Adobe (ADBE) announced on Tuesday that it is introducing AI “agents” in order to help businesses improve how consumers browse their websites. While Adobe is widely known for creative apps like Photoshop, a significant portion of its business comes from selling software tools used in online marketing. Indeed, in its most recent fiscal year, these business-to-business tools accounted for a quarter of its $21.5 billion in sales. The new AI-powered tools will allow brands to personalize marketing messages based on users’ online activity, which will help companies engage with their audiences better.

One key feature of these AI tools is their ability to tailor content based on how users arrive at a website. For example, if a younger user clicks on a site through a TikTok ad, they may see different content than an older user who found the site through a search engine. Amit Ahuja, who is the Senior Vice President of Adobe’s Experience Cloud unit, explained that consumers now expect to interact with websites through AI chatbots. As a result, Adobe’s technology will allow businesses to offer chatbots that understand user intent better by analyzing their browsing behavior and the ads they click.

In addition to chatbots, Adobe is rolling out AI-driven tools to help digital marketers. One new tool allows marketers to specify their website goals—such as increasing digital sales—and the AI agent can recommend and implement changes automatically. This will speed up processes that once took months by eliminating the need to wait for coding teams to make website adjustments.

Is Adobe a Buy, Hold, or Sell?

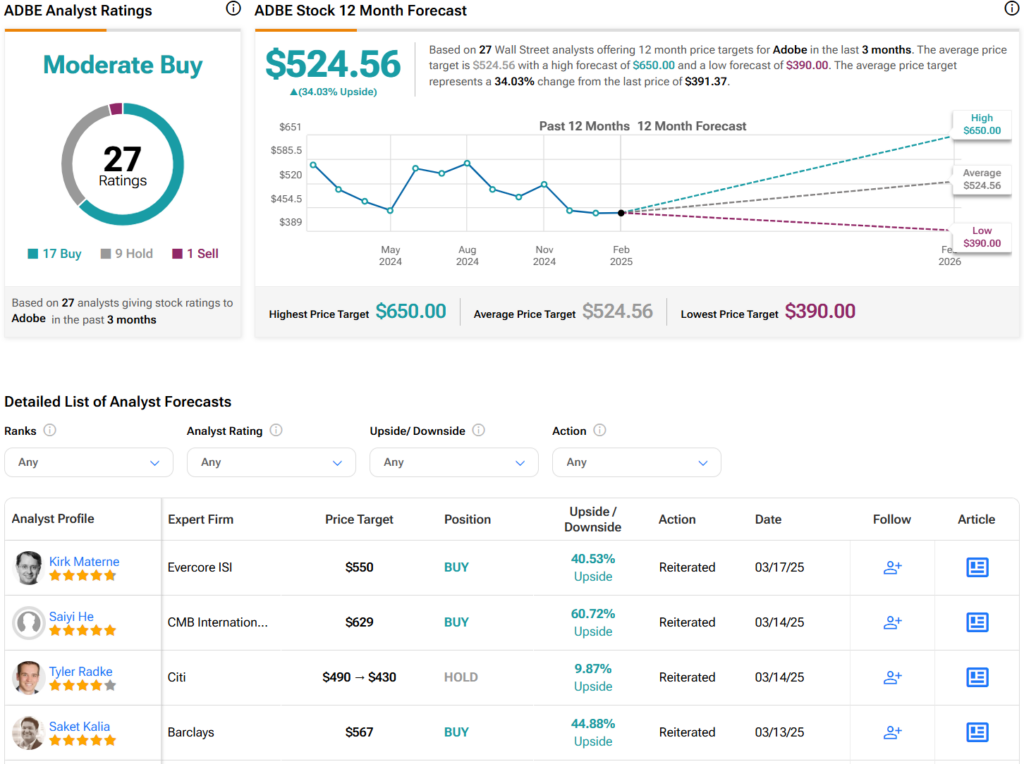

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ADBE stock based on 17 Buys, nine Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average ADBE price target of $524.56 per share implies 34% upside potential.

Questions or Comments about the article? Write to editor@tipranks.com