Renewable fuels are a great way to deal with the future, but sometimes, they just don’t pay the bills. That’s what happened to Aemetis (NASDAQ:AMTX), who posted earnings that proved a disappointment all around, sending Aemetis stock down over 20% in Thursday’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

First, Aemetis dropped the ball on earnings. While analysts expected a loss of $0.42, Aemetis nearly doubled that figure, coming in at a loss of $0.73. Revenue came in at $2.15 million, down 95.9% against this time last year, and a huge miss against analyst projections calling for $59.53 million.

So what happened? Aemetis described how it idled an entire plant in the midst of massively surging energy prices. When energy costs went up five-fold, Aemetis shut down the Keyes plant back in the closing days of 2022. But costs have normalized somewhat, and Aemetis looks to restart the plant sometime this quarter. This is just the latest problem for Aemetis, however, as some investors are already concerned about Aemetis’ ability to meet revenue projections, and the decline in revenue seen so far is lending some credence to those concerns.

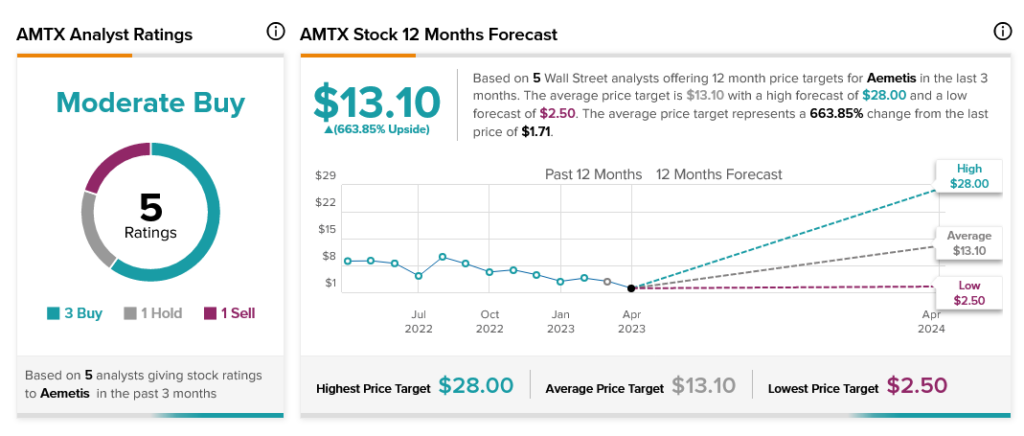

However, Aemetis does enjoy some analyst support. With three Buy ratings, one Hold, and one Sell, Aemetis stock is considered a Moderate Buy among shareholders. With an average price target of $13.10, Aemetis stock offers investors 663.85% upside potential.