Clothing and accessories retailer American Eagle Outfitters (NYSE:AEO) stock declined 9.4% in yesterday’s extended trading session following the release of mixed Q1 results. The earnings of $0.34 per share surpassed estimates, while revenues fell short of expectations.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bullish on AEO had anticipated a Q1 earnings beat due to the company’s strong comparable sales and gross margins.

AEO: Q1 Snapshot

The company’s earnings rose by 277% year-over-year and surpassed consensus estimates of $0.28 per share. Meanwhile, AEO generated Q1 revenues of $1.14 billion, an increase of 6% from the same quarter last year. However, it missed Street estimates of $1.15 billion.

Comparable sales for the company’s Aerie and American Eagle segments increased by 6% and 7%, respectively, on a year-over-year basis. Furthermore, AEO’s total inventory climbed 9% to $681 million, with units up 10%.

Furthermore, American Eagle’s gross margin expanded by 240 basis points to reach 40.6%. This improvement was driven by effective inventory management, a more profitable clearance strategy, and reduced transportation costs.

Q2 and Fiscal 2024 Outlook

For FY24, AEO expects revenue to come between $5.44 billion and $5.54 billion, up 2% to 4% year-over-year. The expected range remains above the consensus estimate of $5.43 billion. Also, the company forecasts that operating income will be in the range of $445 to $465 million.

For the upcoming second quarter, AEO expects operating income to come in between $95 million and $100 million, with revenue likely to grow by high-single digits.

What Is the Stock Price Forecast for AEO?

Overall, American Eagle has a Hold consensus rating based on three Buy, five Hold, and two Sell recommendations. The analysts’ average price target on AEO stock of $26.20 implies an upside potential of 8.9% from current levels. Shares of the company have gained 27.9% in the past six months.

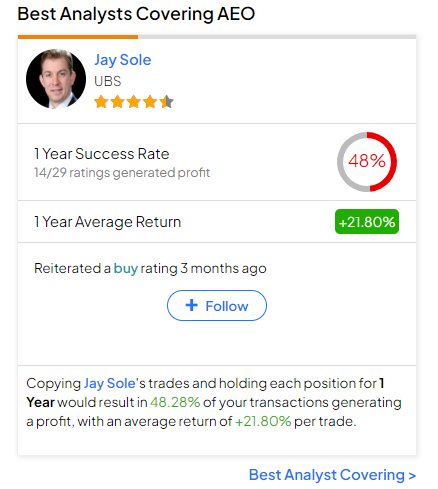

Interestingly, investors considering AEO stock could follow UBS (UBS) analyst Jay Sole. He is the best analyst covering the stock (in a one-year timeframe). He boasts an average return of 21.8% per rating and a 48% success rate. Click on the image below to learn more.