Shares of infrastructure consulting firm Aecom (ACM) have climbed 29.5% over the past 12 months. Aecom’s recent first-quarter showing was a mixed bag with bottom-line coming in ahead of the Street’s estimates.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Revenue declined 1.4% year-over-year to $3.27 billion, lagging estimates by $198.4 million. Earnings per share at $0.89, on the other hand, outperformed expectations by $0.12. Notably, backlog with the company increased to $38.8 billion during this period, coupled with a global book-to-burn ratio of 1.2 points in both design and construction management businesses.

Further, on February 15, Aecom announced that it had been appointed to support Network Rail’s £45 million commercial services framework in the NW&C region of the rail network in the UK. This appointment further expands Aecom’s presence in the region, where it is currently working on Northern Powerhouse Rail, High Speed 2, and the Transpennine Route Upgrade.

With these developments in mind, let us take a look at the changes in Aecom’s key risk factors that investors should know.

Risk Factors

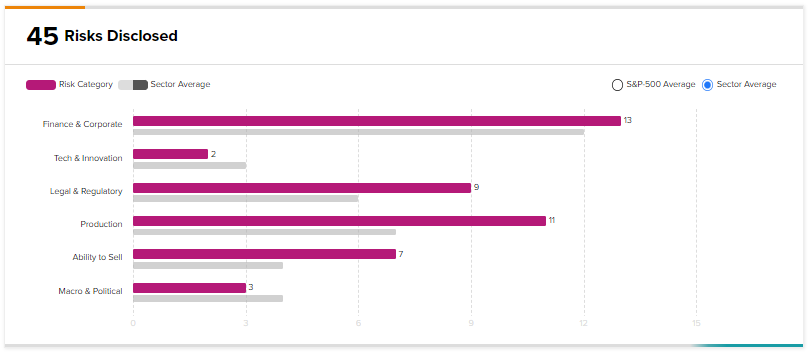

According to the TipRanks Risk Factors tool, Aecom’s top risk category is Finance & Corporate, contributing 13 of the total 45 risks identified for the stock, compared to a sector average of 12 risk factors under the same category.

In its recent report, the company has added one key risk factor under the Finance & Corporate risk category.

Aecom highlighted that while it has adopted a dividend policy, under which it anticipates paying a regular quarterly cash dividend, the declaration of any dividend, its timing, and amount remains at the discretion of the company’s board.

Decisions regarding dividends hinge on a number of factors such as cash flows, financial conditions, and Aecom’s debt levels. The company is not required to declare dividends and hence there can be no assurity if it will pay quarterly or special cash dividends in the future.

Hedge Fund Activity

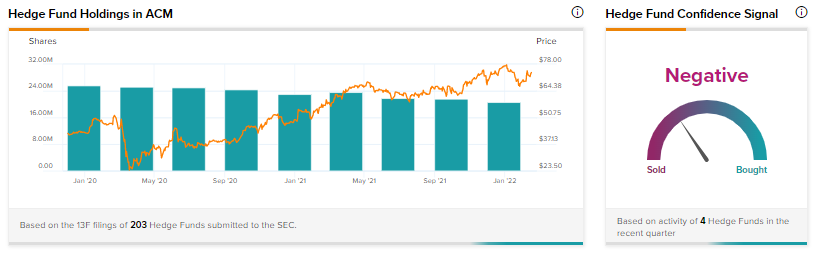

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in Aecom by 1.1 million shares in the last quarter, indicating a negative hedge fund confidence signal in the stock based on activities of 4 hedge funds.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Resonant Shares Jump 260% on Acquisition by Murata

Collegium to Acquire BioDelivery Sciences for $604M; Shares Up 16%

Primerica Posts Mixed Q4 Results