Shares of American Eagle Outfitters (AEO) plummeted in pre-market trading after the company issued weak guidance. The clothing and accessories retailer expects its comparable sales for the holiday quarter (fourth quarter) to rise by around 1%, while total sales are anticipated to decline by about 4%. This drop in revenue reflects an $85 million impact from having one less selling week and a delayed start to the holiday shopping season. Notably, the outlook falls short of analysts’ forecast of 2.2% growth in comparable sales.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

AEO Lowers FY24 Forecast

Consequently, the retailer now forecasts comparable sales growth of 3% for FY24, down from its earlier guidance of 4%. Additionally, American Eagle expects FY24 sales to increase by only 1%, compared to its prior forecast of growth in the range of 2% to 3%.

AEO Reports Disappointing Q3 Results

The retailer reported adjusted earnings of $0.48 per share, falling short of consensus estimates of $0.59 per share.

Furthermore, the company’s revenue declined 1% year-over-year to $1.3 billion in the third quarter. This was below Street estimates of $1.66 billion.

Is AEO a Good Stock to Buy?

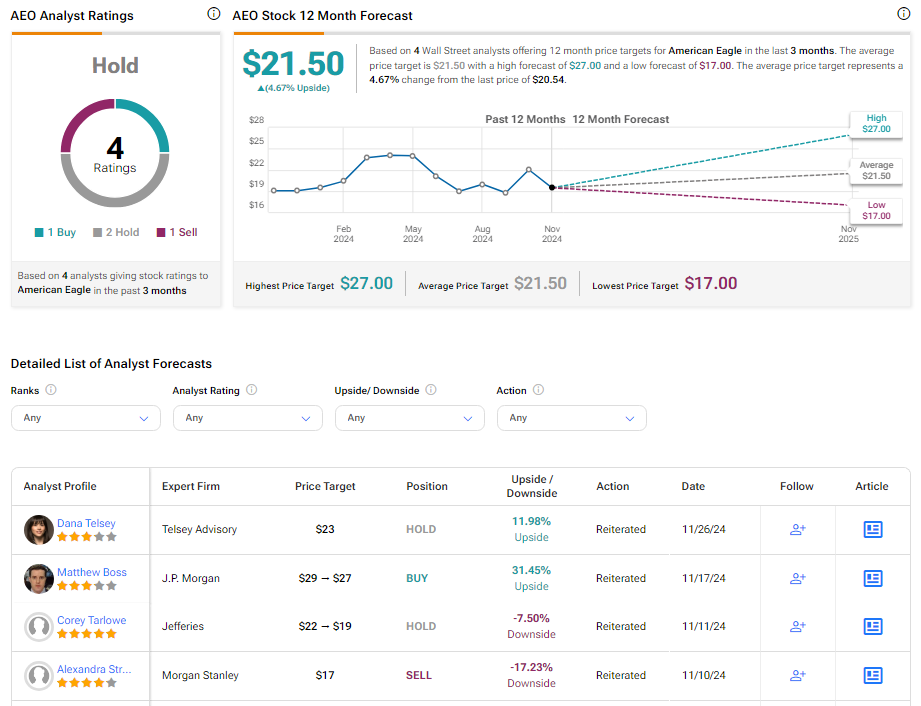

Analysts remain sidelined about AEO stock, with a Hold consensus rating based on one Buy, two Holds, and one Sell. Over the past year, AEO has increased by more than 8%, and the average AEO price target of $21.50 implies an upside potential of 4.7% from current levels. These analyst ratings are likely to change following AEO’s results today.