Aemetis (AMTX), an innovative player in the renewable natural gas and renewable fuels domain, continues to struggle. It fell short of Q1 expectations despite witnessing robust year-on-year revenue growth across its various operational facets. The company aims to broaden its renewable natural gas (RNG) segment and pioneer a sustainable aviation fuels (SAF) production facility.

While high costs have hindered SAF adoption, hope abounds that European mandates and commitments from industry-leading airlines may soon expedite a shift, potentially enhancing the economic viability of SAF production. The stock is down over 32% year-to-date yet still trades at a premium to industry peers. Investors may want to wait for the company to show meaningful progress or a further correction in the price before considering acquiring the stock.

Aemetis Is Planning on Substantial Growth

Aemetis specializes in developing, acquiring, and commercializing technologies that aim to replace petroleum-based products with environmentally friendly alternatives and reduce greenhouse gas emissions.

Aemetis is developing a biorefinery to produce Sustainable Aviation Fuels (SAF), with production slated for 78 million gallons per year. SAF adoption globally has been slower than expected due to high costs. However, European regulators have mandated that SAF contribute 2% of fuel available at EU airports by 2025, escalating to 70% in 2050, which may boost demand. The company has secured a multi-year deal with International Airlines Group (IAG) to provide 78,400 tonnes of SAF to fuel British Airways and Irish flag carrier Aer Lingus’ flights from San Francisco Airport starting in 2025.

The company has adopted a Five-Year Growth Plan, aiming for a nearly 600% increase in the top-line from the current $300 million annual run-rate to $1.95B by 2028. The growth strategy includes expanding the RNG segment from eight to 75 dairies by 2028, potentially increasing dRNG production to over 2 million MMBtu annually. Key growth drivers include the company’s renewable natural gas segment and California’s progressive 2022 Scoping Plan.

Analysis of Aemetis’ Recent Financial Results

The company reported mixed results for the first quarter. Revenue for the quarter was $72.63 million, falling short of analysts’ expectations of $77.21 million but marking a significant increase from $2.2 million in Q1 of 2023. Aemetis’ Keyes plant has resumed full operation, contributing to this leap in revenue. Additionally, the Dairy Natural Gas segment and India Biodiesel sales accounted for $3.8 million and $32.7 million in total revenue, respectively.

The operating loss reported for the quarter was $9.5 million, an improvement from the $12.1 million loss from Q1 2023. Meanwhile, the gross loss for Q1 2024 was $0.6 million, slightly improving from the $1.3 million loss in the same period last year. The company ended the first quarter of 2024 with a net loss of $24.2 million and earnings per share (EPS) of -$0.58, missing analysts’ predictions of a -$0.46.

What Is the Price Target for AMTX Stock?

The stock has been highly volatile, with a beta of 3.47, as it has trended downward, shedding almost 53% over the past year. It trades at the lower end of its 52-week price range of $2.75 – $7.82 and demonstrates mixed technical indicators. With a P/S ratio of 0.54x, it appears to be trading at a slight premium to the Oil & Gas Refining & Marketing industry average of 0.29x.

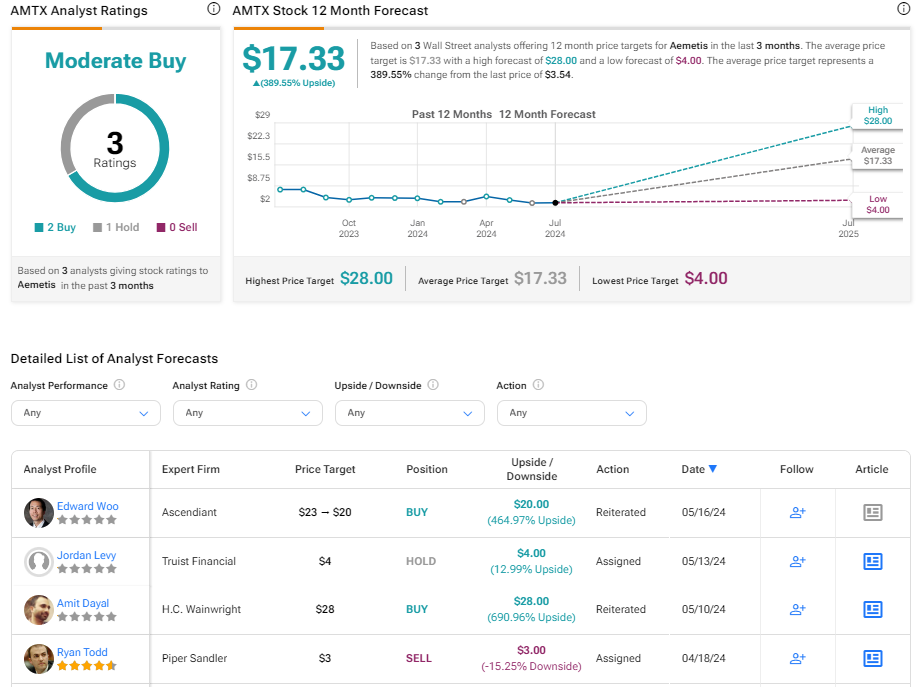

Analysts covering the company have taken a cautiously optimistic view of the stock. For instance, H.C. Wainwright analyst Amit Dayal recently reiterated a Buy rating with a price target of $28.00, noting the recent revenue growth and optimistic revenue forecasts.

Aemetis is rated a Moderate Buy overall, based on the aggregate recommendations and price targets assigned by three analysts. The average price target for AMTX stock is $17.33, representing a potential upside of 389.55% from current levels.

Final Analysis on Aemetis

Aemetis has displayed notable year-on-year revenue growth, and by broadening the renewable natural gas (RNG) segment and introducing a sustainable aviation fuels (SAF) production facility, it shows promise for future upside. However, investors may want to hold off until the company progresses more substantially towards realizing that upside or the stock price corrects further.