Archer-Daniels-Midland (ADM) stock was trading lower in pre-market trading after it reported a steep decline in first-quarter earnings. Also, the agribusiness giant now expects its full-year earnings to be closer to the lower end of its earlier forecast of $4 to $4.75, due to tough market conditions. For reference, analysts are expecting 2025 earnings of $4.12.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The company’s Q1 GAAP EPS of $0.61 declined 57% year-over-year and missed the consensus estimate of $0.66 per share. Also, ADM reported Q1 revenue of $20.18 billion, reflecting a 7.7% drop from the same period last year. Further, the top-line lagged analysts’ expectations of $22.08 billion.

It is worth highlighting that ADM sales have declined in the past few years primarily due to lower commodity margins and weaker global demand. According to Main Street Data, ADM sales reached a peak of $101.85 billion in 2022, but have since been declining.

Weak Ag Services & Oilseeds Offset by Nutrition Growth

During the quarter, ADM’s largest business unit, Ag Services & Oilseeds (AS&O), saw the biggest decline. Its revenue dropped 52% year-over-year, while operating profit fell 31%, mainly due to lower volumes and weaker margins, driven by tariff and trade policy uncertainty.

Also, the Carbohydrate Solutions unit’s profit dropped 3.2% to $240 million. The decline in Starches & Sweeteners was offset by strong performance in Vantage Corn Processors.

In contrast, the Nutrition segment was a bright spot, with profit rising 13% to $95 million. Animal Nutrition’s profits doubled to $20 million due to better market conditions and lower costs.

However, CEO Juan Luciano said the company is making efforts to improve its performance. He said, “We are leveraging our global footprint and taking actions to drive operational improvement and targeted network consolidation to balance a challenging environment.”

Is ADM a Good Stock to Buy?

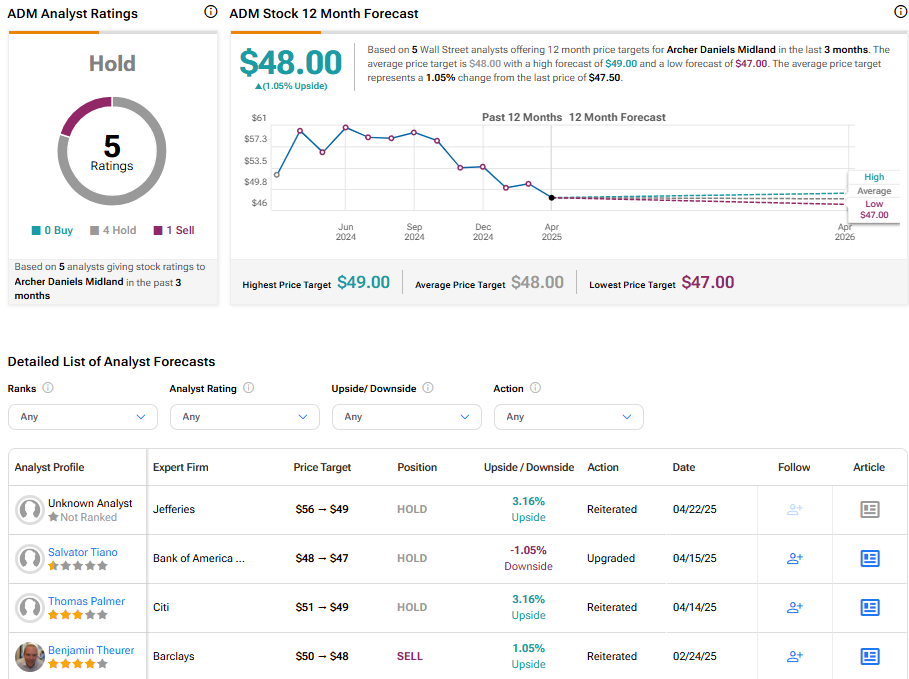

On TipRanks, ADM stock has a Hold consensus rating based on four Holds and one Sell assigned in the last three months. The average ADM price target of $48 suggests an upside potential of 1.05% from its current price.