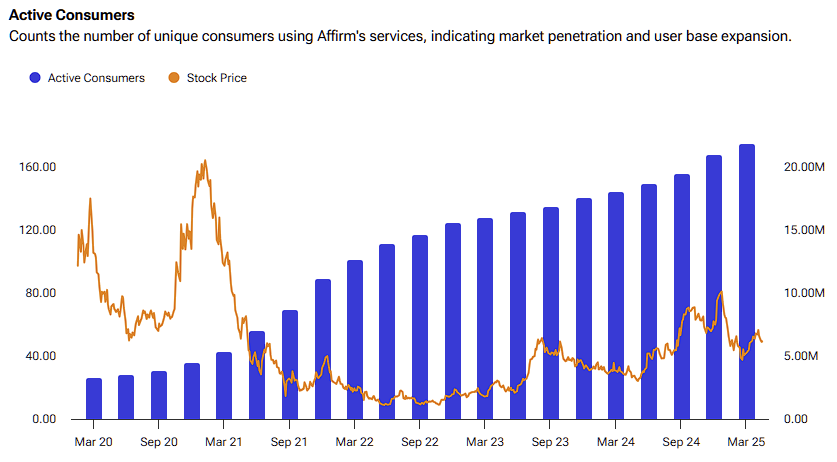

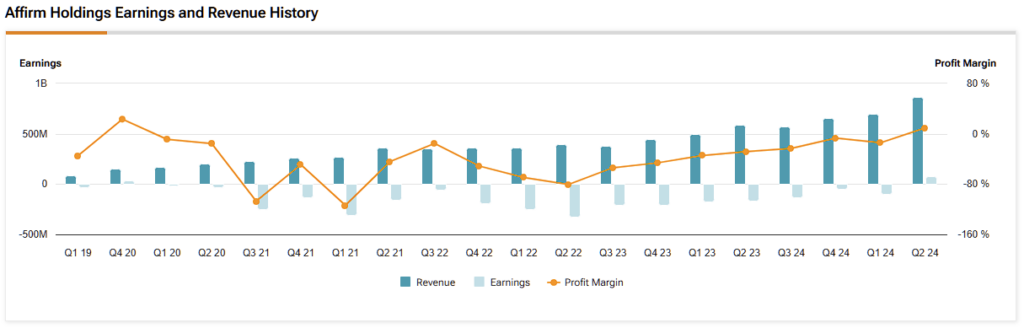

Affirm Holdings (AFRM) has experienced a volatile journey since its 2021 IPO. After soaring to bubble-level valuations, the Buy Now, Pay Later (BNPL) leader saw its stock fall to $9 per share in 2023. Since then, shares have been on a steady upward trajectory, driven by notable financial improvements. However, the current valuation suggests that investor expectations are now running high, setting the stage for its fiscal Q3 2025 earnings earlier this month, which delivered beats on both revenue and earnings per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, Affirm’s guidance for its fiscal fourth quarter fell short of investor expectations, contributing to recent stock volatility. In my view, Affirm—and the broader BNPL sector—is caught in a strategic paradox: demand for BNPL services tends to rise during inflationary periods, yet these same economic conditions heighten investor focus on sustainable growth and profitability. This tension leads me to maintain a cautiously neutral stance on Affirm’s stock.

Why Consumers Are Flocking to BNPL in Today’s Economy

The Buy Now, Pay Later (BNPL) market is positioned for significant expansion in the years ahead, with Affirm competing among a handful of major players, including Klarna, PayPal, and Afterpay (now part of Block). In its fiscal third quarter, Affirm reported a 36% year-over-year increase in Gross Merchandise Volume (GMV), reaching $8.6 billion, driven primarily by rising transaction volumes and a growing base of active users.

Current macroeconomic conditions—marked by persistent inflation and more cautious consumer spending—are accelerating BNPL adoption. The ability to break large purchases into smaller, manageable payments appeals to budget-conscious consumers seeking flexibility. Moreover, BNPL is becoming a familiar option for many shoppers, and emerging data suggests that some consumers are increasingly favoring these services over traditional credit cards, which often come with hidden fees and compounding interest.

Guidance Miss Spooks AFRM Investors

Affirm’s fiscal fourth quarter revenue guidance—ranging from $815 million to $845 million—came in below consensus expectations, which were around $840 million at the midpoint. The market reacted swiftly, with the stock falling nearly 10% following the announcement. This response highlights just how sensitive Affirm’s valuation remains to any signs of slowing growth.

Beyond the disappointing guidance, broader market concerns are at play. While macroeconomic headwinds such as inflation may support increased BNPL adoption, they also amplify investor focus on financial durability. Key concerns include the risk of rising consumer defaults and Affirm’s still-unproven path to consistent GAAP profitability. Despite recent operational progress, the company has yet to deliver the margin stability needed to fully reassure the market.

Moreover, Affirm’s stock performance appears increasingly influenced by market sentiment around its ability to navigate future economic uncertainty—particularly when forward-looking guidance falls short of expectations.

While the company continues to pursue GAAP profitability, signs of slowing growth and a strategic emphasis on 0% APR financing may have raised investor concerns. Although these no-interest products appeal to higher-credit consumers with stronger income profiles, they are inherently less profitable than interest-bearing loans, potentially impacting near-term margins

Fintechs, Banks, and Tech Giants Fight For Market Share

As with any rising consumer trend, growing popularity inevitably attracts competition. The BNPL space is now populated by both dedicated fintech players, like Affirm, and established financial institutions eager to capitalize on the demand.

In my view, the barriers to entry for large financial institutions are relatively low. Tech giants such as Apple and Google are integrating BNPL features directly into their ecosystems, potentially diminishing the relevance of standalone providers like Affirm. At the same time, major banks like JPMorgan Chase and Citibank are embedding BNPL-like options within existing credit card offerings, further intensifying competitive pressure.

Is AFRM a Buy, Sell, or Hold?

On Wall Street, AFRM has a Strong Buy consensus rating based on 16 Buy, five Hold, and zero Sell ratings in the past three months. AFRM’s average price target of $67.18 implies a potential upside of 36% in the next twelve months.

Earlier this month, Wells Fargo analyst Andrew Bauch supported the bullish case for AFRM, issuing a Buy rating with a price target of $67. Bauch highlighted Affirm’s strong GMV growth and was also encouraged by the 18% quarter-over-quarter growth in active cardholders. For context, the Affirm Card is a Visa card that permits full or split purchases, effectively becoming a more regular spending tool for consumers rather than just being used for individual online checkouts.

Meanwhile, Morgan Stanley analyst James Faucette has a Hold rating on AFRM. He is cautiously optimistic on the stock, noting “despite the macroeconomic volatility that poses risks to credit performance, Affirm’s delinquency data remains strong, and insights from other consumer finance companies are generally positive.”

Early BNPL Lead Meets Unproven Profit Path

In summary, the BNPL market remains in its early stages, bringing both opportunity and risk. Affirm’s early entry has helped build brand recognition, a growing user base, and strategic partnerships. With the overall market still expanding, there is significant upside if Affirm can capitalize on its foundation. For example, the company’s card integration with platforms like Apple Pay enhances accessibility and broadens consumer reach.

However, the path forward is far from certain. The BNPL sector faces meaningful regulatory and economic unknowns, having yet to be tested by a full economic downturn. The market is increasingly fragmented, and Affirm may need to prioritize brand differentiation, potentially at the expense of near-term profitability. Perhaps most importantly, its ability to consistently deliver GAAP profitability remains uncertain. In business, generating revenue is not enough—sustainable cash generation is what ensures survival.

Overall, I remain neutral on Affirm (AFRM). At its current valuation, the stock appears to reflect both the growth potential and the underlying challenges of the BNPL paradox.