Creative Software developer Adobe (ADBE) is set to release its third quarter of Fiscal 2024 financials on September 12. Wall Street analysts expect the company to report earnings of $4.53 per share for Q3, up 10.8% year-over-year. Also, analysts expect revenues to increase 10% from the year-ago figure to $5.37 billion, according to TipRanks’ data.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

It’s worth noting that over the past week, seven analysts have given the stock a Buy rating, and three analysts have raised their price targets.

Factors to Consider Ahead of Q3

Analysts forecast both revenues and earnings to increase in fiscal Q3, signaling optimism for Adobe’s near-term performance.

In addition, analysts, according to TipRanks’ Bulls Say, Bears Say tool shown below, believe Adobe is a key player in AI-driven software, with its Firefly product expected to drive significant growth. The company outperformed in 2Q, beating NNARR (Net New Annualized Recurring Revenue) guidance by 11%, following a 5% beat in 1Q.

It’s important to note that NNARR measures the incremental annual revenue generated by new or expanded customer contracts in subscription-based businesses. Beating NNARR guidance indicates Adobe exceeded its forecast for new subscription revenue, reflecting strong demand and growth in its core business.

Nevertheless, a few challenges remain. Bears have pointed out that Adobe faces strong competition from startups like Canva and OpenAI’s DALL-E, which could potentially hinder its growth. Furthermore, analysts have noted that investor sentiment for Adobe remains negative, due to underwhelming net new Creative ARR results in recent quarters.

Encouraging Website Traffic Trend

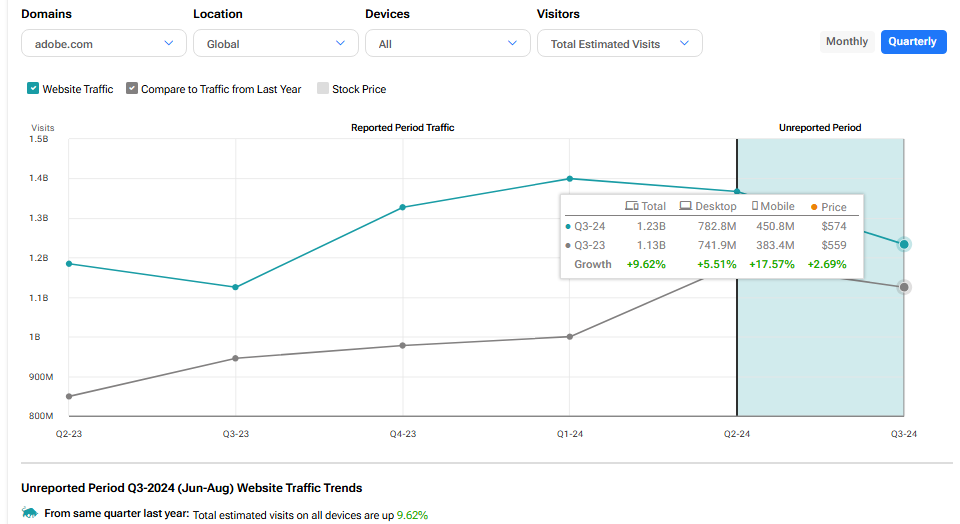

Investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

According to TipRanks’ Website Traffic tool, total estimated visits to adobe.com grew by 9.62% year-over-year in Q3. This increase in visits suggests that demand for the company’s creative and cloud services remained strong during the quarter.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can gauge options traders’ expectations for the stock post-earnings report. Based on a $550 strike price, with call options priced at $31.40 and put options at $16.57, the expected price movement, based on the at-the-money straddle is 8.47%.

Is Adobe Stock a Buy or Sell?

Turning to Wall Street, Adobe has a Moderate Buy consensus rating based on 21 Buys, five Holds, and two Sells assigned in the last three months. At $613.85, the average ADBE price target implies an 8.95% upside potential.