I believe Adobe (ADBE) is a compelling buy at current levels. Despite facing Wall Street’s skepticism for years, the company has consistently delivered strong performance. Now, its shares have drifted back to April 2020 levels. This decline is largely driven by concerns over rising competition, AI’s growing influence, and a less-than-explosive Q2 outlook, all of which have weighed on investor sentiment. However, Adobe has a long track record of adapting to change and turning potential threats into growth opportunities. Given its history of innovation and resilience, I’m bullish on ADBE stock and see this pullback as a prime long-term buying opportunity.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Competition and AI Jitters

Competition is the first big worry here. Canva and Figma have snagged millions of users, some who once counted on Adobe, by offering simpler interfaces and free or super-cheap plans. Canva’s drag-and-drop style has really hooked the small-business crowd, while Figma has made UI/UX design collaboration mainstream. Adobe’s attempt to buy Figma in 2023 was thwarted by regulators, ensuring the rivalry remains fierce.

Then there’s the AI wave. You have probably already seen various demos of exciting projects like DALL·E and MidJourney that produce high-quality visuals from mere text prompts. Runway ML is driving AI-enabled video editing, proving that generative AI can tackle complex creative tasks once reserved for power tools like Adobe Premiere. Bears argue that if AI keeps improving, users may rethink paying for a Creative Cloud subscription.

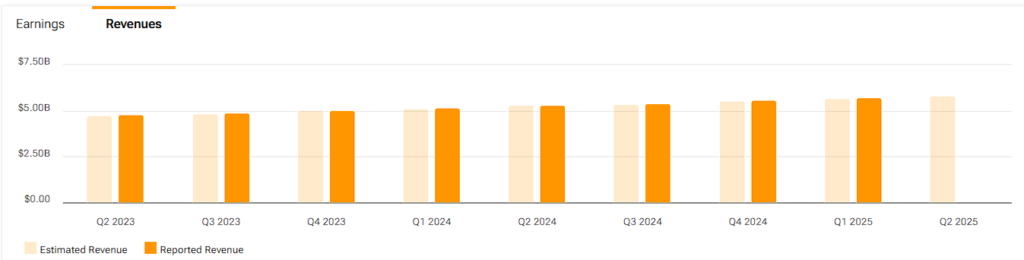

Add to these concerns Adobe’s recent guidance miss for Q2, with projected revenue of $5.77 billion to $5.82 billion coming in marginally under the analyst consensus of $5.8 billion. With competition rising, AI’s rapid evolution, and cautious forecasts, some investors are questioning Adobe’s long-term dominance. But dismissing Adobe too quickly would be a mistake.

But That’s Only Half the Story

On closer inspection, however, Adobe’s actual performance remains enviable. Investor sentiment on the stock appears to have reached rock-bottom. Yet, the company posted record revenues of $5.71 billion in its latest report, up 10% year over year (at an even stronger 11% when adjusted for FX swings). Its Digital Media segment, including Creative Cloud and Document Cloud, expanded 11% to $4.23 billion. Surely, these aren’t numbers you’d expect from a business on the brink of collapse.

Honestly, I’d say AI is more of a boost than a threat for Adobe. Their Firefly platform, now baked into Photoshop, Illustrator, and Premiere Pro, shows they can totally blend generative AI into their usual workflows. And if you’re a pro looking for serious creative control, standalone tools like Firefly Web and Firefly Pro give you all the AI power without giving up that creative control. I want to stress “creative control” here, as none of the exciting AI tools we have seen over time have shown they gave creators full control over their work.

Meanwhile, Adobe’s Digital Experience division remains a key player for enterprises. Revenue climbed 10% to $1.41 billion last quarter, with major clients like IBM (IBM), AT&T (T), and PepsiCo (PEP) reinforcing Adobe’s stronghold. As businesses increasingly seek integrated solutions for content, marketing, and analytics, Adobe’s “One Adobe” strategy continues to make sense.

Putting Slowdown Fears into Context

As I mentioned, Adobe’s continued growth disproves ongoing market sentiment. While some may point to its guidance for 9% revenue growth in fiscal 2025, its first single-digit forecast in over a decade, as a sign of trouble, the bigger picture tells a different story. This is hardly a concern in the proper context, especially considering that currency swings alone reduced Adobe’s Digital Media ARR by $117 million from 2023 to 2024. With the dollar still strong, FX effects are a major factor behind the lower guidance. Without this impact, revenue growth would likely exceed 10% once again.

Importantly, I feel like both retail and institutional investors are actively ignoring Adobe’s capacity to consistently grow earnings year after year against all headwinds. To add some context here, analysts expect EPS to hit $20.41 in 2025, an 11% uptick year-over-year, despite all the market concerns and heavy AI investments. In other words, Adobe seems set to keep delivering double-digit earnings growth. Yet the stock’s sitting at about 19.3 times this year’s EPS, which honestly strikes me as way too low, especially given its dominant spot in the creative software world and, by now, a proven moat. To me, this screams opportunity for anyone who’s willing to tune out the short-term noise.

Is Adobe Stock a Buy or Sell?

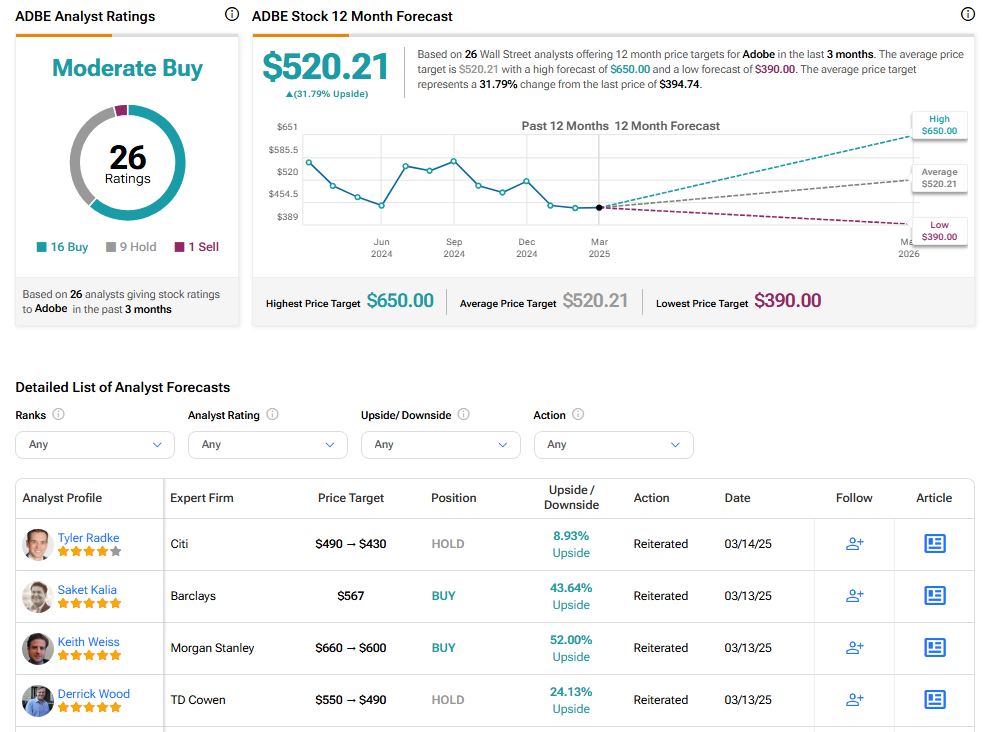

Even with what seems to be all-time-low sentiment for the stock, Wall Street analysts still seem relatively optimistic on Adobe from its current price levels. Specifically, ADBE stock now has a Moderate Buy rating among 26 Wall Street analysts who cover the company. This is based on 16 Buy, nine Hold, and one Sell recommendations assigned in the past three months. The average price target for ADBE stock of $520.21 suggests an upside potential of 31.79%.

Summing Up

To sum my thoughts up, Adobe’s prolonged decline to 2020-era levels might make for catchy headlines, but in no way does it erase the company’s strengths. Its steady growth, top-tier creative and marketing tools, and management’s strategic AI push all reinforce its long-term potential. While competition and macro challenges exist, they are industry-wide headwinds rather than signs of weakness unique to Adobe. Therefore, if you believe in Adobe’s knack for transforming challenges into fresh growth engines, then now, at these price levels, could be the perfect time to lean in rather than shy away.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue