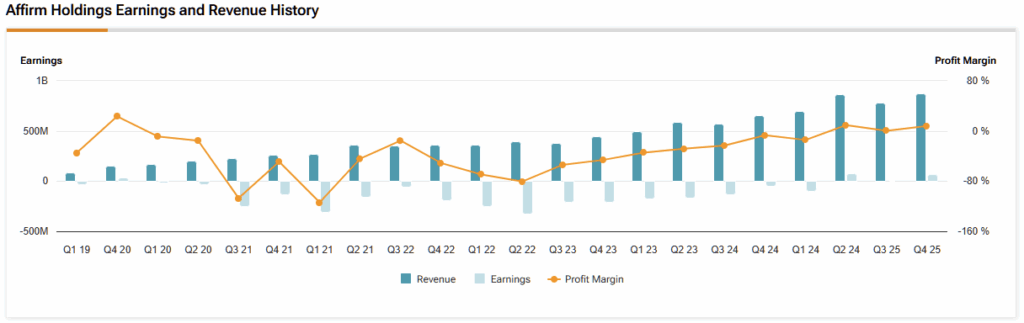

Affirm’s Q4 results published last month underscored its momentum. Gross merchandise volume (GMV) surged 43% year-over-year to $10.4 billion, a clear sign of rising adoption of BNPL products. Operating income also swung to profitability, a milestone for the company’s path to sustainability.

Notably, the proportion of 0% APR loans in the total loan portfolio is increasing. In Q4, about 29% of total loans carried no interest, split between 14% from monthly plans and 15% from Pay-in-X. These products are attracting lower-risk customers and driving GMV growth, with more than half of new users transacting through 0% APR products. While this shift does compress revenue and total cost (RLTC) margins compared to interest-bearing loans, I view it as a reinvestment into long-term growth.

The Affirm Card has emerged as another growth engine. With 2.3 million users as of Q4, the card base grew an astonishing 97% year-over-year. GMV through the card climbed 132% to $1.2 billion, with in-store spending volumes rising 187%. The card’s attach rate has reached 10%, and engagement remains high. A recent partnership that allows Affirm to be used for in-store Apple Pay (AAPL) transactions on iPhone could further accelerate card adoption.

Competition in BNPL Remains Intense

The BNPL sector is expanding rapidly, with industry forecasts calling for ~16% compound annual growth from 2025 through to 2034, driven by rising Gen Z incomes and greater mainstream adoption. That’s the overarching narrative, although competition remains fierce. Traditional consumer finance companies are launching their own installment payment options, while tech giants like Apple and retailers like Walmart (WMT) are embedding BNPL directly into their ecosystems.

One way Affirm differentiates itself from its other pure-play BNPL competitors is its policy of not charging late fees. I view this as a long-term advantage, underscoring both the company’s commitment to transparency and the strength of its underwriting discipline. Still, the competitive landscape makes it challenging to predict how much market share Affirm can maintain as BNPL becomes increasingly commoditized.

Affirm’s Growth Outlook Hinges on Fed Policy

One of the most significant milestones in Q4 was Affirm’s move into GAAP operating profitability. The company generated $58 million in GAAP operating income compared to a $73 million loss a year ago. This inflection point suggests that Affirm has reached the scale needed to balance growth and profitability.

Looking ahead, the macro backdrop could play a decisive role. With the Federal Reserve cutting rates last week and beginning its rate-cutting cycle, Affirm’s funding costs are likely to fall, but not as much as expected, given that the Fed is also in a two-way dilemma.

If the Fed cuts further, inflation is likely to rise. The current bull market could become even frothier than it already is. However, not cutting rates means the U.S. could stumble back into rising unemployment and recession. It would seem AFRM’s fortunes are inextricably tied to the Fed’s choices over the next six months.

Management estimates that every 100 basis point reduction in benchmark rates lowers funding costs by about 40 basis points. That could meaningfully expand margins and make BNPL loans more attractive to consumers.

The risk, however, is that rate cuts may be implemented due to a weakening economy. A softer macro backdrop could dent consumer demand and increase credit risk, offsetting the benefits of lower funding costs. Thus, Affirm’s macro outlook is a double-edged sword — it could accelerate growth or expose vulnerabilities depending on how economic conditions evolve.

AFRM’s Lofty Multiples Point to Limited Upside

Affirm’s stock continues to command a premium valuation. Its non-GAAP P/E (TTM) stands at 44.9, well above the sector median of 12.1. Its EV/EBITDA ratio is even more striking at 180.5, compared to an industry median of 11.1.

While Affirm’s premium multiple reflects its rapid growth and improving profitability, it leaves little room for error. Using a blend of 12 valuation models — including EV/EBITDA multiples, price-to-sales multiples, and five-year DCF growth exits — I arrive at a fair value estimate of $71 per share. That implies about 13% downside from the current price of $81.53.

Is Affirm Stock a Buy or Sell?

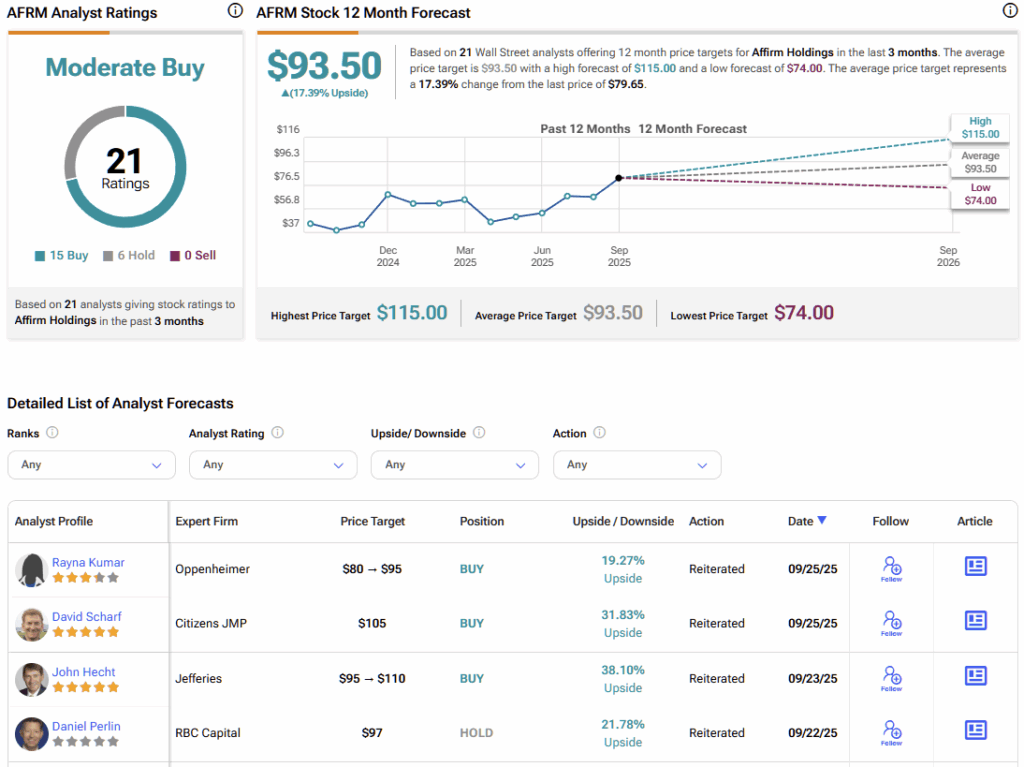

According to the most highly ranked Wall Street analysts, as identified by TipRanks, Affirm carries a Moderate Buy consensus rating from 21 analysts. Fifteen are bullish while six are neutral, with not a single bear in sight. AFRM’s average stock price target of $93.50 implies about 17% upside from current levels, with estimates ranging from $74 to $115.

Affirm’s Q4 Momentum Hits Valuation Ceiling

Affirm’s strong Q4 results show that the company has momentum, with GMV growth above 40%, a surging card business, and the achievement of GAAP operating profitability. Partnerships like Apple Pay integration further expand its reach, while a potential rate-cut cycle could lower costs and fuel more BNPL adoption.

Yet, the stock’s premium valuation remains hard to ignore. Even after factoring in growth, my fair value estimate implies downside from current levels. While I see Affirm as a well-positioned long-term player in the BNPL market, I do not see compelling upside in the near term. For now, I remain Neutral on Affirm, as strong growth is offset by elevated valuation risks.