Earnings season is always unpredictable and likely to throw curveballs at investors, which makes the upcoming third-quarter results from semiconductor giant Advanced Micro Devices ($AMD) a tough nut to crack. For example, tech rival Nvidia ($NVDA) disclosed its Fiscal Q2 2025 earnings in August, beating on both the top and bottom lines. Regardless, NVDA stock fell after the print. Thus, I’m sitting on the sidelines with a Hold assessment on AMD stock. However, neutrality doesn’t mean investors can’t profit from this security.

AMD Options Strategy

In this article, I’m going to discuss an options strategy called the “short iron condor.” The term “short” refers to the fact that this particular condor trade is a net credit approach. That means we start the position from a cash inflow position. Ideally, the price action will land within a predefined range.

What makes the short iron condor somewhat risky is that we’re dealing with four transactions. Structurally, this particular condor represents a combination of a bull put spread and a bear call spread. Imagine an old school side-scrolling video game where you’re flying an airplane into a tunnel: you can’t go too high but you can’t go too low. Maximum profitability occurs when the target security is at or between the middle strike prices.

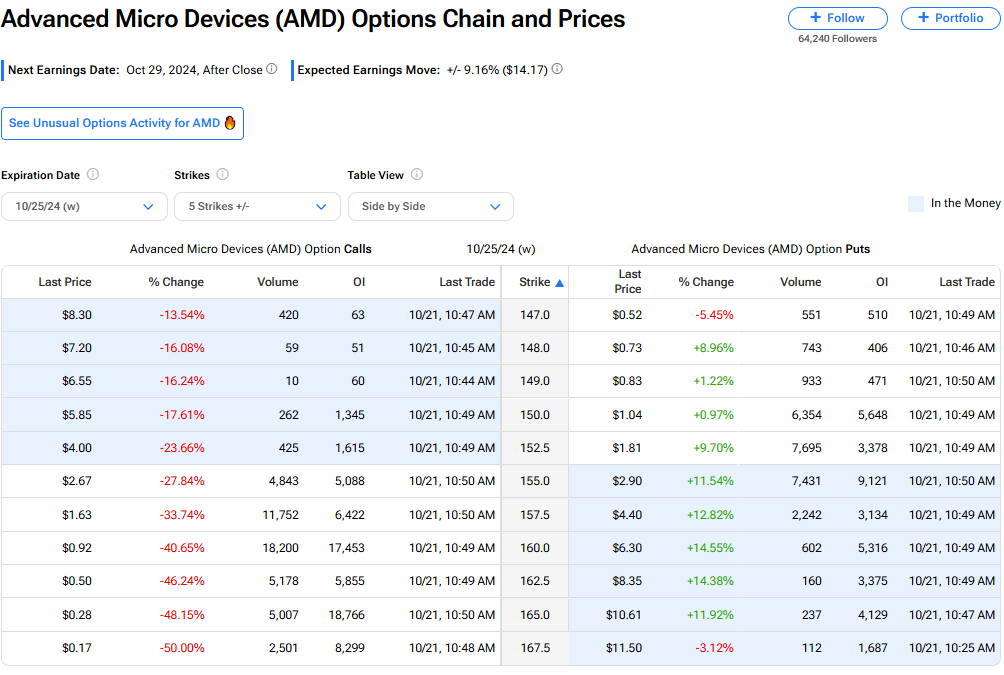

Below is a chart that looks at the current options action on AMD stock at TipRanks.

The Lay of the Land for AMD Stock

Generally speaking, many financial publications will refer to the discipline of technical analysis to determine the wings (strike prices) or the range of profitability for their iron condors. In other words, if a security demonstrates a propensity to trade within a range, the speculator will base their upper and lower profitability boundaries on this fact. However, in my opinion, it’s better to establish a scientific baseline first before relying on gut feelings.

TipRanks’ Options Chain and Prices algorithm notes that the expected move of AMD stock following its earnings disclosure is 9.29%, either to the upside or downside. At minimum, our condor should cover this expected movement, which nominally amounts to $14.49. Second, we can calculate the market’s expected movement via the target option chain’s implied volatility.

For our purposes, we’ll be looking at the options chain expiring on November 29. At the time of this writing, the average implied volatility for this chain stood at 50.22%. Under the principle of stochastic analysis, we multiply IV, the price of AMD stock (Friday’s close of $155.97) and the square root of the adjusted time to expiration. The end product comes out to $26.25 or 16.83% in either direction.

Narrowing Advanced Micro Condors

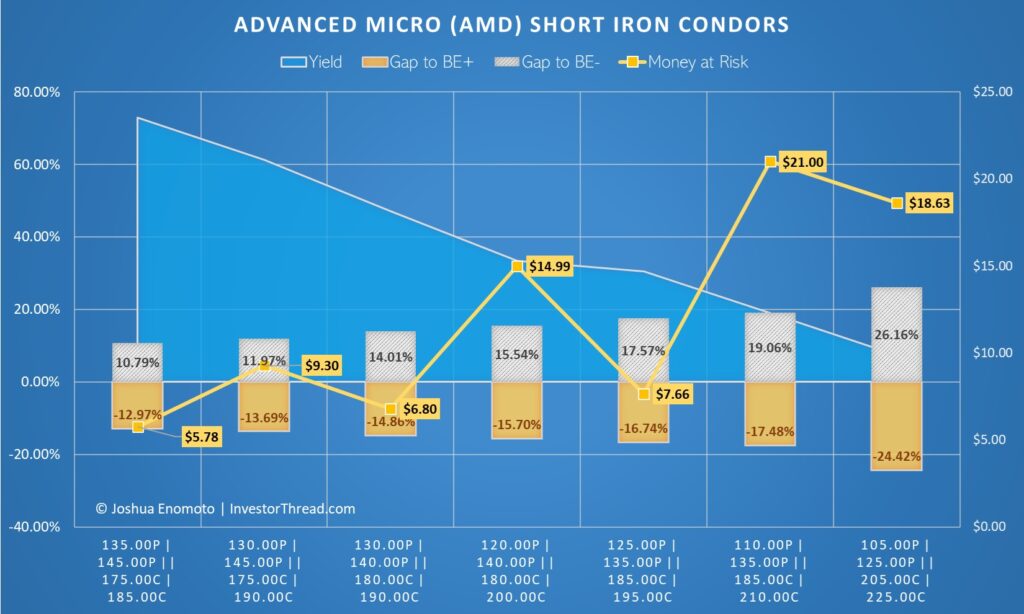

As you might imagine, short iron condors come in all shapes and sizes. Essentially, the narrower the range of profitability, the higher the yield but the greater the risk of maximum loss. To fully cover the potential range of AMD stock as determined by our stochastic projection, we may consider the 110P(ut) | 135P || 185C(all) | 210C. This trade would give us a gap to the upper breakeven (BE) price of 17.48% and a gap of 19.06% to the lower BE.

However, the trade’s yield would only be 19.05%. Further, the amount of money at risk stands at $2,100. A more palatable idea would be to consider the 125P | 135P || 185C | 195C condor. Here, the profitability window narrows to 16.74% to the upside and 17.57% to the downside. Still, the yield clocks in at 30.55% and the amount at risks shrinks to $766. Holistically, this might be the most sensible condor.

For a more daring proposition, you could consider the 130P | 140 P || 180C | 190C condor. This trade narrows the “safety” zone conspicuously to 14.86% up, 14.01% down. On the positive side, the yield pops up to 47.06%. Enticingly, traders only need to risk $680 for the chance to earn $320. In the first trade, the maximum profit potential is $400, while the second trade is $234.

Image by author

Risk Factors to Consider

For those who are interested in credit-based iron condors, it might be better to consider trades with a shorter period to expiration. Specifically, options close to expiration benefit from what’s known as faster theta decay; that is, as derivatives get closer to expiration, they lose their extrinsic value at an exponential rate. This dynamic favors options sellers or those underwriting credit trades (such as the short iron condor).

Another risk factor to consider is market sentiment. As discussed earlier, we can use mathematical methodologies to help determine the wingspan of our iron condors. Nevertheless, the above examples assumed a relatively equal propensity of AMD stock to rise or drop by the forecasted kinetic range. This framework assumes a net neutral range of motion that might not actually pan out.

If instead you anticipate a slight skew either to the upside or downside, you can adjust your calculations to fine tune your desired condors. In the above examples, I filtered for condors that featured an average gap to BE (of both thresholds) close to 0%. If, however, you anticipate an upward bias in AMD stock, you may consider average gaps closer to 1%, or whatever ratio you are comfortable with taking on.

Wall Street’s Take on Advanced Micro Devices

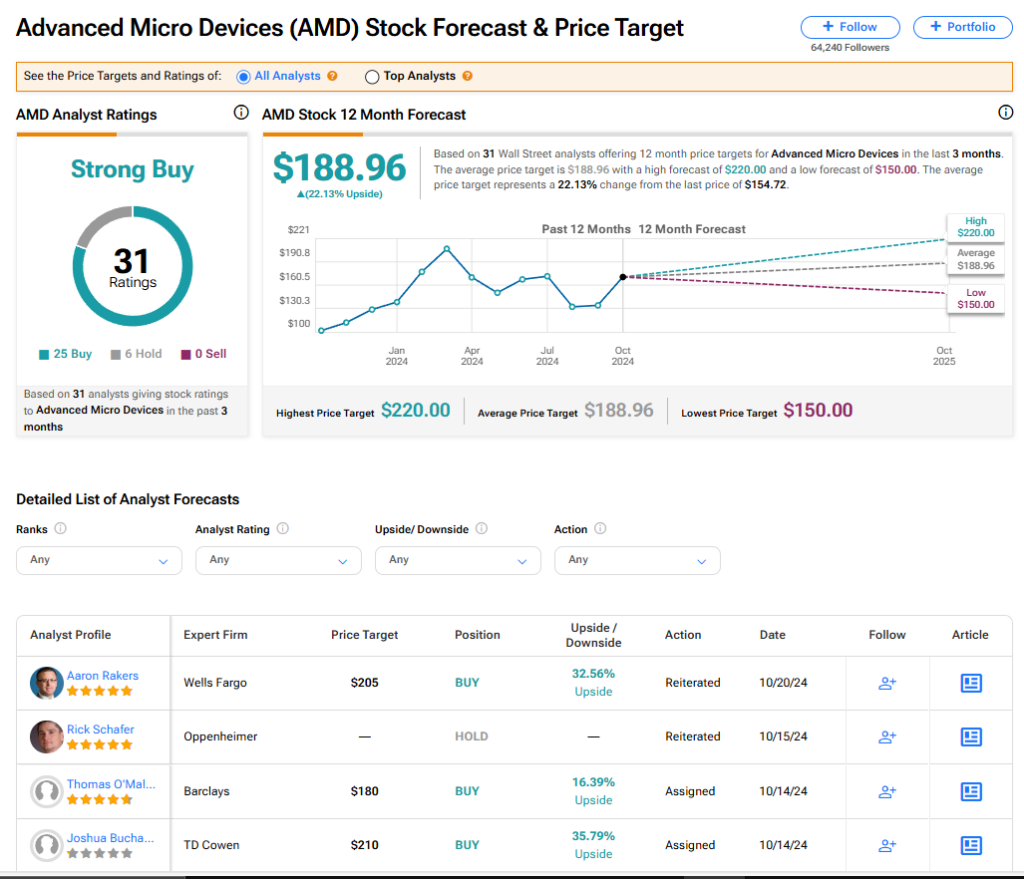

Turning to Wall Street, AMD stock has a Strong Buy consensus rating based on 25 Buy, six Hold, and zero Sell ratings assigned in the last three months. The average AMD price target of $188.96 implies 22.13% upside potential from current levels.

Read more analyst ratings on AMD stock

Conclusion: Bet on the Range with AMD Stock

Given the unpredictable nature of earnings season — especially for the technology sector — betting on a directional trajectory of Advanced Micro Devices is always going to be a tough proposition. However, if you anticipate that AMD stock will instead trade within a defined range, a short iron condor could be an attractive and lucrative idea. Using a combination of mathematical methodologies and research on sentiment, it’s possible to narrow down condor trades to a compelling few.