Shares of Advanced Micro Devices (NASDAQ:AMD) fell over 4% in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $0.70, which beat analysts’ consensus estimate of $0.68 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales increased by 4.1% year-over-year, with revenue hitting $5.8 billion. This beat analysts’ expectations by $110 million. For reference, analysts were expecting $5.7 billion in revenue.

Looking forward, management now expects revenue for Q4 2023 to be approximately $6.1 billion, plus or minus $300 million. Analysts project Q4 revenue to be at $6.39 billion.

Is AMD a Buy, Sell, or Hold?

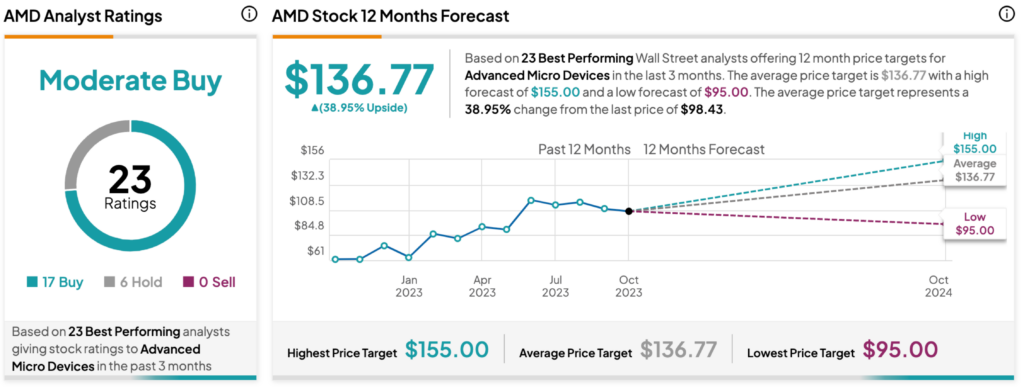

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMD stock based on 17 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average AMD price target of $136.77 per share implies a 38.95% upside potential.